Bitcoin's Bull Run

Could crypto's power demand outpace datacenters in the short-run?

𝙒𝙝𝙖𝙩 𝙘𝙖𝙪𝙜𝙝𝙩 𝙢𝙮 𝙖𝙩𝙩𝙚𝙣𝙩𝙞𝙤𝙣?

Bitcoin has jumped nearly 20% since the US election as Trump’s pro-crypto stance likely catalyzed a market primed after the April halving.

𝙒𝙝𝙮 𝙞𝙩 𝙢𝙖𝙩𝙩𝙚𝙧𝙨?

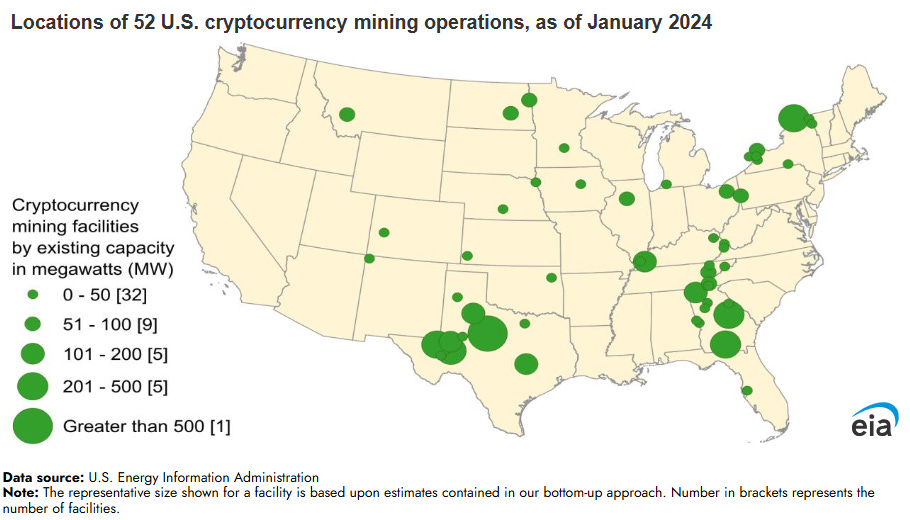

Crypto-mining (including Bitcoin mining) is already large consumer of electricity (0.6% to 2.3% of U.S. electricity demand according to the EIA).

Higher Bitcoin prices (and crypto price in general) incentive more mining and more power consumption. Could this bull-run drive power demand faster than even datacenters?

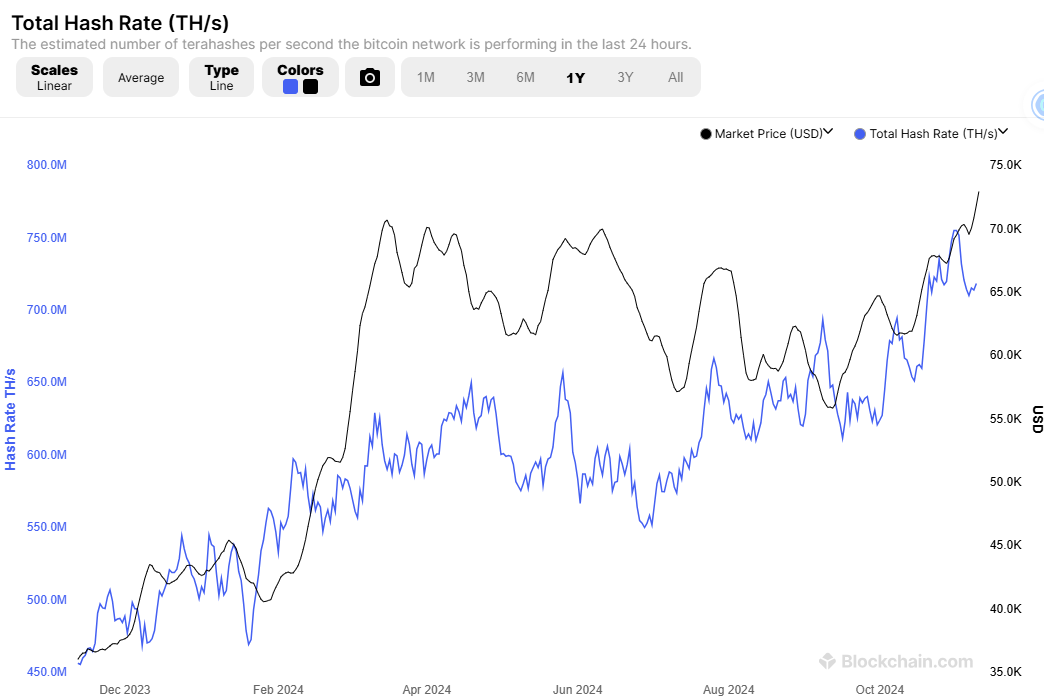

Notice that hashrate (a measure of computational power used in crypto-mining) has risen alongside prices through 2024.

𝘿𝙚𝙩𝙖𝙞𝙡𝙨:

Trump is seen as pro-crypto and pledged to make the United States "the crypto capital of the planet" at the Bitcoin 2024 conference over the summer. He has also proposed the creation of a "strategic national bitcoin stockpile."

The most recent halving occurred on April 19, 2024, reducing the block reward from 6.25 to 3.125 bitcoins per block. Historically, Bitcoin's price has experienced significant increases following halving events.

Bitcoin halving is a pre-programmed event that occurs approximately every four years, reducing the reward miners receive for adding new blocks to the blockchain by 50%. The next halving is anticipated around March 26, 2028, further decreasing the reward to 1.5625 bitcoins per block.

𝙇𝙞𝙣𝙠𝙨: