Canada-Alberta Energy MOU

Initial Thoughts on a Risky Bargain

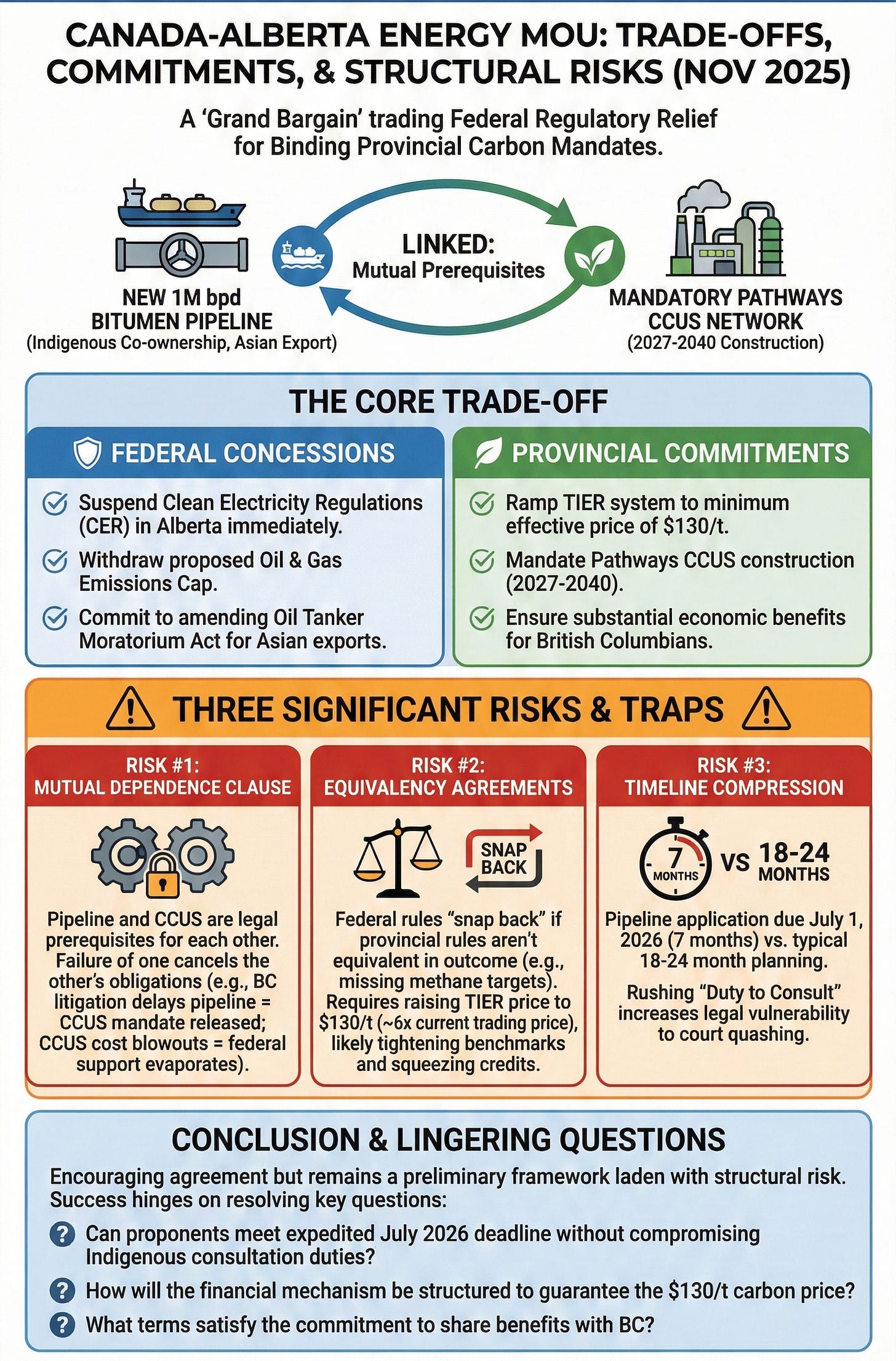

Prime Minister Mark Carney and Alberta Premier Danielle Smith signed a memorandum of understanding (MOU) today composed of a trade-off between Federal regulatory relief and binding Provincial carbon mandates.

Central to the deal is the construction of a new, private-sector, Indigenous-co-owned pipeline exporting 1 million barrels per day of low-emission bitumen, linked directly to the mandatory construction of the Pathways CCUS network.

Federal Concessions: Ottawa immediately suspends the Clean Electricity Regulations (CER) in Alberta, withdraws the proposed Oil & Gas Emissions Cap, and the federal government commits to amending the Oil Tanker Moratorium Act to enable Asian exports.

Provincial Commitments: Alberta’s TIER system must ramp to a minimum effective price of $130/t. Additionally, the Pathways Alliance CCUS network shifts from a proposal to a provincial mandate, with construction fixed between 2027 and 2040. The province also commits to “ensure British Columbians share substantial economic and financial benefits of the proposed pipeline”.

The MOU introduces three significant risks:

Risk #1: The Mutual Dependence Clause

The MOU explicitly states that the approval and continued construction of the new bitumen pipeline is a prerequisite for the Pathways CCUS project, and vice versa.

If the pipeline is delayed by litigation in British Columbia (likely), the Pathways Alliance is released from its obligation to build the CCUS network. If the Pathways consortium fails to reach a Final Investment Decision (FID) due to cost blowouts, federal support for the pipeline evaporates, and the Tanker Moratorium remains in place.

Risk #2: The Equivalency Agreements

The MOU relies on “Equivalency Agreements”. Under the Canadian Environmental Protection Act (CEPA), the federal government can only “stand down” if provincial rules are equivalent in outcome to federal ones.

If equivalency is lost (e.g., Alberta misses the 75% methane target), the federal regulations come back into force. This means industry could suddenly face dual regulation or immediate federal enforcement.

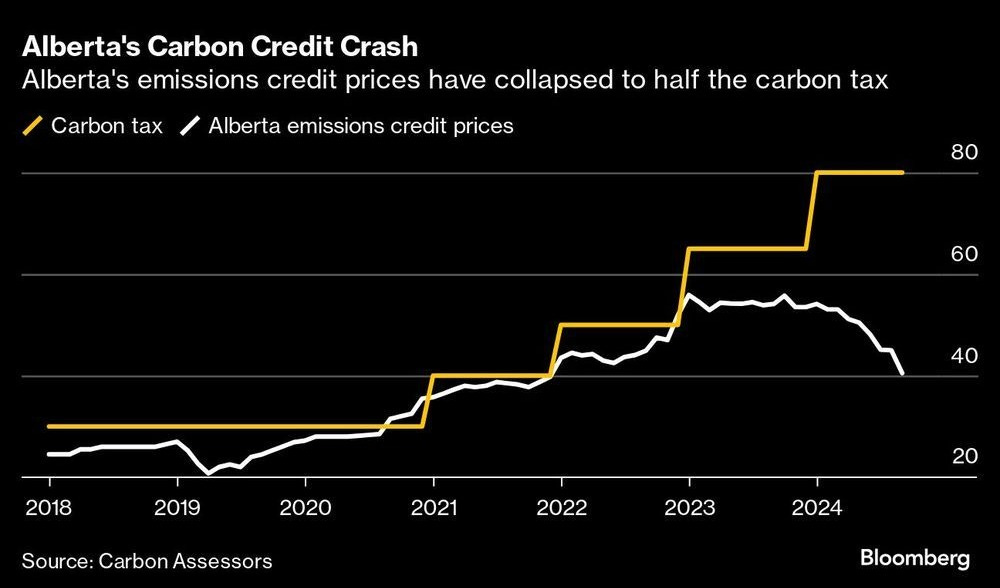

To maintain “equivalency” for the TIER system, Alberta will need to raise its minimum effective carbon price $130/t, more than 6x what emissions credits are currently trading at. The mechanism increase these prices likely includes tightening the benchmarks (give away fewer free credits) meaning higher prices for emitters and greater difficulty in generating credits.

Risk #3: The Timeline Compression

The MOU demands a “ready” application for the ~1MMbbl/d pipeline by July 1, 2026. This deadline is very tight and could force create legal vulnerability.

A typical “Planning Phase” (Indigenous consultation, route scoping) for a major project takes 18–24 months, while this deal gives proponents just 7 months. Rushing the “Duty to Consult” phase is a frequent reason major projects are quashed by the Federal Courts. By forcing a rushed application, the MOU exposes the pipeline project to legal challenge.

While it is encouraging to see an agreement between the federal and provincial governments that addresses long-standing disagreements on energy and net-zero policy, this MOU remains a preliminary framework laden with structural risk. Its ultimate success hinges on resolving several lingering questions:

Can proponents meet the expedited July 2026 filing deadline without compromising Indigenous consultation duties?

How will the financial mechanism be structured to guarantee the $130/t carbon price?

What terms and conditions would satisfy the commitment to “ensure British Columbians share substantial economic and financial benefits of the proposed pipeline”?