CCUS, Gas, and Renewables Forge New Paths to Low-Carbon Reliability

The Week That Was: October 26 - November 2, 2024

NOTE: “The Week That Was” is a recap of ideas shared over the last seven days.

This Week’s “On Energy”

Spare Parts: What Caught My Eye This Week

Billions for CCUS | Pathways Alliance CCS Project Poised for Multibillion-Dollar Investment Backing

More Gas = More Renewables | NextEra on the Relationship Between Technologies

Three Mile Island and Competing Pathways to Low Carbon & Reliable Energy

Power Inflection | Is It Really Here?

And who benefits most? The EIA’s most recent report highlights a record-breaking moment: Texas (ERCOT) hit an all-time peak demand of 85.5 gigawatts on August 20.

With buzz around data centers and long-awaited load growth, you'd expect to see clear signs of an inflection point in the data.

But it's not that simple.

Weather plays a significant role in the short-run, of course, but look closer at the charts. The change is subtle, hidden in the light blue trendline—hardly the paradigm shift many are hoping for. When compared to the shift in energy mix—gas ramping up (green), coal declining (orange), and wind and solar emerging—the demand shift is subtle at best.

Yet this could be why power markets are buzzing. A break from this 20-year trend would mark a generational shift.

For me, the real question is: Which generation source benefits most from growing demand? The new renewables? The incumbent gas? Maybe it is nuclear?

Billions for CCUS | Pathways Alliance CCS Project Poised for Multibillion-Dollar Investment Backing

Canada Growth Fund (CGF) has proposed funding support for the carbon capture and storage (CCS) project led by the Pathways Alliance, a consortium of the largest oil sands producers, including Canadian Natural Resources, Cenovus, and Suncor.

This project, estimated to cost C$16.5 billion, aims to capture emissions from Alberta’s oil sands and is critical to meeting Canada’s climate targets.

The Canada Growth Fund (CGF) is set to finance a significant portion, although final agreements are reportedly still under negotiation, with investment decisions expected by mid-2025.

Other government support includes a 50% tax credit for CCS and is expected to offer additional support through contracts for difference (potentially through the CGF?), helping to stabilize future carbon prices.

Gas Fired Data Centers | GE Vernova on Hyperscalers

What caught my attention? GE Vernova CEO Scott Strazik pointed to solutions that provide “baseload power with HA gas turbines” when asked: “are you seeing any commonality in the mix of product type that they [hyperscalers] are interested in?” during their Q3 2024 earnings call.

Why it matters? The headlines have focused on nuclear -SMRs, Three Mile Island restart, etc. – but GE Vernova is seeing strong demand for gas-fired solutions in their order book, even with EPA rules that require CO2 emissions reductions equivalent to 90% carbon capture and storage by 2032.

GE Vernova HA Gas Turbines:

Output Range: 448–571 MW in simple-cycle mode.

Fuel Flexibility: Operates on both "rich" and "lean" gaseous fuels.

Hydrogen Capability: Supports up to 50% hydrogen (H₂) with a pathway to reach 100%.

30% Load Turndown: The gas turbine efficiently operates at as low as 30% of its maximum capacity, allowing operators to meet lower demand without shutting down.

Optional Park Mode (7–15% Load): At 7–15% of maximum load, park mode keeps the turbine online and ready to quickly ramp up as demand increases.

More Gas = More Renewables | NextEra on the Relationship Between Technologies

𝙒𝙝𝙖𝙩 𝙘𝙖𝙪𝙜𝙝𝙩 𝙢𝙮 𝙖𝙩𝙩𝙚𝙣𝙩𝙞𝙤𝙣?

"Renewables will be built for energy and battery storage and gas for capacity." - John Ketchum, Chairman, President, and CEO of NextEra Energy describing the relationship between technologies in the power system during the Q3 2024 earnings call.

𝙒𝙝𝙮 𝙞𝙩 𝙢𝙖𝙩𝙩𝙚𝙧𝙨?

The quote describes the changing role of gas to a complement to battery storage, versus a competitor to solar and wind generation.

He noted that "storage has an advantage because it's ready now as it can be paired with renewables at the same interconnect and there are no wait times or permitting hurdles for batteries".

And that as additional gas capacity is added, "we also enable more renewables to come to market as the lowest cost generation source of energy".

Do you agree with John's comments? What role do you see for gas generation?

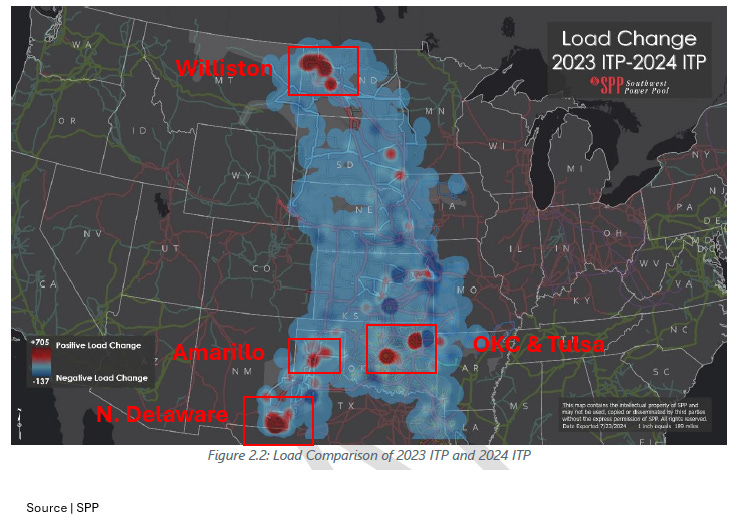

SPP Load Hotspots | What's Happening?

𝙒𝙝𝙖𝙩 𝙘𝙖𝙪𝙜𝙝𝙩 𝙢𝙮 𝙖𝙩𝙩𝙚𝙣𝙩𝙞𝙤𝙣?

Oil and gas development was highlighted by SPP for creating "higher-than-average load growth" in New Mexico (northern Delaware) and North Dakota (the Williston).

Not mentioned were hotspots (see the map) around Oklahoma City, Tulsa and Amarillo, major intersection points for fibre and a large number of data center and crypto sites.

𝙒𝙝𝙮 𝙞𝙩 𝙢𝙖𝙩𝙩𝙚𝙧𝙨?

• US load growth is barely visible at a macro scale, but is becoming very obvious at a micro scale.

• SPP's comment were in it's 2024 Integrated Transmission Planning Assessment. The load growth hotspots are a major factor in the recommended transmission projects.

In short, grid level investment is already being significantly influenced by load growth BEFORE load growth is clearly visible at the macro scale.

Three Mile Island and Competing Pathways to Low Carbon & Reliable Energy

When you value energy, reliability and carbon intensity explicitly you end up a number of compelling and competing pathways. Check out this post from Manuj Nikhanj:

An in depth analysis of the Three Mile Island (TMI) restart deal between Microsoft and Constellation prompts a revaluation of nuclear assets, especially merchant plants eyeing similar opportunities. With Microsoft paying over $100/MWh in a 20-year agreement for a project with a $39/MWh breakeven, the economics could not look stronger for Constellation.

Looking at alternative power generation pathways to achieve a similar decarbonized data center showed that gas-fired-generation with CCS is the next most compelling option. Assuming the same PPA value, a 900 MW natural gas and CCS pairing at the same site would have a PV-10 breakeven of $81/MWh, with an NPV of $788 million and IRR of 25%. On paper this looks attractive but pairing this with our in depth CCS pore space mapping, class VI permit tracking, full value chain economics and layering in the challenges with building CO2 pipelines, the TMI deal really starts to look even more appealing.