Chris Wright Tapped for Secretary of Energy, Bitcoin's Power Surge, Exxon Backs Paris, AI Revives Nuclear, and CARB Bolsters LCFS

The Week That Was: November 9-16, 2024

NOTE: “The Week That Was” is a recap of ideas shared over the last seven days.

Spare Parts: What Caught My Eye This Week

Bitcoin's Bull Run | Could crypto's power demand outpace datacenters in the short-run?

AI for Nuclear | Diablo Canyon Deploying AI to Extend Operating Life

Chris Wright: Secretary of Energy

𝙒𝙝𝙖𝙩 𝙘𝙖𝙪𝙜𝙝𝙩 𝙢𝙮 𝙖𝙩𝙩𝙚𝙣𝙩𝙞𝙤𝙣? Chris Wright has been nominated to serve as energy secretary by Donald Trump.

𝙒𝙝𝙮 𝙞𝙩 𝙢𝙖𝙩𝙩𝙚𝙧𝙨? Chris is an energy executive (CEO of Liberty Energy) and vocal advocate for energy. Regardless of the technology or pathway folks prefer (and there are many), his willingness, and ability, to engage in constructive discourse across a range of energy topics will be an asset for US energy interests.

Please consider watching this discussion between Chris, Scott Tinker (Switch Energy Alliance), and Dr. Julio Friedmann (Carbon Direct) from the 2023 Evolve conference:

Bitcoin's Bull Run | Could crypto's power demand outpace datacenters in the short-run?

𝙒𝙝𝙖𝙩 𝙘𝙖𝙪𝙜𝙝𝙩 𝙢𝙮 𝙖𝙩𝙩𝙚𝙣𝙩𝙞𝙤𝙣?

Bitcoin has jumped nearly 20% since the US election as Trump’s pro-crypto stance likely catalyzed a market primed after the April halving.

𝙒𝙝𝙮 𝙞𝙩 𝙢𝙖𝙩𝙩𝙚𝙧𝙨?

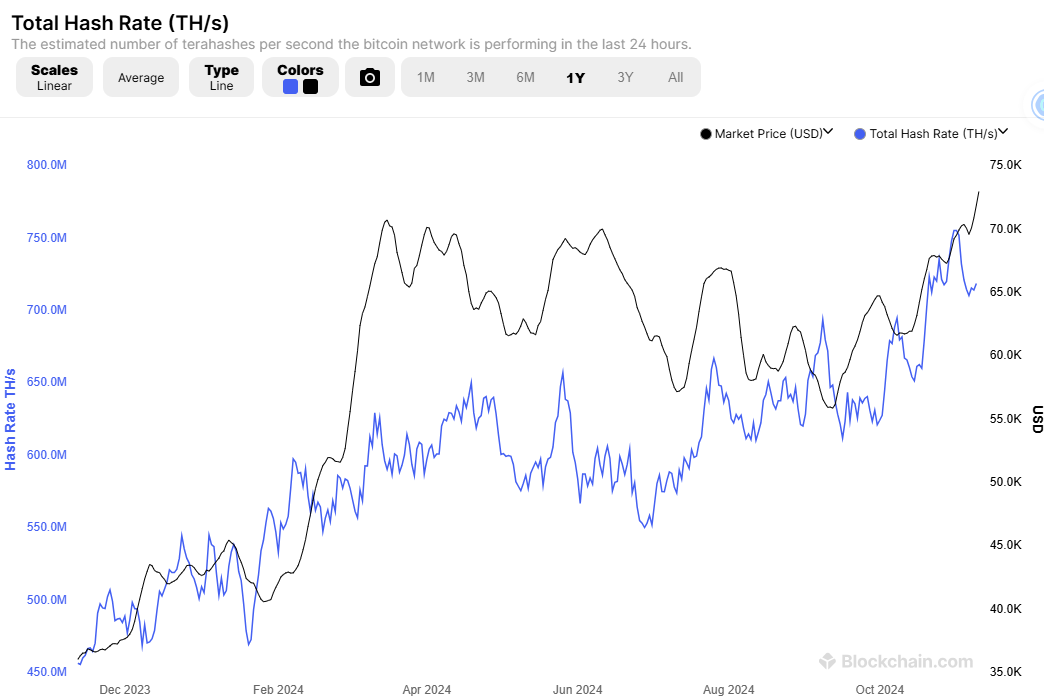

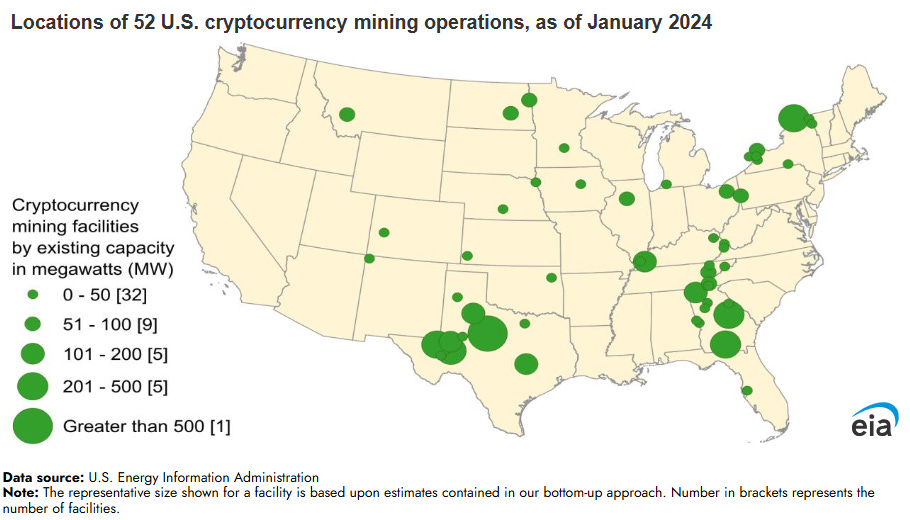

Crypto-mining (including Bitcoin mining) is already large consumer of electricity (0.6% to 2.3% of U.S. electricity demand according to the EIA).

Higher Bitcoin prices (and crypto price in general) incentive more mining and more power consumption. Could this bull-run drive power demand faster than even datacenters?

Notice that hashrate (a measure of computational power used in crypto-mining) has risen alongside prices through 2024.

𝘿𝙚𝙩𝙖𝙞𝙡𝙨:

Trump is seen as pro-crypto and pledged to make the United States "the crypto capital of the planet" at the Bitcoin 2024 conference over the summer. He has also proposed the creation of a "strategic national bitcoin stockpile."

The most recent halving occurred on April 19, 2024, reducing the block reward from 6.25 to 3.125 bitcoins per block. Historically, Bitcoin's price has experienced significant increases following halving events.

Bitcoin halving is a pre-programmed event that occurs approximately every four years, reducing the reward miners receive for adding new blocks to the blockchain by 50%. The next halving is anticipated around March 26, 2028, further decreasing the reward to 1.5625 bitcoins per block.

𝙒𝙝𝙖𝙩 𝙘𝙖𝙪𝙜𝙝𝙩 𝙢𝙮 𝙖𝙩𝙩𝙚𝙣𝙩𝙞𝙤𝙣?

The WSJ reporting that Exxon Mobil supports the U.S. remaining in the Paris climate agreement.

The article highlights concerns that a U.S. withdrawal would “create uncertainty and risk undermining global efforts to prevent the worst impacts of climate change.”

Darren Woods, CEO of Exxon Mobil, noted that it is challenging for businesses when policy shifts with each administration, likening it to an unproductive “pendulum swing.”

𝙒𝙝𝙮 𝙞𝙩 𝙢𝙖𝙩𝙩𝙚𝙧𝙨?

• Exxon Mobil, once seen as resistant of climate policies, is now publicly backing continued participation in the Paris Agreement. This shift underscores the company's prioritization of policy stability over rapid change, recognizing that consistency can be more beneficial for long-term business planning than short-term policy shifts.

• The article highlights the influence of prominent oil and gas leaders, such as Harold Hamm, founder of Continental Resources, and Liberty Energy CEO Chris Wright — who is reportedly under consideration for the role of Energy Secretary — on Trump’s energy policy.

• Darren Woods joined the Zero podcast while at COP. Well worth a listen. Episode: “What is the Exxon CEO doing on a climate podcast?”.

AI for Nuclear | Diablo Canyon Deploying AI to Extend Operating Life

𝙒𝙝𝙖𝙩 𝙘𝙖𝙪𝙜𝙝𝙩 𝙢𝙮 𝙖𝙩𝙩𝙚𝙣𝙩𝙞𝙤𝙣?

AI headlines have spotlighted nuclear-powered data centers, but yesterday, PG&E signed with Atomic Canyon to deploy AI software that will streamline document retrieval, cut costs, and boost operational efficiency, supporting its license extension efforts at the Diablo Canyon power plant.

𝙒𝙝𝙮 𝙞𝙩 𝙢𝙖𝙩𝙩𝙚𝙧𝙨?

AI-driven software that extends the operating life of physical assets like Diablo Canyon—a large-scale, low-carbon, and dispatchable generation source—plays a key role in meeting the rising energy demands, much of which are fueled by AI itself.

This is a good example of software’s potential to address the grid’s physical limitations. Other promising applications include software that optimizes transmission infrastructure, manages virtual power plants, and enhances load flexibility.

𝘿𝙚𝙩𝙖𝙞𝙡𝙨:

• Diablo Canyon generates approximately 2,300 megawatts (MW) of electricity, and represents about 9% of California’s total electricity generation.

• The facility holds approximately 9,000 procedures and 9 million documents, many digitized from paper or microfiche. To extend its federal license for up to 20 more years, PG&E must develop aging management plans, relying heavily on decades-old records.

• PG&E's noted that AI could eventually assist with complex tasks like maintenance scheduling, which requires understanding the plant's interconnected systems. This labor-intensive process could see significant efficiency gains through AI.

CARB Sends the LCFS Market a Lifeline

𝙒𝙝𝙖𝙩 𝙘𝙖𝙪𝙜𝙝𝙩 𝙢𝙮 𝙖𝙩𝙩𝙚𝙣𝙩𝙞𝙤𝙣? Revisions to the Low Carbon Fuel Standard were approved by CARB last Friday.

𝙒𝙝𝙮 𝙞𝙩 𝙢𝙖𝙩𝙩𝙚𝙧𝙨? Revisions to the LCFS program were needed to help remedy an oversupply in the credit bank that has depressed LCFS prices since 2022. Spoiler: even with the changes it is going to take while.

Fun fact: O&G producers are some of the largest RNG and renewable diesel producers. Examples include: Archaea Energy (BP owned), Chevron, Shell and Marathon Petroleum Corporation.

𝘿𝙚𝙩𝙖𝙞𝙡𝙨:

• LCFS prices have dropped to approximately $65, down significantly from around $150 in 2022, mainly due to an increase in renewable diesel supply. Many anticipated that regulatory revisions would be approved to help alleviate the supply surplus and bring balance back to the LCFS market.

• Stricter Carbon Intensity (CI) Targets: The LCFS now mandates a 30% reduction in carbon intensity by 2030, an increase from the previous 20% target, relative to 2010 levels. This will help clear the overhang in the credit bank.

• Limitations on Biomass-Based Diesel: Capping biomass-based diesel (especially from virgin feedstocks like soybean oil) to 20% of a company’s production is impactful given that biomass-based diesel has been a cornerstone in meeting past LCFS targets.