Datacenter Boom Powers Cummins' Growth

Who else is (should be) benefiting from the boom?

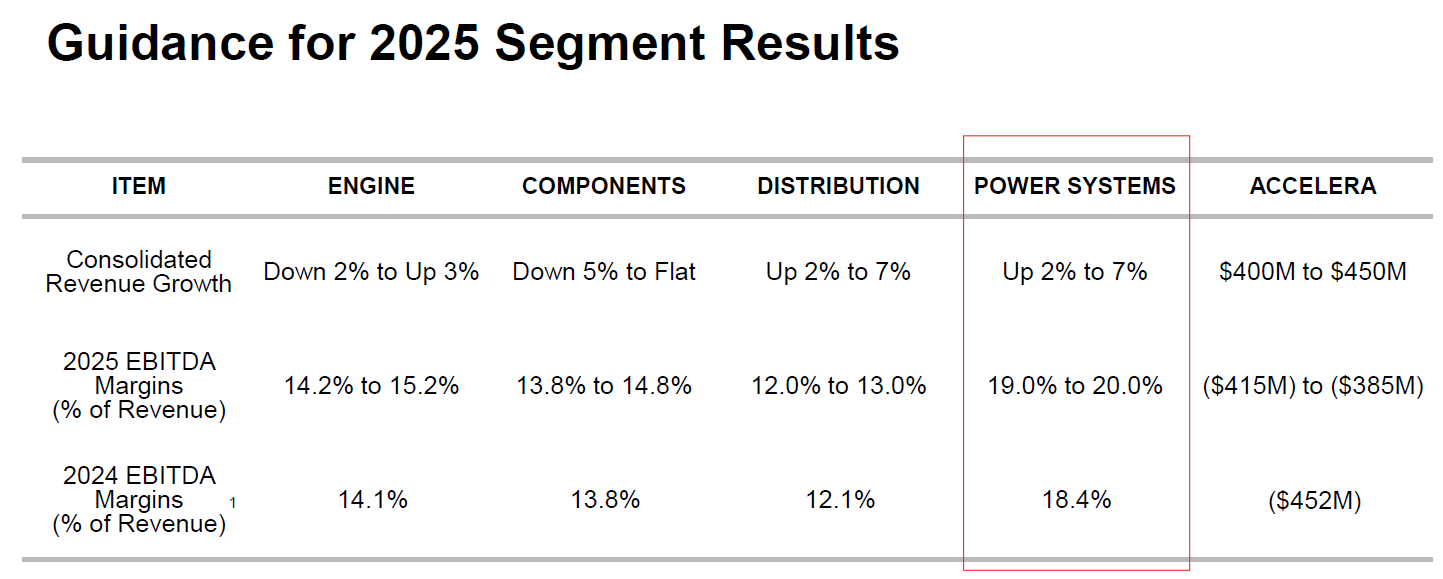

𝙒𝙝𝙖𝙩 𝙘𝙖𝙪𝙜𝙝𝙩 𝙢𝙮 𝙖𝙩𝙩𝙚𝙣𝙩𝙞𝙤𝙣? The impact of datacenter led power growth on Cummins 2024 results and 2025 guidance: the Power System’s business leads the way in terms of revenue and EBITDA margin growth “driven primarily by power generation demand, especially data center applications”.

𝙒𝙝𝙮 𝙞𝙩 𝙢𝙖𝙩𝙩𝙚𝙧𝙨? Datacenter led power demand growth is impacting a broad cross-section of the economy and Cummins provides a good example. It’s Power Systems business contributes less than 20% of total revenue, but offers the highest (and growing) EBITDA margins (18.4% in 2024 and 19-20% in 2025) and some of the fasted revenue growth in the company (13% in 2024, and 2-7% in 2025). The sustained strong performance of the company is also capturing investment in the business with $200 million deployed to double capacity by the end of this year.

Similar to the Cummins example, we see many businesses with opportunities related to power. However, only some are actively seeking those them out, while others appear to underappreciate their ability to profitably participate.

What are some of your favorite examples of “non-power” businesses getting into the power game?

𝘿𝙚𝙩𝙖𝙞𝙡𝙨:

• The Cummins team noted that Power System revenue growth was driven by a combination of more units, larger units (which command higher prices) and higher prices overall.

• Power Systems 2024 EBITDA margins were 18.4% or 370 basis points higher than 2023