NOTE: “The Week That Was” is a recap of ideas shared over the last seven days.

Spare Parts: What Caught My Eye This Week

Bitcoin Miner Buying Wind Farm | Making Money on Curtailment

Gas Now and Nuclear Later | Meta's Announcements Highlight the Energy Reality for Data Center Growth

Wonder Valley, Alberta | Are We In the Data Center Bubble Phase?

Big Oil Making Low Carbon Power for Big Tech | Another Competitor in the Data Center Gold Rush

How Much Nuclear Potential Is Left for Data Centers?

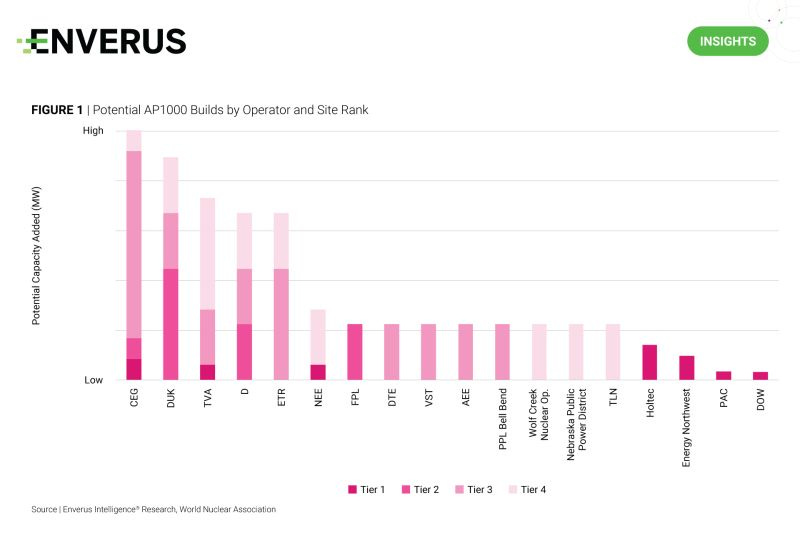

Some great work from the Enverus Intelligence® Research team on the potential to expand capacity at sites already setup for nuclear development:

The rapid adoption of artificial intelligence has created exponential demand for data centers. Hyperscalers such as Microsoft, Google and Amazon require reliable, low-carbon electricity to power future data centers, leading to a renewed interest in nuclear energy.

• Favorable power purchase agreements (PPAs), like the Constellation Energy-Microsoft deal for Three Mile Island Unit 1, make repowering economic. New reactors need more initial investment, and Enverus Intelligence Research modeled an achievable ~10% IRR on a $100/MWh PPA at a $7 billion/GW capital cost.

• Figure 1 illustrates the potential for expanding U.S. nuclear capacity to meet aggressive targets of 35 GW of capacity by 2035 and 200 GW by 2050.

• Constellation, Duke Energy, Dominion Energy and Florida Power & Light operate sites that screen well for near-term construction starts, with Holtec International’s Palisades and NextEra Energy’s Duane Arnold sites already leading a new wave of nuclear activity.

Great summary