First nuclear, now hydro.

Google and Brookfield have entered a Framework Agreement (HFA) for up to 3,000 MW of hydroelectric capacity across the United States. This partnership, initially valued at over $3 billion, includes long-term contracts for the 670 MW Holtwood and Safe Harbor facilities in Pennsylvania.

This agreement is consistent with the strategy that has made nuclear, and now hydro, popular:

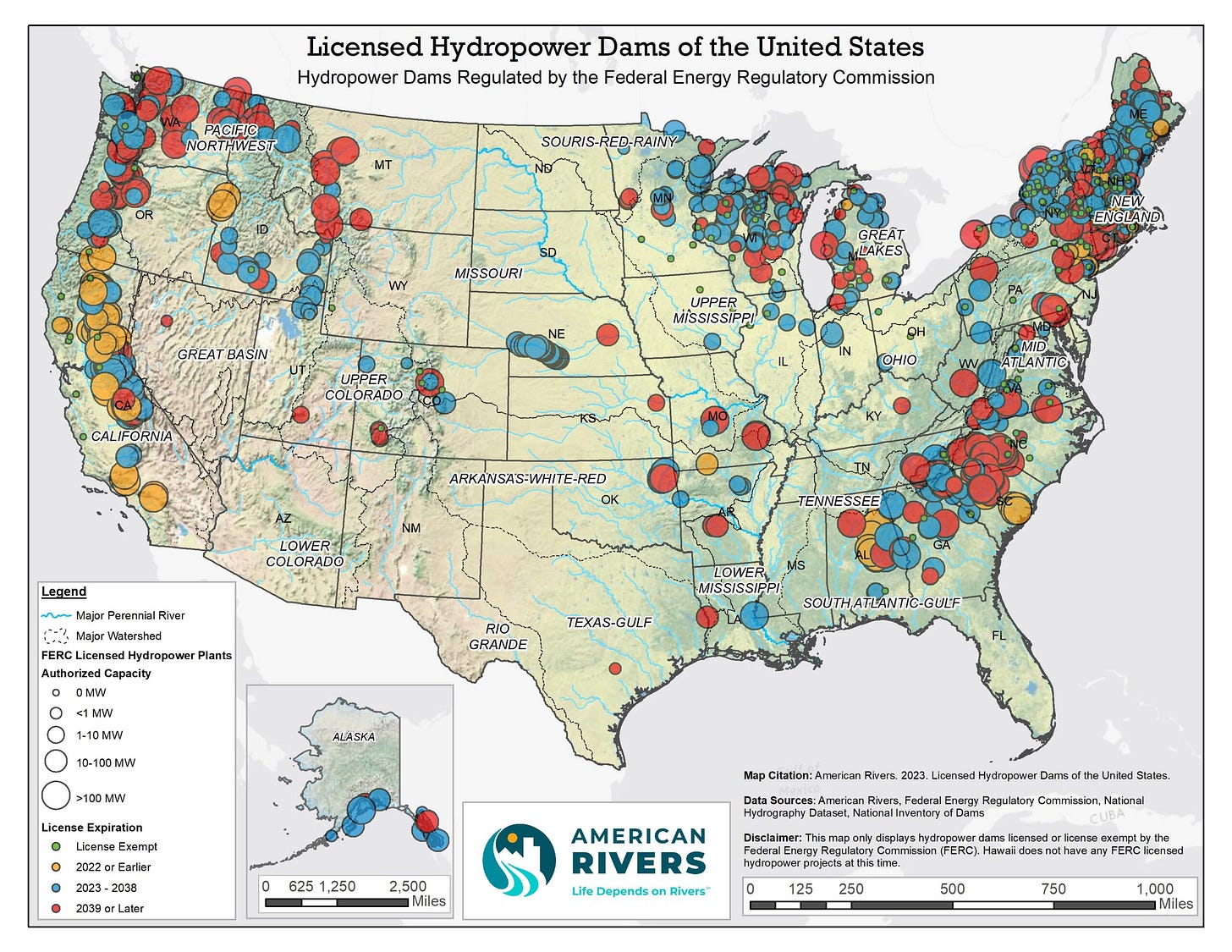

Target existing assets: The 3,000 MW target encompasses assets that will undergo relicensing, overhaul, or upgrades to extend their operational lifespan.

Key Market Focus: The initial facilities are strategically located in PJM and MISO, two critical power markets for Google's operations.

Long-Term Certainty: The 20-year Power Purchase Agreements (PPAs) provide both parties with long-term economic stability.

The deal also highlights the ongoing drive for hyperscalers to secure 24/7 carbon-free power to meet the escalating demands of data centers and artificial intelligence (AI). Specifically, balancing the power needs of companies like Google and Microsoft at the forefront of the AI boom, while also meeting their ambitious carbon neutrality goals (such as Google's aim to power its operations with round-the-clock carbon-free energy).

The result is many leaders of the AI boom are placing value on all three attributes of the electrons they source: the energy, carbon attributes and reliability attributes.

Case in point: Based on the initial contracts for the relicensing of the Holtwood and Safe Harbor facilities, the implied cost is approximately $70/MWh. This is derived from the $3 billion investment over 20 years for 670 MW, assuming a 36.5% capacity factor.

The premium is real for reliable, dispatchable, and carbon-free electricity.