Gas-fired Generation is UNDERPAID

The reliability attribute is undervalued and likely the draw for financial buyers

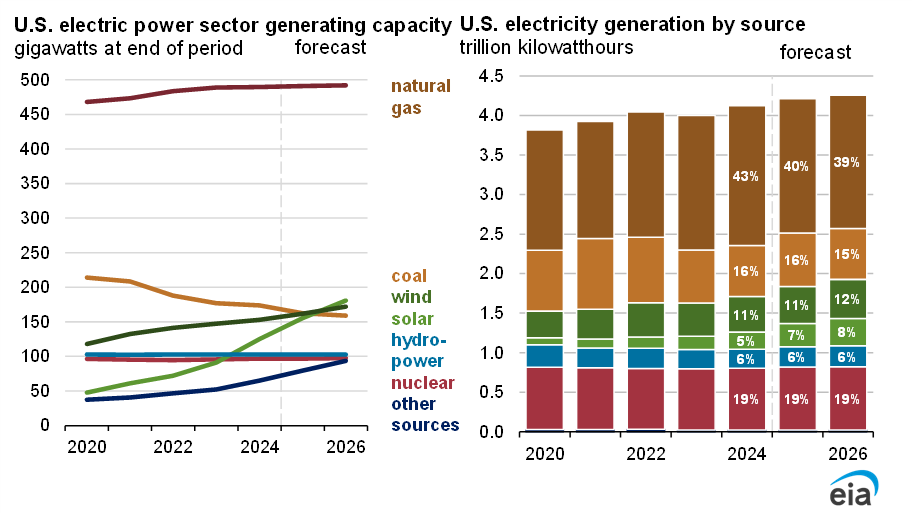

𝗚𝗮𝘀-𝗳𝗶𝗿𝗲𝗱 𝗴𝗲𝗻𝗲𝗿𝗮𝘁𝗶𝗼𝗻 𝗶𝘀 𝗨𝗡𝗗𝗘𝗥𝗣𝗔𝗜𝗗 𝗳𝗼𝗿 𝗿𝗲𝗹𝗶𝗮𝗯𝗶𝗹𝗶𝘁𝘆. Financial buyers like these assets, even as US power supplied by gas is set to DECLINE 3.7% and 0.8% in 2025 and 2026, while total generation grows 2.1% and 1.0% (from the latest STEO from the EIA).

𝙒𝙝𝙮 𝙞𝙩 𝙢𝙖𝙩𝙩𝙚𝙧𝙨? Natural gas markets have experienced a nice tailwind for the three years with gas-fired generation growing 7.2%, 7.4% and 3.9% from 2022-2024.

That trend is set to reverse as solar PV capacity grows an estimated 24% in 2025 and takes a growing share of the energy portion of the power market. Meanwhile the EIA is calling for gas-generation to decline 3.7% in 2025 resulting in ~1.2Bcf/d LESS power burn that in 2024.

But gas provides two "products" to the market: energy and reliability. LOCE and other metrics focus on energy, and indeed, solar can be cheaper on that basis alone (hence the growth).

Of course, we also care about getting our energy when we want and need it. The cost of that reliability is embedded in gas-fired generation, but not in non-dispatchable resources.

Getting this “product” more fully priced into the market is one of the great opportunities of the moment, especially as inflexible and relatively price insensitive loads (think data centers) drive growth.

No wonder the likes of Blackstone, Quantum and Trafigura are accumulating gas-fired power assets. Consider these examples: