𝗘𝘃𝗲𝗿𝘆𝗼𝗻𝗲 𝗶𝘀 𝘁𝗮𝗹𝗸𝗶𝗻𝗴 𝗮𝗯𝗼𝘂𝘁 𝗵𝗼𝘄 𝗵𝗮𝗿𝗱 𝗶𝘁 𝗶𝘀 𝘁𝗼 𝗴𝗲𝘁 𝗮 𝗴𝗮𝘀 𝘁𝘂𝗿𝗯𝗶𝗻𝗲.

𝗛𝗼𝘄 𝗯𝗮𝗱 𝗶𝘀 𝗶𝘁?

Here are a few hints from recent transcripts from from GE Vernova (~50% market share) and Siemens Energy (~28% market share):

📍𝗧𝗶𝗴𝗵𝘁𝗲𝗻𝗶𝗻𝗴 𝗦𝘂𝗽𝗽𝗹𝘆 𝗮𝗻𝗱 𝗥𝗶𝘀𝗶𝗻𝗴 𝗣𝗿𝗶𝗰𝗲𝘀: GE Vernova is capping its gas turbine manufacturing capacity at 20 GW per year. With rapid slot bookings (e.g., 9 GW in November alone), availability is shrinking, driving multiple rounds of price increases (GEV’s Scott Strazik commented “𝘸𝘦 𝘤𝘰𝘯𝘵𝘪𝘯𝘶𝘦 𝘵𝘰 𝘣𝘦 𝘪𝘯 𝘢 𝘱𝘳𝘪𝘤𝘦-𝘶𝘱 𝘦𝘯𝘷𝘪𝘳𝘰𝘯𝘮𝘦𝘯𝘵”). Further price gains are expected into 2025 as demand extends into the next decade.

📍𝗦𝗵𝗶𝗳𝘁𝗶𝗻𝗴 𝗗𝗲𝗺𝗮𝗻𝗱 𝗯𝘆 𝗥𝗲𝗴𝗶𝗼𝗻 𝗮𝗻𝗱 𝗧𝗶𝗺𝗲𝗹𝗶𝗻𝗲: GE Vernova expects Middle East to dominate 2024 shipments, with 𝘁𝗵𝗲 𝗨.𝗦. 𝗲𝗺𝗲𝗿𝗴𝗶𝗻𝗴 𝗮𝘀 𝘁𝗵𝗲 𝗹𝗮𝗿𝗴𝗲𝘀𝘁 𝗺𝗮𝗿𝗸𝗲𝘁 𝗶𝗻 𝟮𝟬𝟮𝟱 𝗮𝗻𝗱 𝗯𝗲𝘆𝗼𝗻𝗱. Asia also presents growing demand, particularly due to hyperscaler expansion in Southeast Asia.

📍𝗜𝗻𝗱𝘂𝘀𝘁𝗿𝘆-𝗪𝗶𝗱𝗲 𝗖𝗮𝗽𝗮𝗰𝗶𝘁𝘆 𝗘𝘅𝗽𝗮𝗻𝘀𝗶𝗼𝗻: Both GE Vernova and Siemens Energy are expanding manufacturing capacity to meet long-term demand. GE plans to ramp from 48 to 70–80 gas turbines/year by late 2026; Siemens targets a 30% increase in capacity, with 𝗱𝗲𝗹𝗶𝘃𝗲𝗿𝘆 𝘁𝗶𝗺𝗲𝗹𝗶𝗻𝗲𝘀 𝗻𝗼𝘄 𝘀𝘁𝗿𝗲𝘁𝗰𝗵𝗶𝗻𝗴 𝗶𝗻𝘁𝗼 𝟮𝟬𝟮𝟵–𝟮𝟬𝟯𝟬 𝗳𝗼𝗿 𝗹𝗮𝗿𝗴𝗲-𝗳𝗿𝗮𝗺𝗲 𝘁𝘂𝗿𝗯𝗶𝗻𝗲𝘀.

Anytime you see a combination rising prices amidst a lengthy term of tight supply, you know 𝘁𝗵𝗲𝗿𝗲 𝗶𝘀 𝗮𝗻 𝗼𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝘆 𝗳𝗼𝗿 𝗼𝘁𝗵𝗲𝗿 𝘁𝗲𝗰𝗵𝗻𝗼𝗹𝗼𝗴𝗶𝗲𝘀 𝗮𝗻𝗱 𝘀𝗼𝗹𝘂𝘁𝗶𝗼𝗻𝘀 𝘁𝗼 𝘀𝘁𝗲𝗽 𝗶𝗻𝘁𝗼 𝘁𝗵𝗲 𝘃𝗼𝗶𝗱 (fears of peak oil supply and high prices helped usher in the shale revolution).

𝗪𝗵𝗮𝘁 𝗰𝗼𝘂𝗹𝗱 𝗰𝗼𝗺𝗽𝗲𝘁𝗲 𝗶𝗻 𝘁𝗵𝗲 𝟮𝟬𝟯𝟬+ 𝘁𝗶𝗺𝗲𝗳𝗿𝗮𝗺𝗲?

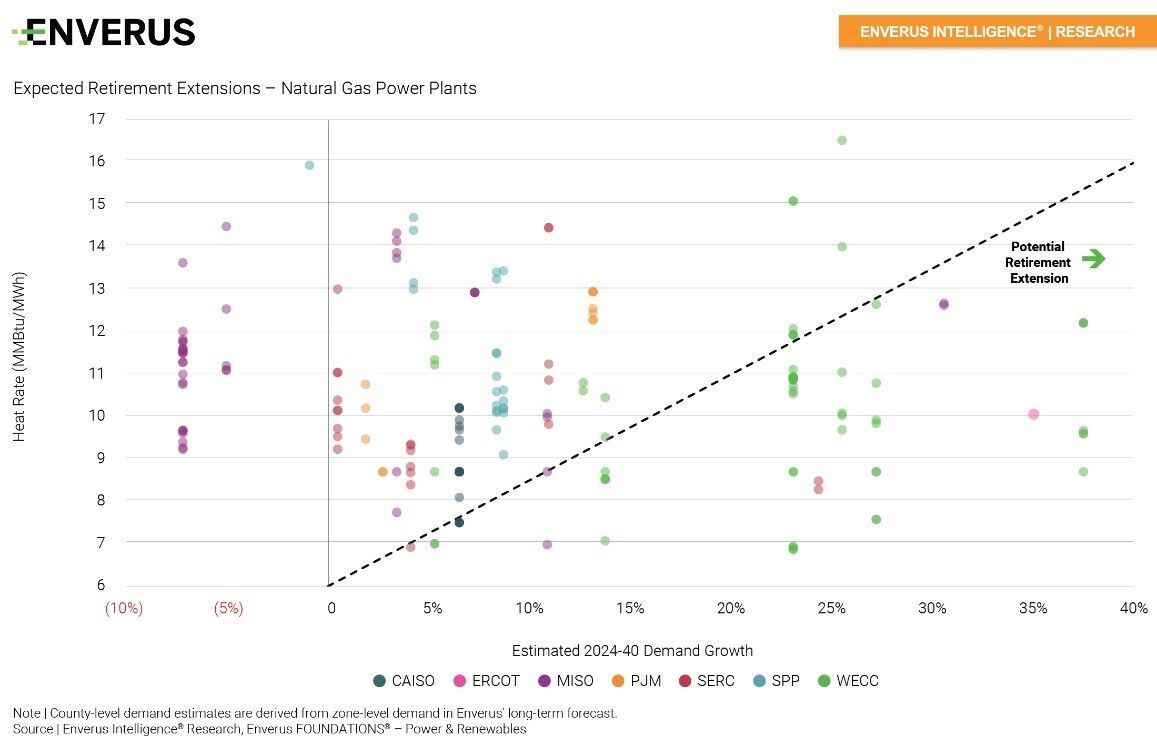

𝗗𝗲𝗹𝗮𝘆𝗲𝗱 𝗿𝗲𝘁𝗶𝗿𝗲𝗺𝗲𝗻𝘁𝘀 (𝘀𝗲𝗲 𝘁𝗵𝗲 𝗰𝗵𝗮𝗿𝘁 𝗯𝗲𝗹𝗼𝘄), 𝗴𝗲𝗼𝘁𝗵𝗲𝗿𝗺𝗮𝗹 𝗮𝗻𝗱 𝗦𝗠𝗥𝘀 𝘄𝗶𝗹𝗹 𝗹𝗶𝗸𝗲𝗹𝘆 𝗯𝗲 𝗼𝗻 𝘁𝗵𝗲 𝗹𝗶𝘀𝘁 - 𝘄𝗵𝗮𝘁 𝗻𝗲𝗲𝗱𝘀 𝘁𝗼 𝗵𝗮𝗽𝗽𝗲𝗻 𝗶𝗻 𝘁𝗵𝗲 𝗻𝗲𝘅𝘁 ~𝟮𝟰 𝗺𝗼𝗻𝘁𝗵𝘀 𝘁𝗼 𝗹𝗲𝘁 𝗳𝗼𝗹𝗸𝘀 𝗺𝗮𝗸𝗲 𝘁𝗵𝗮𝘁 𝗯𝗲𝘁?

Excerpts from transcripts:

Scott Strazik, CEO GEV

“I think to contextualize pricing, you have to take a step back and say, how many slots they have available, right, supply and demand. And what we announced last fall was capacitizing our gas business to be able to fulfill at about 20 gigawatts of new units build per year. That decision we made last summer, we continue to believe that's about the right number. So, we don't foresee taking on more supply than the 20 gigawatts that we're investing into right now. And as we do that in a 20-gigawatt capability for us to fulfill, there's less and less slots that are available.”

“For context, in the month of November last year, we secured – or our customers secured 9 gigawatts of slots in the month of November alone. In December, we took up prices again with the heavy-duty gas turbine slots we still had available in the later years of this decade, call it 2027, 2028, 2029 after that November surge.

We've continued to secure multiple gigawatts of incremental slots, or our customers have, since that price move in December and we're implementing another price action today, because the reality are directionally in the month of February, because of the fact that there's less and less slots that are available and we need to kind of vet this thing out.”

“So, we do see on the heavy-duty gas turbine side that we continue to be in a price-up environment right now. And probably in a – certainly in orders price, we will have more price benefit in 2025 than we had in 2024.”

“I can look at the market in totality and say we're generally half the market. And as approximately half the market, this is going to be our position for the foreseeable future.”

“And I think what is moving our way is the market is evolving from a very intense focus on just 2027 and 2028 to an acknowledgement that there's going to be a need for more power over a longer period of time. And whereas even four months ago, we struggled to get our customers' attention [ph] span on (13:13), let's call it, the 2031, 2032 COD, which would require a 2029 shipment, let's say, that acknowledgement of longer-duration programs is becoming more productive.”

“We expect our first quarter to be at least 5 gigawatts of new orders, so somewhat linear in the pathway for the year.”

“Our largest market in 2024 for new Gas capacity additions was in the Middle East. Our biggest orders market in 2025 will be in the US, by a fairly large margin as we see the profile of 2025 orders. So when it comes to shipment and where these things are going, 2026, 2027 is going to be a little bit more Middle East-oriented; 2027, 2028 and I would say beyond is going to be a much larger US market. I wouldn't dismiss though Asia generally as a market. I mean it's a part of the world that needs a lot of power dense solutions. There's only just so much land and we continue to see a healthy pipeline of opportunities there. I was in Singapore the first week of the year. There is a lot of hyperscaler buildout into Malaysia and Indonesia, kind of leveraging the Singapore infrastructure. That's going to create a lot of gas turbine orders for us in the next 18 months or selections in the next 18 months at minimum. So there's demand in a number of locations.”

Maria Ferraro - Siemens Energy CFO

“in Q1, we booked 24 gas turbines greater than 10 megawatts, thereof, 4 large gas turbines, and 20 industrial gas turbines. We had a very strong SGT-800 bookings with 18 units in the quarter. Our market share therefore stands at 28%.”

Christian Bruch - Siemens Energy CEO

“we are also looking on capacity expansion of roughly 30% on our side, which you have to factor in, if you talk about this there. So, there is an increase in volume coming from obviously 2026, 2027 then onwards. The second point is in terms of, let's say more or less, what does it mean in terms of how loaded are we, it depends a bit on the frames. The larger frames are more loaded than the smaller frames, is what we see in terms of delivery time.”

“You have to think about obviously if you talk about a large frame, 2029, 2030, and then onwards, really now if it is about timing there. So, this is roughly where we are. And obviously, we also try and we see us able to do this to ensure that we serve customer needs, also with a flexibility on the frames, which could be the multiple trains on a smaller turbine and find solution there.

The one thing you have to keep in mind, obviously, that we will, as I said, continue to extend capacity on the supply chain and on our own factory.”