Global Carbon Markets, Energy Shifts, and TMI’s Revival

The Week That Was: November 23-30, 2024

NOTE: “The Week That Was” is a recap of ideas shared over the last seven days.

Spare Parts: What Caught My Eye This Week

Building a Global Carbon Market | Article 6 Progress at COP29

First to Fall? | TotalEnergies Pausing Attentive Energy Offshore Project

53 MWh Second-Life Battery Storage | Element Energy's New Project in ERCOT

Building a Global Carbon Market | Article 6 Progress at COP29

𝙒𝙝𝙖𝙩 𝙘𝙖𝙪𝙜𝙝𝙩 𝙢𝙮 𝙖𝙩𝙩𝙚𝙣𝙩𝙞𝙤𝙣?

Progress towards a global carbon market at COP29: delegates agreed on a global carbon market framework under Article 6 of the Paris Agreement, allowing countries and companies to trade carbon credits to achieve climate targets.

𝙒𝙝𝙮 𝙞𝙩 𝙢𝙖𝙩𝙩𝙚𝙧𝙨?

A global carbon market would allow for a more cost effective, scalable and coordinated pursuit of climate goals. A few examples:

• Shared Climate Goals: Article 6 allows countries and entities to work together to achieve their nationally determined contributions (NDCs), aligning efforts with the global temperature targets of the Paris Agreement.

• Cost-Effectiveness: A global carbon market allows emissions reductions to occur where they are cheapest, optimizing resources and reducing the overall cost of achieving net-zero targets.

• Scalability and Liquidity: By connecting markets worldwide, it creates a larger pool of participants, increasing market liquidity and scaling investments in emissions-reduction projects across diverse sectors and geographies.

• Harmonized Standards and Accountability: It establishes consistent rules for measuring, verifying, and trading emissions reductions, ensuring transparency, avoiding double counting, and aligning efforts globally to meet net-zero goals.

• Interaction with Compulsory and Voluntary Markets: A global market can link compliance systems for greater efficiency, validate and harmonize voluntary credits, and integrate both into unified frameworks that prevent double counting and enhance transparency.

𝘿𝙚𝙩𝙖𝙞𝙡𝙨:

• At COP29 delegates reached a significant agreement to establish a global carbon market framework under Article 6 of the Paris Agreement. This framework enables countries and companies to trade carbon credits, each representing one ton of carbon dioxide either removed from the atmosphere or not emitted, to meet their climate targets.

• Key elements involve setting up a registry to track credits and determining the level of information sharing and project accountability. Countries without the resources to create their own registries to use U.N. services without U.N. endorsement of the credits.

First to Fall? | TotalEnergies Pausing Attentive Energy Offshore Project

𝙒𝙝𝙖𝙩 𝙘𝙖𝙪𝙜𝙝𝙩 𝙢𝙮 𝙖𝙩𝙩𝙚𝙣𝙩𝙞𝙤𝙣? TotalEnergies is reportedly pausing the Attentive Energy offshore wind project off the coast of New York.

𝙒𝙝𝙮 𝙞𝙩 𝙢𝙖𝙩𝙩𝙚𝙧𝙨? Trump’s victory has raised questions about which incentives for renewables and other “energy transition” technologies might be at risk under the new administration. The “pausing” of the Attentive project illustrates the chilling effect this uncertainty can have on investment, even before the new administration takes office.

𝘿𝙚𝙩𝙖𝙞𝙡𝙨:

• Offshore wind has been a top target for Trump. He has described offshore wind projects as “horrible, the most expensive energy there is… They ruin the environment, they kill the birds, they kill the whales” and told voters “we are going to make sure that that ends on Day 1” in a speech.

• Patrick Pouyanne was quoted “I decided to put the project on pause, because all the offshore wind projects are in Democratic states ... we'll see better in four years”

• The Attentive Energy project is a offshore wind project in New York state and a joint venture between TotalEnergies, Rise Light & Power, and Corio Generation. Phase 1 was planned to be 1,400, with the project ultimately producing as much as 3,000 MW.

53 MWh Second-Life Battery Storage | Element Energy's New Project in ERCOT

𝙒𝙝𝙖𝙩 𝙘𝙖𝙪𝙜𝙝𝙩 𝙢𝙮 𝙖𝙩𝙩𝙚𝙣𝙩𝙞𝙤𝙣? Element Energy energized a 53 MWh (the world’s largest) second-life grid connected battery installation in ERCOT this week.

𝙒𝙝𝙮 𝙞𝙩 𝙢𝙖𝙩𝙩𝙚𝙧𝙨? The electric vehicle (EV) industry is providing multiple tailwinds for battery electric storage systems (BESS). Second-life battery applications, like Element’s storage project, depend on “waste” from EV’s and illustrate post-production synergies between the technologies.

First-life battery projects also benefited as rising EV production has driven down battery costs for battery energy storage systems by enhancing economies of scale, spurring technological advancements, and strengthening the supply chain.

𝘿𝙚𝙩𝙖𝙞𝙡𝙨:

• Second-life batteries are lithium-ion batteries that, after serving their initial purpose—typically in electric vehicles (EVs)—still retain about 70-80% of their original capacity.

• In November 2023 Element Energy raised $111 million in capital comprised of a $73 million Series B equity investment and a $38 million debt facility provided by Keyframe Capital Partners, L.P. Equity investors included: Cohort Ventures, Mitsubishi Heavy Industries, Drive Catalyst, FM Capital, AFW Partners, LG Technology Ventures, Edison International, Prelude Ventures, and Radar Partners.

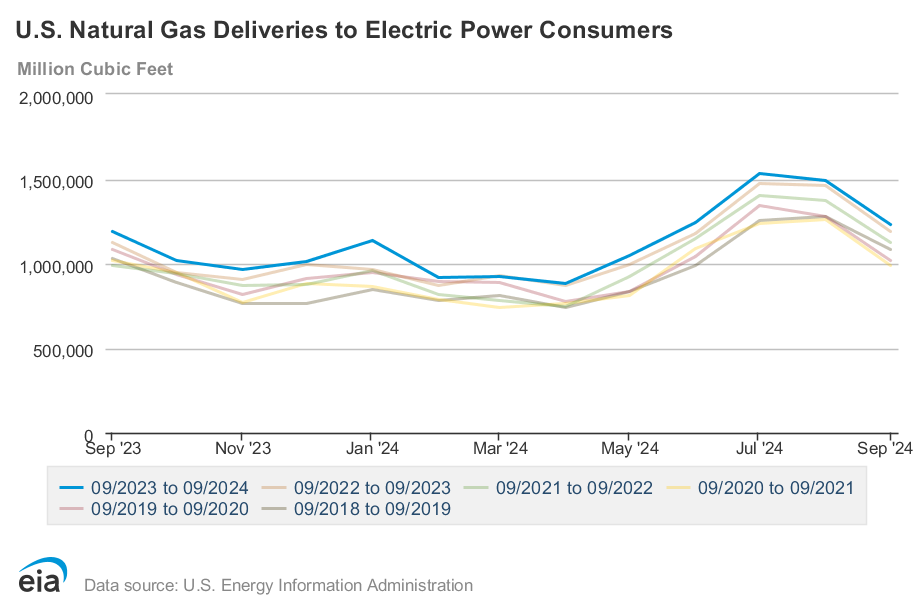

Gas-Fired Growth | September's 3.1% Increase in Gas Burn

𝙒𝙝𝙖𝙩 𝙘𝙖𝙪𝙜𝙝𝙩 𝙢𝙮 𝙖𝙩𝙩𝙚𝙣𝙩𝙞𝙤𝙣? US gas burn for electric power reached 40.9 Bcf/d in September, a 3.1% increase compared with September 2023 (39.7 Bcf/d), and the highest daily rate of electric power deliveries for the month since the EIA began using the current methodology in 2001.

𝙒𝙝𝙮 𝙞𝙩 𝙢𝙖𝙩𝙩𝙚𝙧𝙨? Gas-fired generation is marginal source of power in most markets, with coal retirements and growing load (from electrification, data centers, etc.) increasing demand for gas historically more than offsetting growth in solar, wind and BESS capacity.

A key marker in the energy transition will be when this trend plateaus, and ultimately declines. No sign of that change yet.

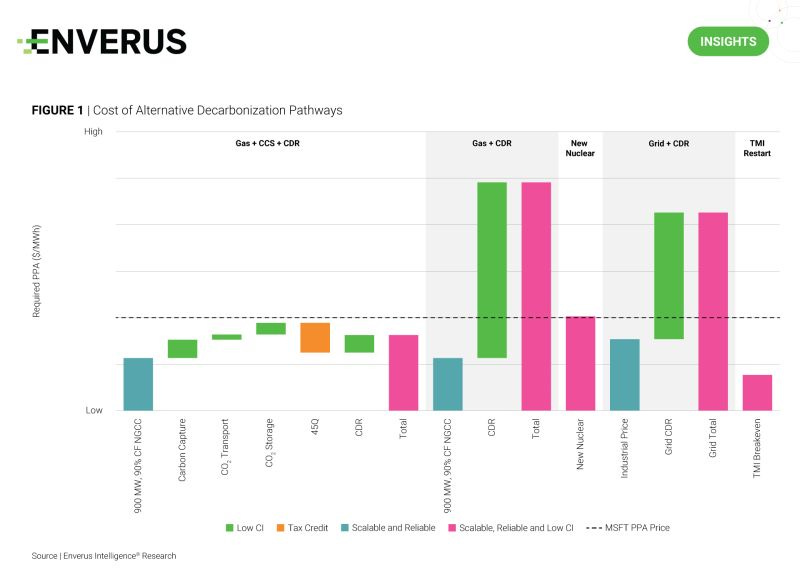

Check out this post from our team that points out nuclear is not the only path. A combination of CDRs, CCUS and gas fired generation can also get you there:

The rapid growth of artificial intelligence has created a surging demand for data centers. Tech giants like Microsoft, Google and Amazon are seeking reliable, low-carbon electricity to power future data processing hubs. Recent announcements, such as Microsoft’s repowering of Three Mile Island (TMI), Google’s backing of small modular reactors (SMRs) and Amazon’s plans to follow with its own SMR buildout, are paving the way for a nuclear resurgence.

• EIR evaluated the agreement to recommission the TMI reactor by 2028 under a 20-year PPA at ~$100/MWh, finding it more favorable than a natural gas plant with CCS due to lower risks despite higher costs.

• For a gas plant and grid power, using voluntary carbon dioxide removal credits to offset emissions is expensive, making them uneconomic at the proposed PPA price.