India's Energy Rise, Fusion Ambitions, Solar Trends, and 2025's Data Center Focus

The Week That Was: December 21-28, 2024

NOTE: “The Week That Was” is a recap of ideas shared over the last seven days.

Spare Parts: What Caught My Eye This Week

India's Energy Super Status | Now #1 in Oil, Coal and Population Growth

Fusion by the 2030's? | 400MW Project Planned in Virginia's Data Center Alley

The Solar PV Business | The Meaning of Flat PPAs and the Tight Match to LOCE

The “One Topic” for 2025: Data Center Siting

If I had to pick one topic to focus on in 2025, it would be "data center siting". Why? The scale of investment and energy demand, the available transfer capacity and withdrawal capacity at specific sites, the opportunity for multiple technology pathways to meet the challenge (CCUS, gas, geothermal, nuclear, solar, BESS, etc.).

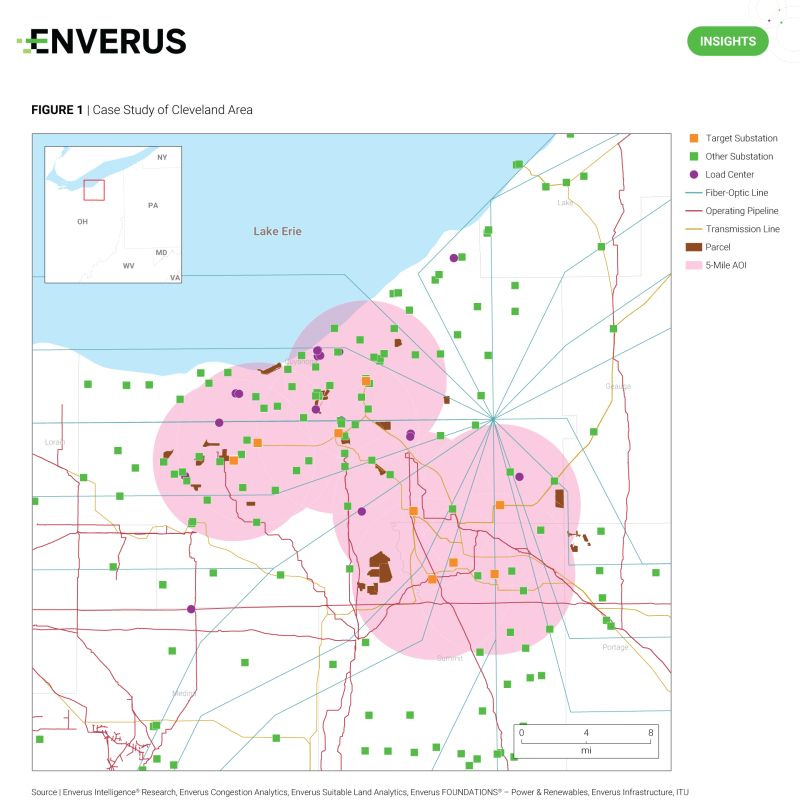

This analysis from our team Enverus Intelligence® Research does a great example illustrating the analytics market participants (investors, developers, energy producers) are performing as they make investments. Have a look:

The recent surge in data center development is driving the need for effective resource management in data center siting. Enverus Intelligence Research has developed a workflow using the Enverus PRISM® Power & Renewables suite to quickly and effectively screen for high-value sites.

💡 Key considerations in site screening include energy availability, site quality and energy costs, using metrics like available withdraw capacity, available acreage and access to transmission and fiber-optic networks.

💡 In a case study of the Cleveland area, Glenwillow and Hummel substations were found to be ideal for 1,000 MW projects due to their large AWC, while the Inland and Hummel substations were best for 600 MW projects.