Molecules and Data Centers

Will access to CCUS and hydrogen attract data center projects?

Everyone is focused on power for data centers.

But “molecules” might make the difference in attracting new projects…

By molecules, I mean CO2 (CCUS) and hydrogen.

For example, Chevron and Exxon recently announced initiatives that combine their expertise in natural gas and CCUS to develop power solutions for data centers.

Both companies are building off-grid power solutions that deliver reliable, and potentially low-carbon, power:

Chevron, in partnership with Engine No. 1 and GE Vernova, plans to deliver up to 4 GW of natural gas-based power to data centers across the U.S., with potential integration of CCUS and renewables to reduce emissions.

ExxonMobil is developing a 1.5 GW natural gas-fired plant exclusively for data centers, incorporating carbon capture technology designed to eliminate over 90% of CO₂ emissions.

And Microsoft has been dabbling with hydrogen as backup power solution:

Microsoft tested a 3MW hydrogen fuel cell in 2022 (~the size of a single diesel generator) at it’s Latham, NY facility as a zero-emission backup power alternative.

And hydrogen fuel cell was included in a demonstration project (a collaboration between Microsoft, Caterpillar and Ballard Power Systems) that simulated a 48-hour backup power event at its Cheyenne, Wyoming data center last year.

What’s the point?

This week I have been focused on Alberta’s potential as data center hub, but the province’s data center strategy barely references the region’s CCUS and hydrogen potential (CCUS is referenced once).

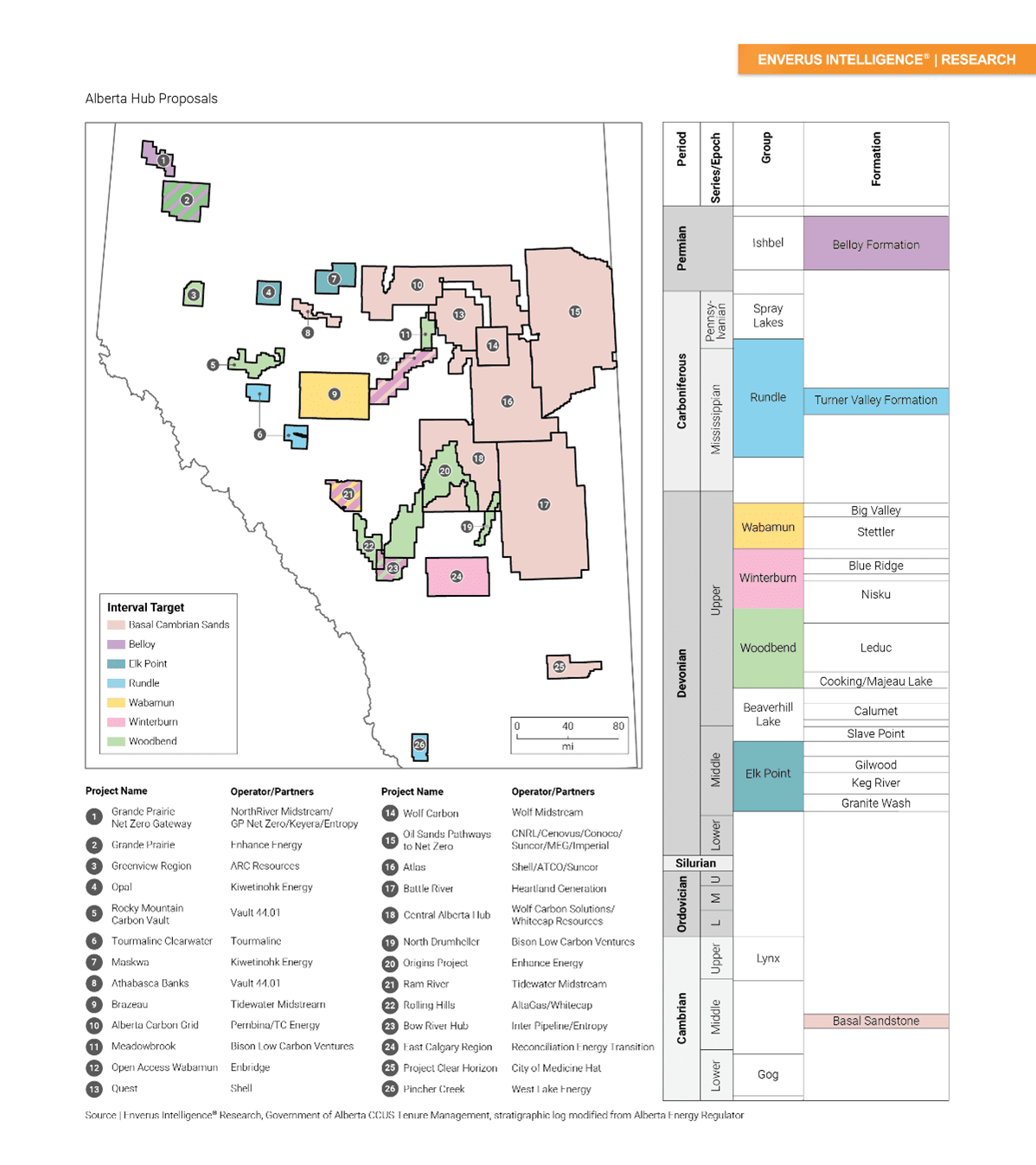

Meanwhile, Alberta has some of very best CCUS potential - from a both a technical and economic perspective - our Enverus Intelligence® Research team has seen (the map is a simplified snip from a press release - happy to share more if folks are interested).

Given the emphasis Chevron and Exxon have put on CCUS in their announcements, and Microsoft’s interest in hydrogen, I makes me wonder:

Are regions with CCUS and hydrogen infrastructure are positioning themselves as more attractive to energy-intensive industries like data centers?

Will access to these technologies become a key differentiator in data center site selection?

Does Alberta have an underappreciated advantage?