Nuclear Gains, SMR Doubts, CCUS Milestones, and Battery Boom

The Week That Was: December 28, 2024 - January 4, 2025

NOTE: “The Week That Was” is a recap of ideas shared over the last seven days.

Spare Parts: What Caught My Eye This Week

Skepticism Towards SMR Businesses | Investor Cautions Amidst the Hype

Battery Boom | U.S. Storage Soars 71% in 2024, Redefining the Role of Fossil Fuel "Peakers"

Is CEG's GSA Deal As Big As it Sounds? | The TMI Unit Deal Had More Bite than Today's Hype

Nuclear Headlines Translate to Nuclear Returns

Headlines matter. Nuclear has been a hot topic in industry with lots of great headlines (with lots of good projects and exciting plans behind them), many related to big tech and data centers.

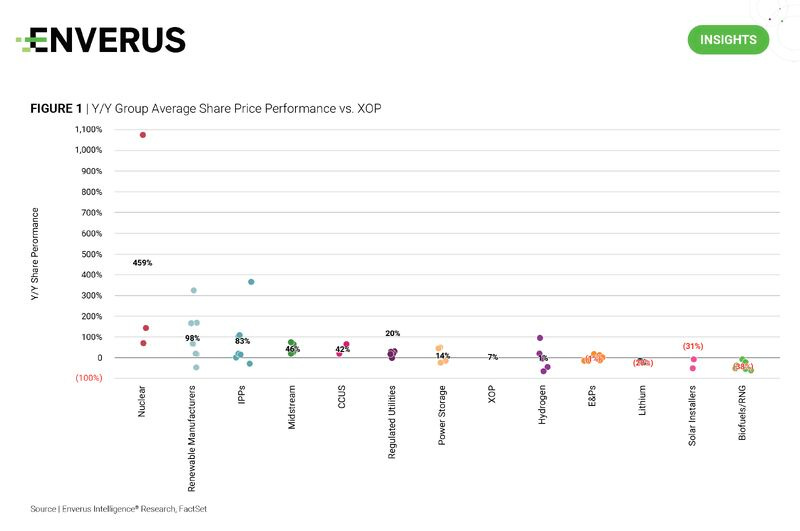

And the market has responded with the group of nuclear names we track Enverus Intelligence® Research up 459% year-over-year (as of 3Q24 earnings). See more from the team below!

An Enverus Intelligence® Research analysis of the energy transition 3Q24 earnings season found nuclear companies rose 459% year-over-year, reflecting a bullish trend driven by confidence in a supportive incoming presidential administration. Favorable policies and global decarbonization goals underscore the potential importance of small modular reactors to supply reliable, low-carbon baseload power.

• Independent power producers (IPPs) experienced an 83% increase, driven by rising demand from AI data centers and electrification, with long-term contracts ensuring sustained growth.

• Solar installers saw a 31% decline due to leveraged balance sheets, potential tax credit rollbacks and proposed tariffs, with only favorable interest rates as a positive factor.