Power shifts: Rising Demand, Nuclear Potential, and the Reality of the Energy Transition

The Week That Was: October 12-19, 2024

NOTE: “The Week That Was” is a recap of ideas shared over the last seven days.

This Week’s “On Energy”

Power is now a strategic concern for large consumers.

As an oil and gas executive put it: “You used to be able to count on the utility whenever you needed more power. Now, you must manage how you source and integrate your power into your base business.”

Why is this a boardroom issue?

Spare Parts: What Caught My Eye This Week

Energy Transition is Not the Same as Energy Independence

Countries lacking natural resources have always looked abroad to meet their needs, and this holds true for carbon storage (CCUS) and low-carbon fuels like hydrogen and ammonia.

A great example from last week:

Sumitomo Corporation, "K" line (Kawasaki Kisen Kaisha, Ltd), and Hilcorp Alaska have teamed up to explore the feasibility of transporting CO2 from Japan to Alaska for long-term storage. Formalized during an event co-hosted by Japan’s Ministry of Economy, Trade and Industry (METI) and the U.S. Department of Energy (DOE), this marks Japan's first cross-border CCS initiative with the U.S.

Why partner?

[1] Limited Domestic Storage: Japan's geography and earthquake risks limit its carbon storage options, making overseas solutions like Alaska ideal.

[2] Alaska’s Storage Potential: Cook Inlet's geological formations offer ample capacity, far exceeding Japan's annual emissions.

[3] Energy Relationships: Alaska has long exported LNG to Japan. Now, CCS can capture and store emissions back in Alaska, fostering collaboration.

This partnership showcases Japan’s strategy to overcome domestic limitations and leverage international cooperation to meet its 2050 decarbonization targets—a relationship built on interdependence.

"Skepticism and Sustainability"

Thank you to the Haskayne School of Business and all the incredible thought leaders and industry experts for an insightful event on this theme.

It was an great to hear from Dr. Serasu D. on the circular economy and Dr. Chelsea W. on the impact of corporate social responsibility. A special thanks to Senator Pamela Wallin for moderating dynamic conversations with Mac Van Wielingen, Byron Neiles, and Janice Tran.

Three ideas I left with:

[1] Authenticity is key to successful CSR communication, as stakeholders value genuine efforts over visibility, and companies must align their actions with credible, congruent messaging to avoid criticism.

[2] Unlocking economic potential in renewables and waste conversion requires innovative business models, like off-balance sheet financing, to capitalize on waste energy and drive profitability in the green economy.

[3] The missing element in ESG is Economics, highlighting the need to integrate financial viability into sustainability efforts.

Headline Hype or Huge step? Google + SMRs

Google has signed the world’s first corporate agreement to purchase nuclear energy from Kairos Power’s small modular reactors (SMRs).

A few observations:

[1] The language is specific: the agreement is to purchase “nuclear energy from multiple small modular reactors (SMRs)”, not the reactors themselves...

[2] ... meaning the tech and development risks likely remain with Kairos.

[3] At 500 MW by 2035, delivered by multiple reactors, this is a small fraction of Google’s overall AI led energy demand growth. I.e. not a massive commitment by the tech giant.

Still the headline is an important milestone for Kairos' technology. And it is yet another signal that tech companies are looking to diversify their energy mix with low-carbon solutions, reinforcing their support for nuclear (of all flavors) as part of a broader strategy to meet their sustainability goals.

What are your thoughts on how this might affect the broader adoption of SMRs? How big a deal is this news?

Emissions Posts Don't Get Much of a Reaction

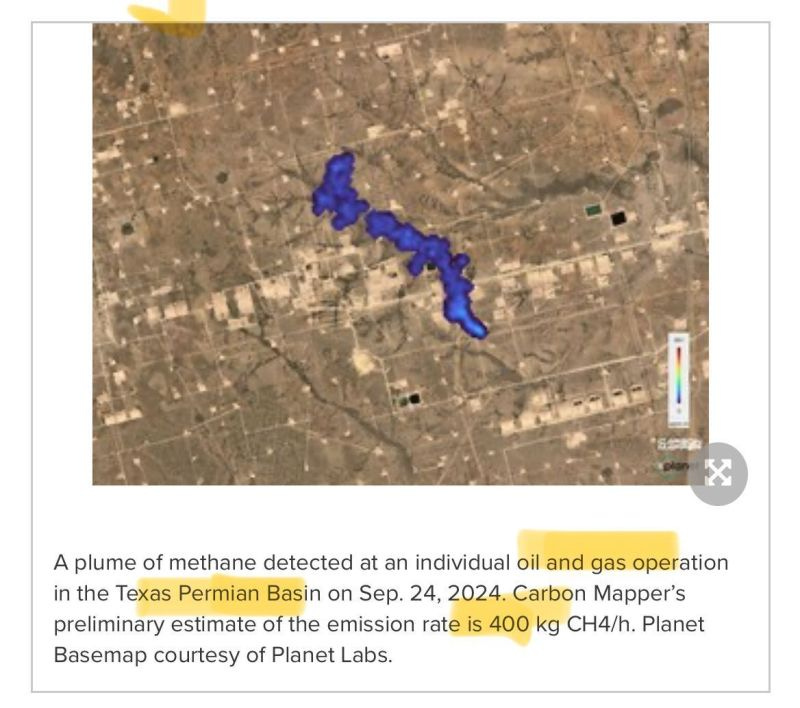

But this deserves attention.

The eyes in the sky have arrived. Carbon Mapper just released the first methane detections from its Tanager-1 satellite, which can pinpoint emissions at a resolution of 30 meters—down to specific equipment like flare stacks and pipelines.

It’s a huge leap beyond satellites like TROPOMI, which can't identify precise sources. This makes tracking leaks and attributing them to operators far easier.

The kicker? Carbon Mapper's data is publicly available, meaning anyone can analyze emissions from industries like oil & gas in real time.

Expect more stories exposing methane leaks to surface soon. How will companies stay ahead of these data-driven narratives?

In case you missed it, Energy Alberta is planning up to a 4,800 MW new nuclear power project in Alberta — about 23% of the province's current capacity.

Here’s what you need to know:

[1] Massive Output: Up to five CANDU reactors, each producing 1,000 MW, far surpassing Alberta’s largest natural gas plant (1,300 MW).

[2] Privately Funded: A first for Canada, this $35 billion project is backed by private capital with no government funding required, a groundbreaking shift for nuclear energy.

[3] Next-Gen Design: The new CANDU Monark reactor offers cutting-edge fuel efficiency, flexibility with fuel types, and an extended 70-year lifespan.

"Privately funded"? Let's see if Alberta can take advantage of big tech's quest for power for AI datacenters!

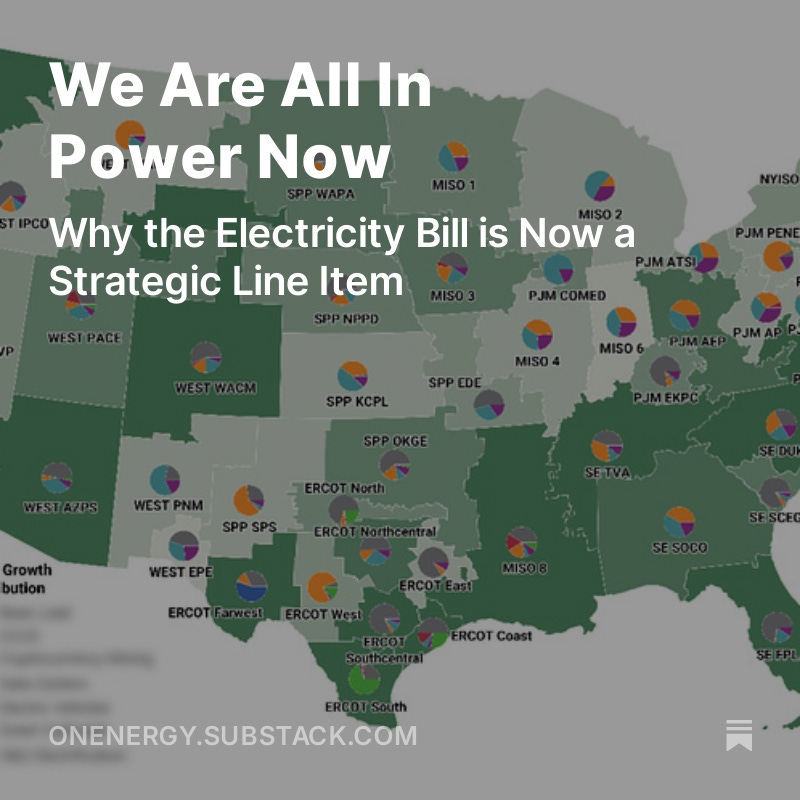

Power Demand is Rising

Check out Manuj Nikhanj's post on natural gas and its role supporting renewables.

3 ideas he highlights:

[1] Enverus Intelligence® Research has identified prime U.S. locations for natural gas-fired projects, taking into account forward power prices, gas feedstock costs, and demand growth.

[2] Using seven-year gas price forward curves, our analysis highlights key trends, like ISONE's $6/MMBtu winter price spikes and PJM/ERCOT’s sub-$3/Mcf gas.

[3] Doing this right requires analytics from upstream oil and gas, paired with regional gas hub price forecasts and evaluations of natural gas plant economics and assess regional gas demand for power generation.

How do you identify the right locations for natural gas-fired projects? What insights do you need to navigate shifting supply-demand dynamics?