Policy Shifts, Growing Data Center Demands, and Emerging Carbon Removal Technologies

The Week That Was: November 2-9, 2024

NOTE: “The Week That Was” is a recap of ideas shared over the last seven days.

Spare Parts: What Caught My Eye This Week

FERC Rejects Talen-AWS | Amended ISA to Expand Co-Located Load Denied

Microsoft Buys mCDRs From Ebb Carbon | A step forward for marine CDR technology?

Virginia's Power Future | Dominion Energy Virginia: 30% Increase in Data Center Demand

Changing Trajectories | How is Policy Impacting Energy Supply on Either Side of the 49th Parallel?

FERC Rejects Talen-AWS | Amended ISA to Expand Co-Located Load Denied

𝙒𝙝𝙖𝙩 𝙘𝙖𝙪𝙜𝙝𝙩 𝙢𝙮 𝙖𝙩𝙩𝙚𝙣𝙩𝙞𝙤𝙣?

U.S. energy regulators denied an amended interconnection agreement for an Amazon data center at Talen Energy's Susquehanna nuclear plant, citing concerns over potential public cost increases and grid reliability impacts.

𝙒𝙝𝙮 𝙞𝙩 𝙢𝙖𝙩𝙩𝙚𝙧𝙨?

• The proposal would have increased "the amount of Co-Located Load from 300 megawatts (MW) to 480 MW and to make revisions related to the treatment of this Co-Located Load".

• The proposed agreement failed to prove the changes were "necessary". The ruling notes"a transmission provider seeking a case-specific deviation from its pro forma interconnection agreement bears a high burden to justify and explain that its changes are not merely “consistent with or superior to” the pro forma agreement, but are necessary changes".

• What does connected to the grid mean? It's not just about energy, but also about ancillary services and capacity. Exelon and AEP claim the co-located load would receive two types of benefits from the transmission system: 1) power from the transmission system to operate: "the nuclear power plants cannot operate without electricity and cannot be islanded from the system" and, 2) it "still receives ancillary services and capacity from the PJM transmission system".

Microsoft Buys mCDRs From Ebb Carbon | A step forward for marine CDR technology?

𝙒𝙝𝙖𝙩 𝙘𝙖𝙪𝙜𝙝𝙩 𝙢𝙮 𝙖𝙩𝙩𝙚𝙣𝙩𝙞𝙤𝙣?

Microsoft has entered into an agreement with Ebb Carbon for 1,333 tons of CO₂ removal with options for an additional to 350,000 tons over ten years, signaling confidence in Ebb Carbon’s ocean-based, verifiable marine carbon dioxide removal (mCDR) technology.

𝙒𝙝𝙮 𝙞𝙩 𝙢𝙖𝙩𝙩𝙚𝙧𝙨?

• Carbon Dioxide Removal (CDR) credits have consistently priced above $1,000 per ton, underscoring both the challenges of direct CO₂ removal and the high value placed on technologies capable of removing previously emitted carbon.

• This marks a significant step toward scaling Ebb Carbon's technology. The initial phase will deliver 1,333 tons of CO₂ removal, with Microsoft holding an option to secure up to an additional 350,000 tons over the next decade.

• Ebb Carbon's technology harnesses the ocean's natural capacity for CO₂ capture, offering a pathway to scalable, large-scale carbon removal. By increasing seawater alkalinity through electrochemical processes, Ebb Carbon enables the ocean to absorb more atmospheric CO₂ and store it as stable bicarbonate ions, providing a long-lasting solution for carbon storage.

Virginia's Power Future | Dominion Energy Virginia: 30% Increase in Data Center Demand

Dominion’s Q3 2024 call included plenty of discussion on data centers, load growth in Virginia, and the implications for the future.

𝙒𝙝𝙖𝙩 𝙘𝙖𝙪𝙜𝙝𝙩 𝙢𝙮 𝙖𝙩𝙩𝙚𝙣𝙩𝙞𝙤𝙣?

Robert Blue, Chair, President & Chief Executive Officer of Dominion noted: “we have data center demand of over 21 gigawatts as of July 2024, which compares to around 16 gigawatts as of July 2023. These contracted amounts do not contemplate the many data center projects that are in development phase, and have not yet reached a point in the service connection process or a contract is executed”.

A few other notes:

Increasing REC Prices and Local Demand Pressures: The surge in forecasted REC prices, driven by escalating demand and Virginia-specific procurement requirements, adds cost pressures for data centers striving to meet renewable energy targets in the Virginia region.

Massive Data Center Energy Demand: Dominion Energy’s service area currently has over 21 gigawatts of committed data center demand, reflecting an accelerated growth trajectory. With substantial infrastructure investments underway, any project cancellations will require reimbursements, and escalating service agreements reflect ongoing capacity ramp-up.

Strategic Growth with Nuclear and Renewable Expansion: Dominion is pursuing extensive generation diversification, including SMRs (small modular reactors) to meet around-the-clock carbon-free energy needs for data centers, while also expanding offshore wind and natural gas projects in response to Virginia’s Clean Economy Act, which mandates a carbon-free grid by 2045.

Trump Wins | What Now for Energy?

𝙒𝙝𝙖𝙩 𝙘𝙖𝙪𝙜𝙝𝙩 𝙢𝙮 𝙖𝙩𝙩𝙚𝙣𝙩𝙞𝙤𝙣?

Trump is set to return to the White House, bringing his "America First" approach to energy policy, prioritizing fossil fuel production, deregulation, and energy independence.

𝙒𝙝𝙮 𝙞𝙩 𝙢𝙖𝙩𝙩𝙚𝙧𝙨?

Energy legislation and policy from Biden’s administration now face the possible revision of either their application or underlying directives. A few examples:

• The ~$2 Trillion of bills that influence and support energy were passed under Biden: the Inflation Reduction Act (IRA), the Bipartisan Infrastructure Law (BIL) & the CHIPS and Science Act. Will there be any amendment to these bills or how they are implemented?

• The EPA’s new standards for power plant emissions, passed in April 2024, which aims to reduce power sector carbon emissions by 90% through carbon capture technologies. This negatively impacts the use of natural gas for baseload power needed serve AI and ensure grid reliability. Does this change in support of natural gas?

• State Primacy for Class VI Wells: States with primacy can tailor the permitting process to their specific geologic and regulatory contexts, potentially expediting project approvals and fostering local expertise in CO₂ sequestration. States like Texas, West Virginia and Arizona are seeking primacy, while North Dakota, Wyoming and Louisiana already have it. Will States get a greater say in energy related policy making?

What do you predict will be the most significant shifts in energy under Trump?

Changing Trajectories | How is Policy Impacting Energy Supply on Either Side of the 49th Parallel?

𝙒𝙝𝙖𝙩 𝙘𝙖𝙪𝙜𝙝𝙩 𝙢𝙮 𝙖𝙩𝙩𝙚𝙣𝙩𝙞𝙤𝙣?

The different trajectories of US and Canadian energy policy.

Two stories highlight the contrast: This week we received details on Canada's proposed cap on emissions from it's oil and gas sector. Critics see this as a cap on oil and gas production.

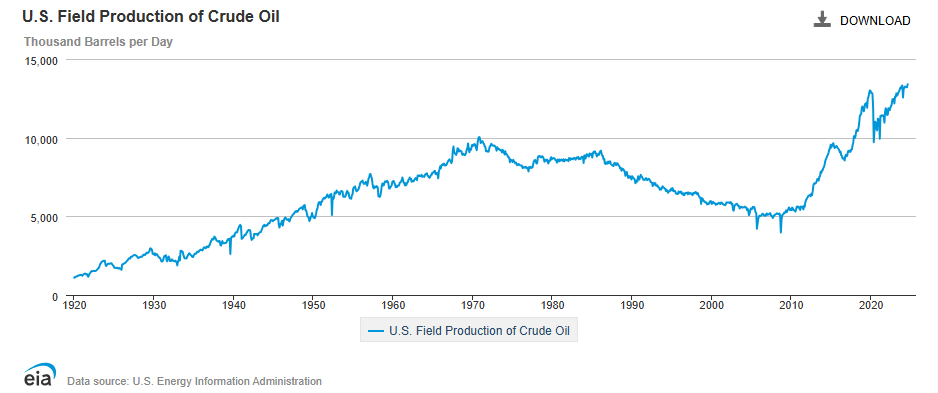

Meanwhile US policy has been less restrictive - Bloomberg Green highlighted US oil production growth in spite of John Kerry's claim from last year that "We are moving away from fossil fuels”. And it may get better for US energy with Trump heading to the Whitehouse.

𝙒𝙝𝙮 𝙞𝙩 𝙢𝙖𝙩𝙩𝙚𝙧𝙨?

Both Canada and the are energy superpowers and benefit economically from the success of their energy industry. Both countries have seen their hydrocarbon production reach new highs.

How quickly could these trajectories change?

𝘿𝙚𝙩𝙖𝙞𝙡𝙨:

• Canada has proposed draft regulations to cap greenhouse gas emissions* in its oil and gas sector, targeting a 35% reduction below 2019 levels. The regulations introduce a cap-and-trade system to incentivize cleaner production, supporting jobs and innovation without restricting production growth. The measures are part of Canada’s broader climate strategy to lower emissions by 40-45% by 2030. Consultation on the draft runs from November 9, 2024, to January 8, 2025.

• US policy, in contrast, has not placed a strict total emissions cap, favoring policies that restrict the relative level of emissions (proposing a carbon capture requirement from some fossil fueled power plants), targeting the rate of a release from a single source (through the methane tax, for example), or through the IRA that promotes low carbon technologies in an effort to crowd out fossil fuels.

“Price is what you pay. Value is what you get.”

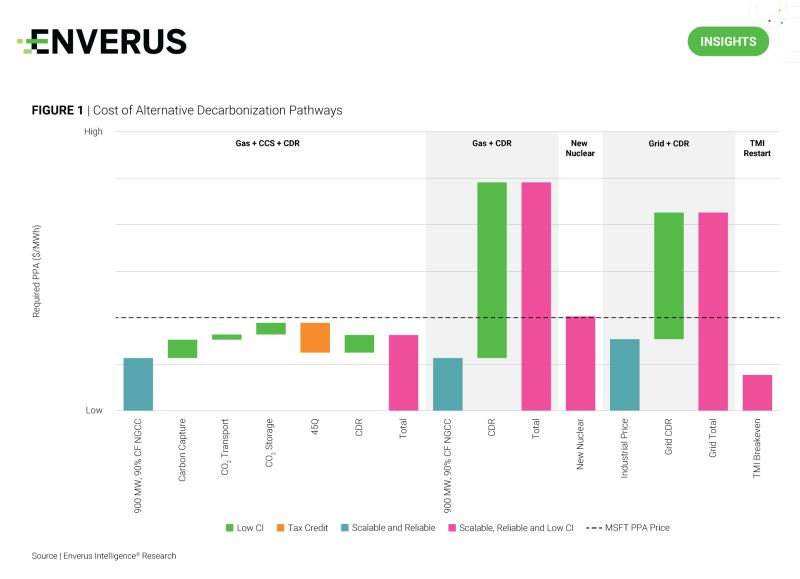

For big tech the value of power + reliability + low carbon is high. Nuclear isn’t the only path, as my team Enverus Intelligence® Research shows in the note highlighted below.

Gas may be faster and cheaper (if low carbon is less of an issue), and competitive with CCUS (if the pore space will cooperate). Geothermal is on the horizon, as are SMRs.

The “best” path will in the eye of the beholder, colored by the pace of technological progress. The future is a diverse and complex energy world.

Check out the LinkedIn post from our team:

The rapid growth of artificial intelligence has created a surging demand for data centers. Tech giants like Microsoft, Google and Amazon are seeking reliable, low-carbon electricity to power future data processing hubs. Recent announcements, such as Microsoft’s repowering of Three Mile Island (TMI), Google’s backing of small modular reactors (SMRs) and Amazon’s plans to follow with its own SMR buildout, are paving the way for a nuclear resurgence.

• Enverus Intelligence® Research (EIR) evaluated the agreement to recommission the TMI reactor by 2028 under a 20-year PPA at ~$100/MWh, finding it more favorable than a natural gas plant with CCS due to lower risks despite higher costs.

• For a gas plant and grid power, using voluntary carbon dioxide removal credits to offset emissions is expensive, making them uneconomic at the proposed PPA price.