Power & Gas: Diamondback Style

“... stop selling your gas for zero and paying full boat for power...”

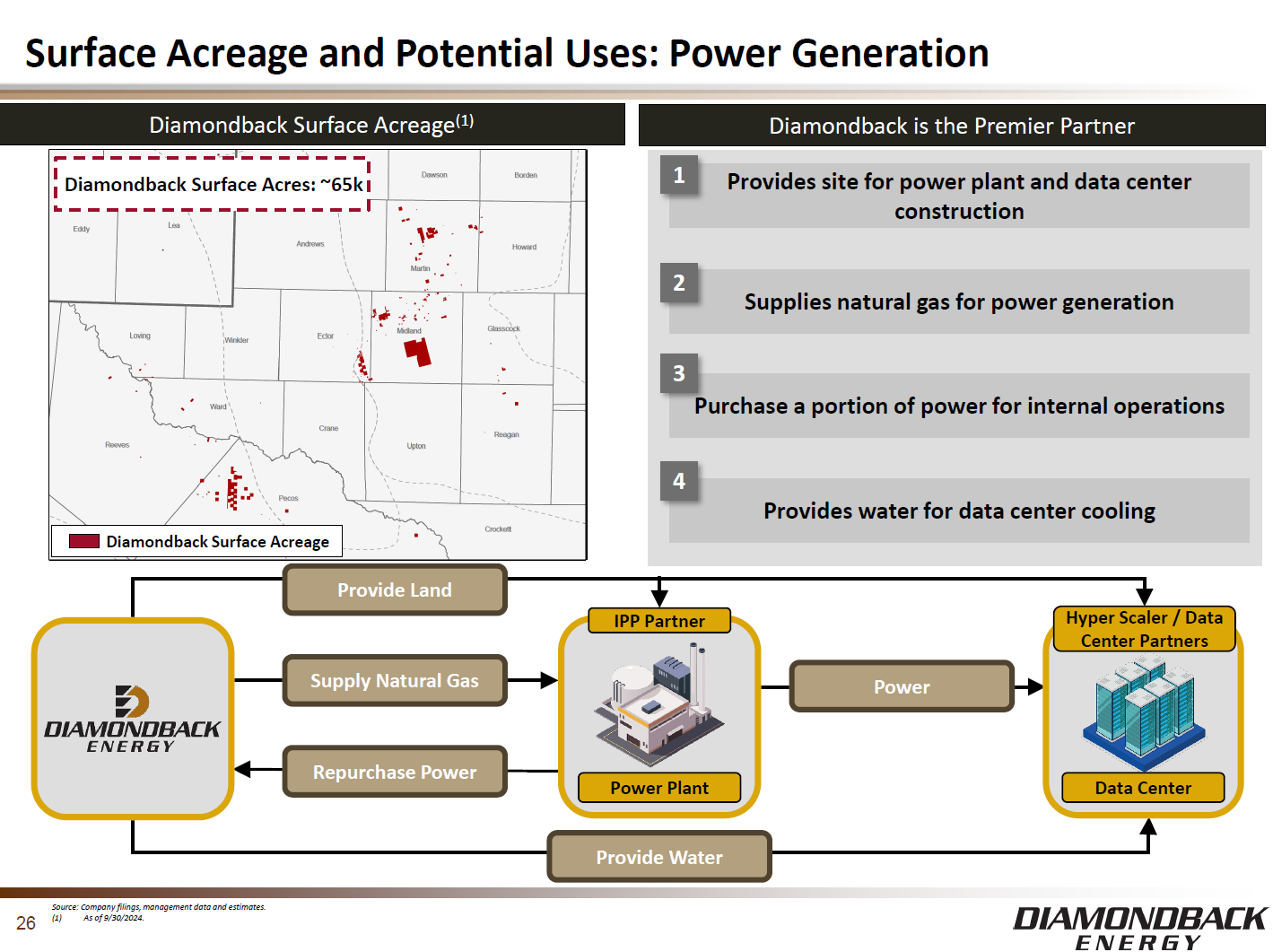

𝙒𝙝𝙖𝙩 𝙘𝙖𝙪𝙜𝙝𝙩 𝙢𝙮 𝙖𝙩𝙩𝙚𝙣𝙩𝙞𝙤𝙣? Power and gas (THE theme of 2025) comments from Kaes Van’t Hof, Diamondback Energy’s CFO, during their last earning’s call. Specifically, the opportunity to allocate capital to power generation and “stop selling your gas for zero and paying full boat for power.”

𝙒𝙝𝙮 𝙞𝙩 𝙢𝙖𝙩𝙩𝙚𝙧𝙨? Executives from across the energy ecosystem are increasingly focused on power, both as an opportunity and risk to their business. In this case, there opportunity and risk is to transform low priced (zero priced?) Permian gas into a higher value energy stream (power), while reducing the exposure to rising power prices:

“… we're going to find ways to benefit Diamondback shareholders by finding a new local market for our gas, but also insulating part of our business from what we believe to be an increasing power price in Texas over the next 10 years…”

Kaes Van’t Hof

What I like about this example is that available land and water infrastructure (strengths from their core business) combine with low cost gas (a weakness in the core business) to create a potentially attractive opportunity capital allocation decision and business expansion.