Slowing Warming, Offshore Wind Woes, and Hydrogen Breakthroughs

The Week That Was: January 18-24, 2025

NOTE: “The Week That Was” is a recap of ideas shared over the last seven days.

Spare Parts: What Caught My Eye This Week

The “Unleashing American Energy” Executive Order | Shifting US Energy Policy

Ørsted's $600M Impairment on Sunrise Wind | Offshore Wind Challenges in the U.S.

Gas, Nuclear and GE Vernova | Portfolio tailwinds and headwinds

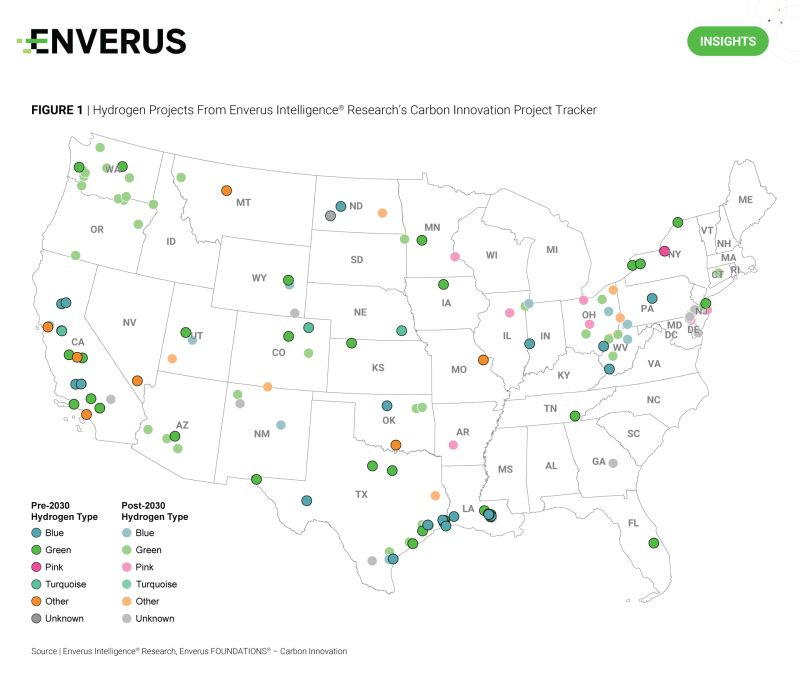

Hydrogen’s Future | Finalized 45V Credit Rules

Can the hydrogen industry get going? Finalized 45V tax credit rules clarify what the rules of the game, but, as our team at Enverus Intelligence® Research point out, more (technology progress, market demand, etc.) is likely required for the industry to hit primetime. Check out the post:

The finalized 45V clean hydrogen production tax credit provides clarity and incremental flexibility for electrolytic (green) and methane-derived (blue) hydrogen developers but may still fall short of revitalizing the industry.

• The new regulations permit green hydrogen producers to use retiring nuclear power and suggest greater eligibility for blue hydrogen, but critical details remain unresolved.

• Enverus Intelligence® Research finds delaying the hourly electricity matching requirements to 2030 reduces the levelized cost of green hydrogen by $0.33/kg H₂, lowering it to $3.57/kg H₂ assuming operations begin in 2025.