Could tariffs be a tailwind for LNG demand?

Maybe it is a stretch, but hear out the logic:

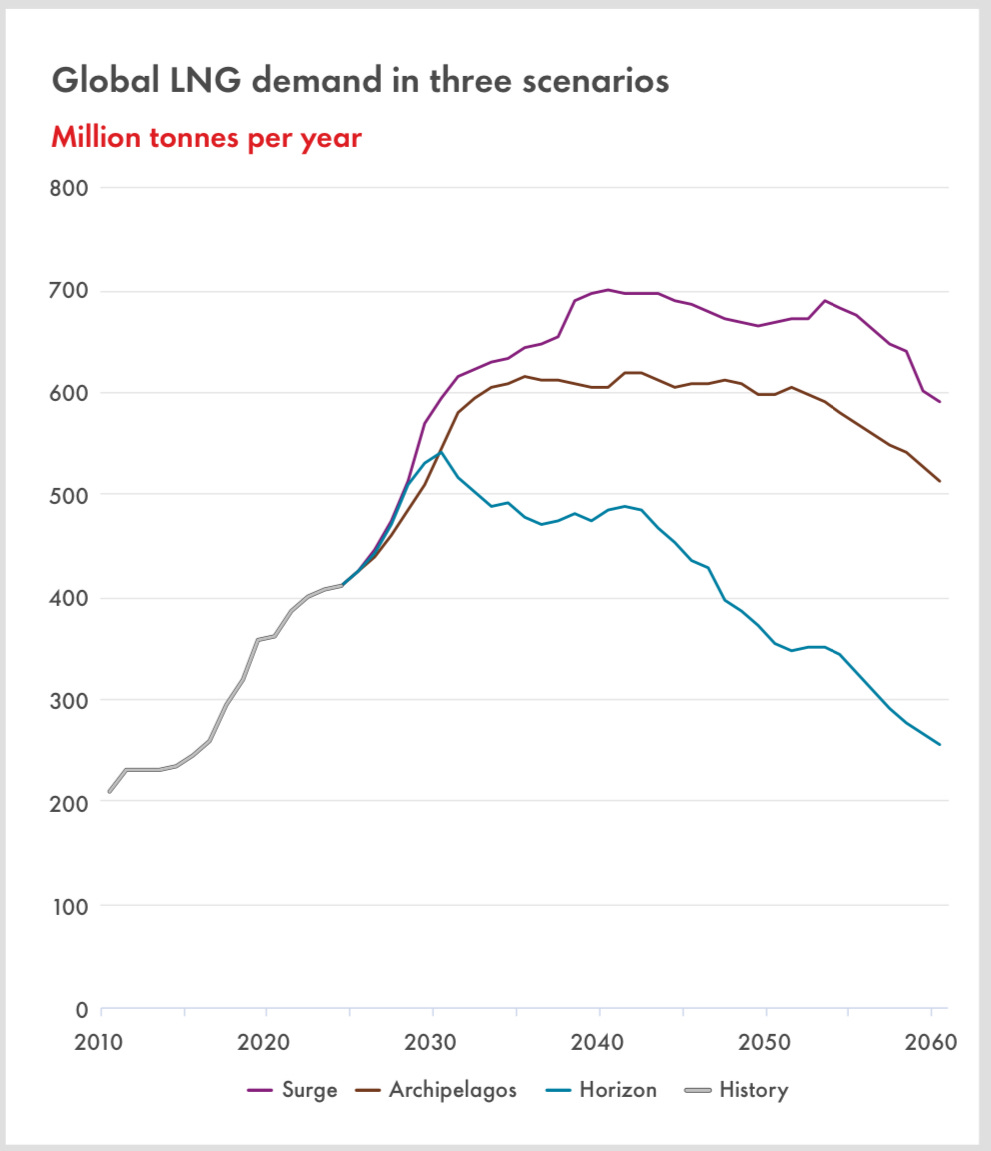

Shell's Surge Scenario (from there Energy Security Scenarios) outlined the potential that AI offers the potential for accelerated economic growth and energy demand. For that to be true, a lot of data centers will be required around the world.

At the same time, a more protectionist and geopolitically uncertain environment encourages more countries to build their own AI infrastructure and reduce dependence on others (even partners and allies).

Data centers have a cooling problem (you need to dissipate a lot of heat). LNG regas has "cold energy" and can act as heat sink while also providing feedstock for gas-fired power generation. The result is a number of examples of "LNG-cooled data centers" being considered in import countries. For example:

Singapore: Floating Data Centre Park (FDCP) – Keppel Data Centres developing a floating data center using seawater cooling. Source

Thailand: ST Telemedia Global Data Centres (STT GDC) & PTT Digital Solutions – Studying LNG cold energy for data center cooling. Source

South Korea: KT Corporation & KOGAS – Developing a data center cooled using LNG regasification cold energy. Source

South Korea: SK Gas Ulsan Project – Exploring LNG cold energy utilization for data center cooling. Source

If more regions feel the need to develop their own data center infrastructure, collocating them with gas generation at LNG regas facilities makes some sense: you save on cooling, you secure power supply, but still have LNG supply risk.

For energy lean countries/regions - those where energy independence is unlikely - this might be an attractive solution for AI independence. If it is, that sounds like a tailwind for LNG.

What do you think? Could this dynamic be big enough to influence LNG markets?