The 2032 Question

EIA’s Latest Outlook Sets the Stage for Policy and Market Tension

2032 looms large in the 2025 edition of the EIA’s Annual Energy Outlook (AEO), released this week.

The outlook is based on laws and regulations implemented as of December 2024 (i.e. pre-Trump) with the EPA’s proposed GHG rules, the Inflation Reduction Act (IRA) and Infrastructure Investment and Jobs Act (IIJA) baked in.

The new administration has signaled significant shifts in policy not incorporated in the AEO, making this edition of the EIA’s long-term outlook an interesting catalyst for conversation.

Here are a few charts from the “Reference Case” that caught my attention:

“Delivered Energy” remains relatively flat while “Total Energy “use is set to decline. (NB: delivered energy is energy that actually reaches the consumer and excludes losses from generation, transmission and distribution). This accounting. ~100% of the difference is due to a decline in “Electricity-Related Losses” attributed to the conversion of fossil fuels to electricity. Notably, “conversion losses are not attributed to non-thermal, renewable sources such as wind, solar and hydroelectric”.

What impact will the drive to bring manufacturing back to the US have?

Natural Gas use by the power sector declines beyond 2032. Declining coal generation accommodates renewable generation growth until ~2032. Continuing renewable generation growth leads to a decline in gas consumption for power through the mid-2030s before stabilizing in 2040+. Nuclear is a non-factor in the outlook.

How does this chart look without the EPAs Power Plant Rules? How do tariffs and potential changes to the IRA impact the renewables outlook?

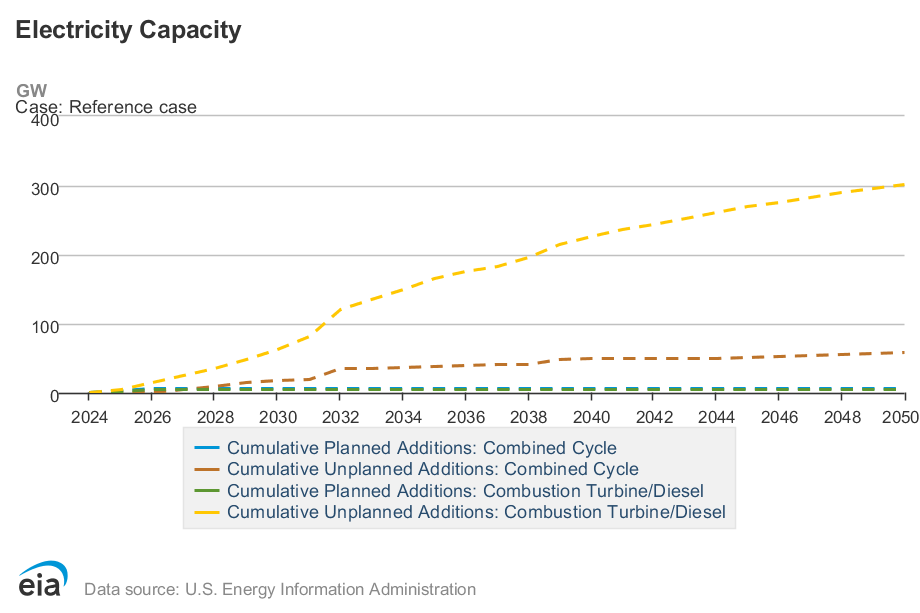

Gas related generation capacity is added throughout the outlook period. The biggest additions are in the “Combustion Turbine/Diesel” category (simple-cycle combustion turbines and diesel generators) and continue through the outlook to 2050. Combined cycle capacity is also added through ~2032.

What other technologies compete for the peaker plant market? How quickly can gas respond if there is a slowdown in renewable development?

Electricity generation costs decline in share of total electricity costs (presented in real terms). Generation prices decline this decade before rising for the remainder of the outlook. Transmission and distribution costs rise (in real terms) throughout.

Will prices rise a gently as projected? How certain is the near-term decline in generation prices?

The “cheapest” reliable power capacity depend on carbon objectives. Gas technologies (combined cycle and aeroderivative) are presented as the lowest cost firm power (in terms of overnight capital costs). If decarbonized power is a priority, solar PV with storage comes in below combined cycle gas with carbon capture.

Can nuclear compete? Can combined-cycle with carbon capture costs fall below solar PV with storage? Where?

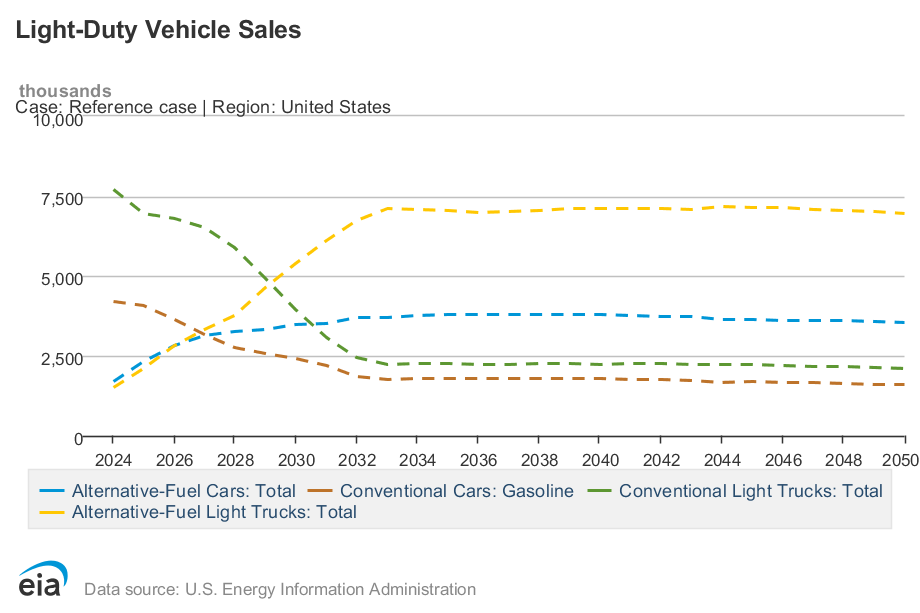

Light truck sales shift towards “alternative fuels” (including EVs) faster than conventional cars. The shift in sales composition is complete by 2032 with buyer patterns stabilizing for the remainder of the outlook.

How much of this pathway is driven by vehicle emissions standards? How does this look like with more relaxed standards?

What is the AEO? The AEO provides long-term projections of U.S. energy markets to inform policy, investment, and planning decisions. Using the National Energy Modeling System, it outlines a reference case based on current laws and explores alternative scenarios to assess key uncertainties. While not a forecast, the AEO offers a consistent, policy-neutral baseline for understanding future energy trends.