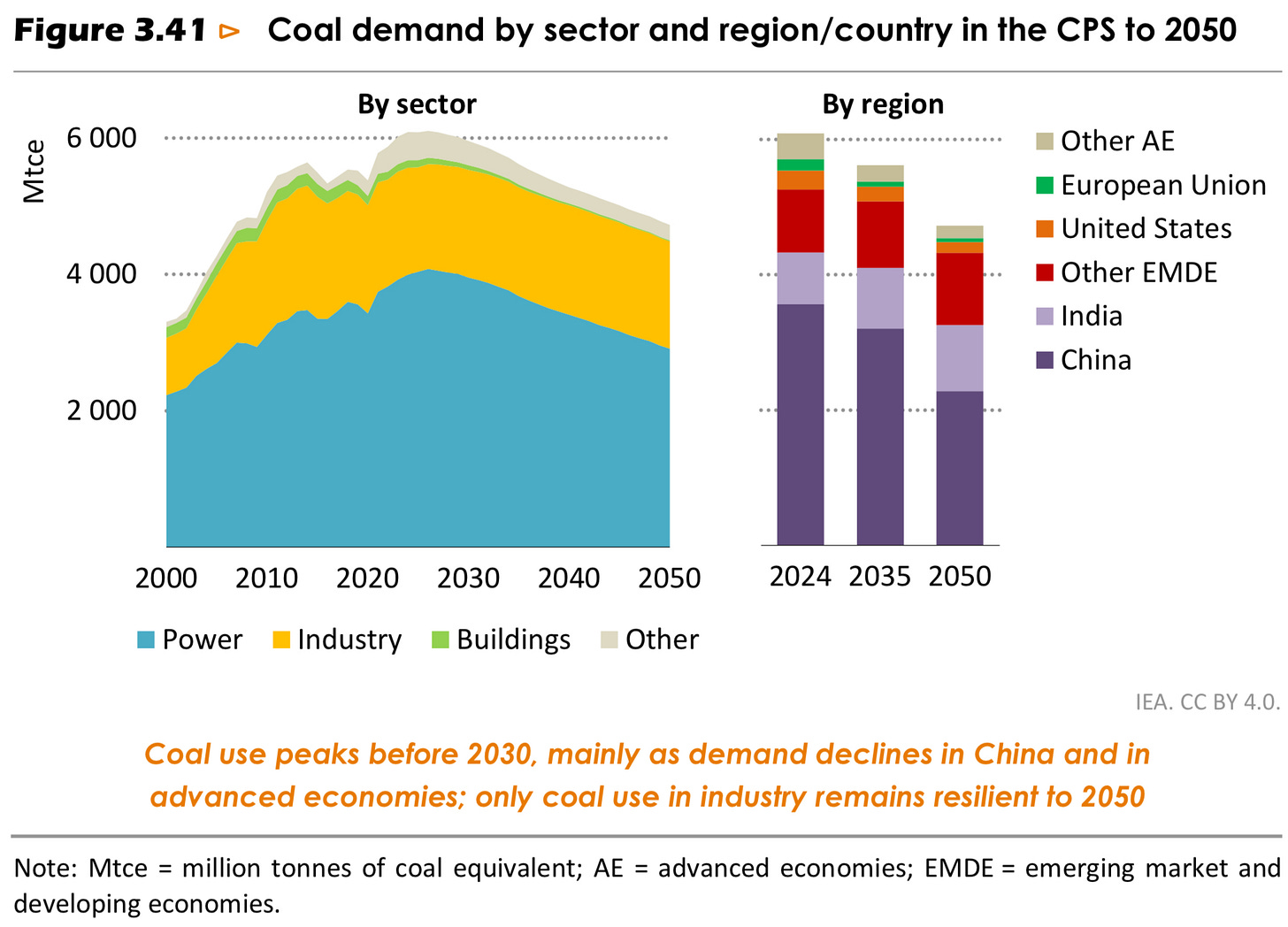

The prevailing narrative in energy markets holds that global coal demand is peaking and headed into irreversible decline. The IEA’s World Energy Outlook 2025 Current Policies Scenario is consistent with this view: coal consumption edges higher before falling sharply through 2050 (Figure 3.41).

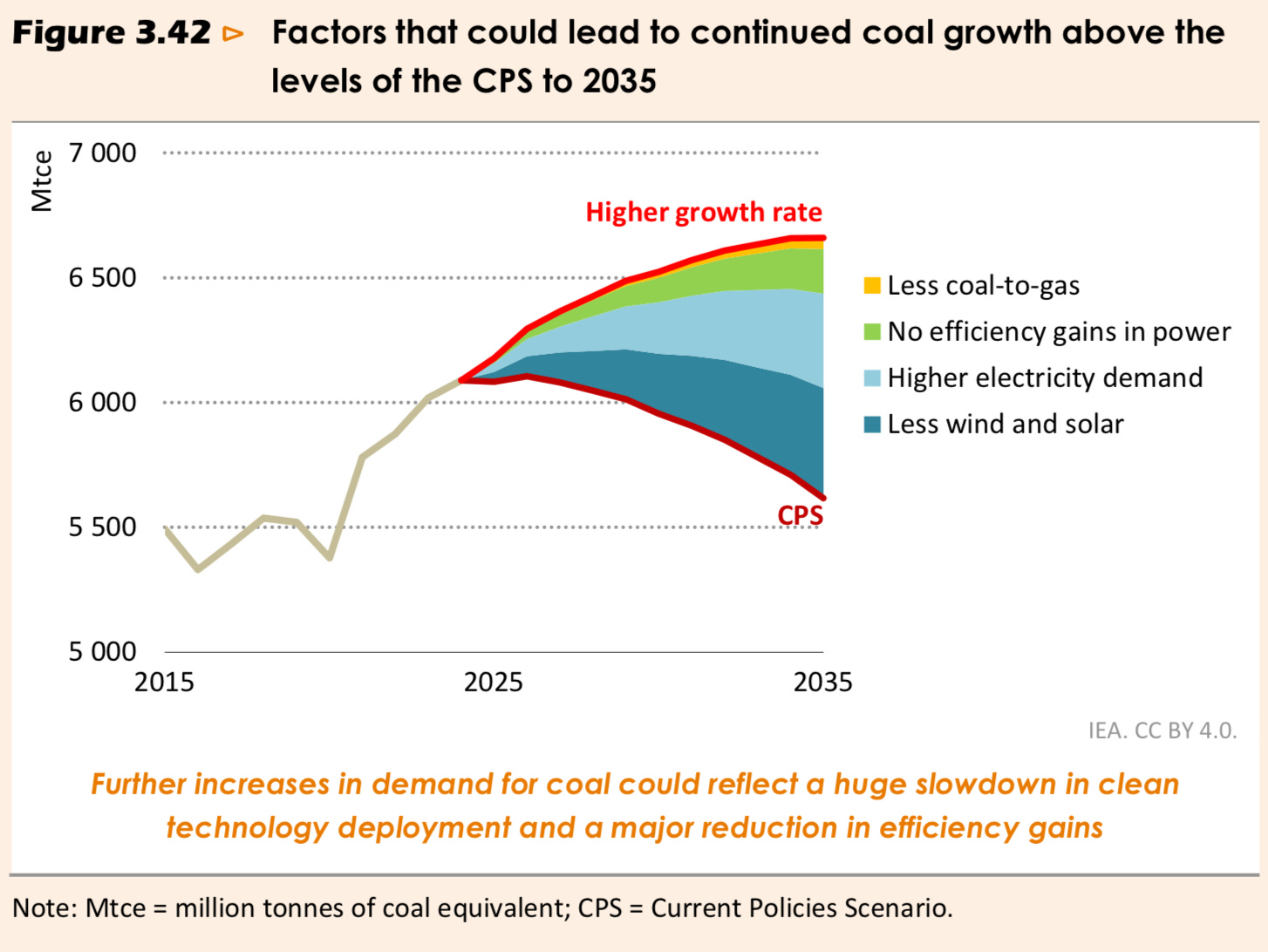

Figure 3.42 demonstrates how easily the trajectory could flip back upward. Four factors could return global coal demand to sustained growth through 2035 and beyond:

Slower wind and solar build-out

Stronger-than-expected electricity demand

Stalled efficiency gains in power generation

Negligible additional coal-to-gas switching

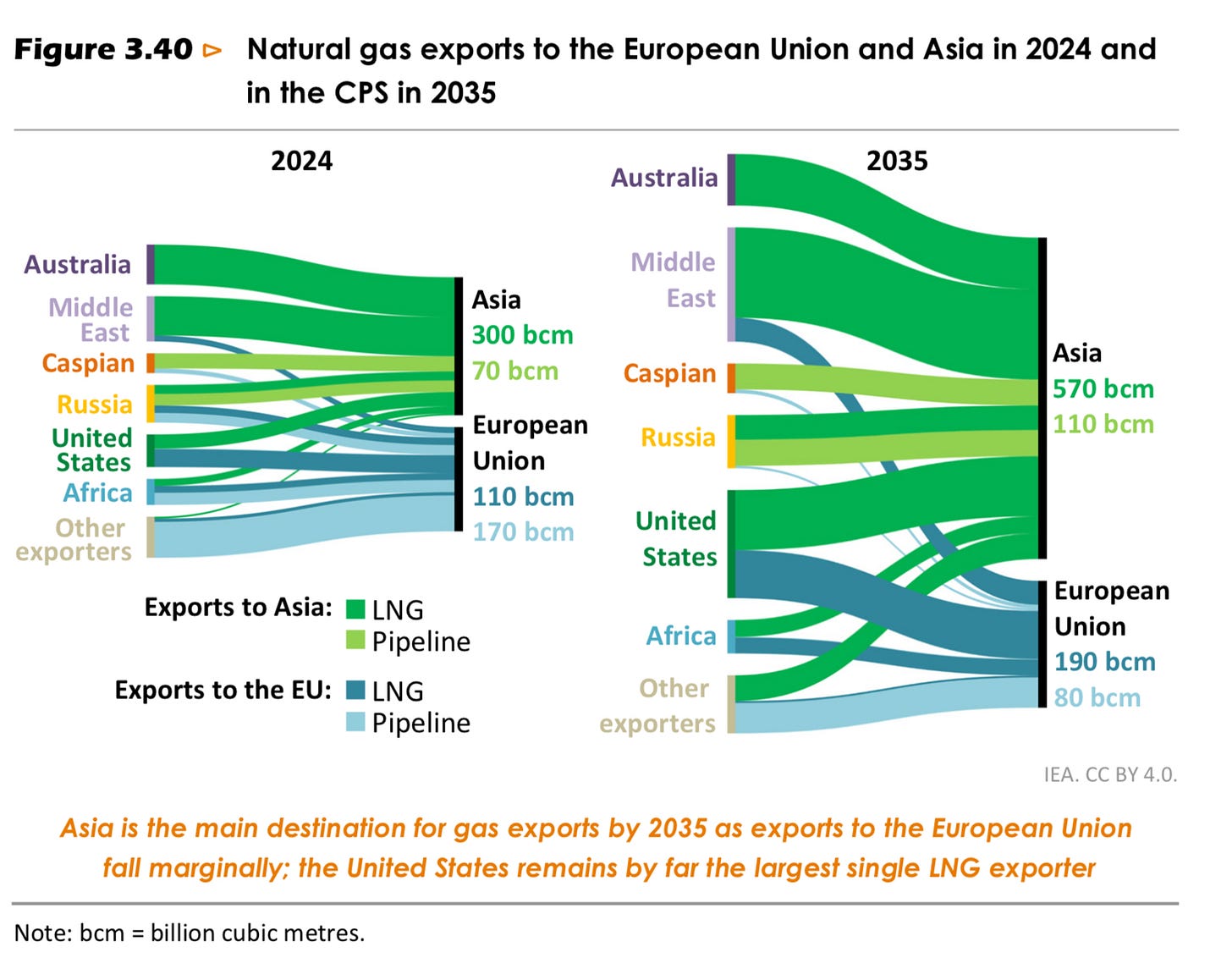

Coal-to-gas switching is worth watching: it is the primary absorption mechanism for additional LNG supply (Figure 3.40). The assumption is that “cheap enough” gas will simply outcompete coal on merit in emerging Asia. The IEA’s analysis challenges that assumption.

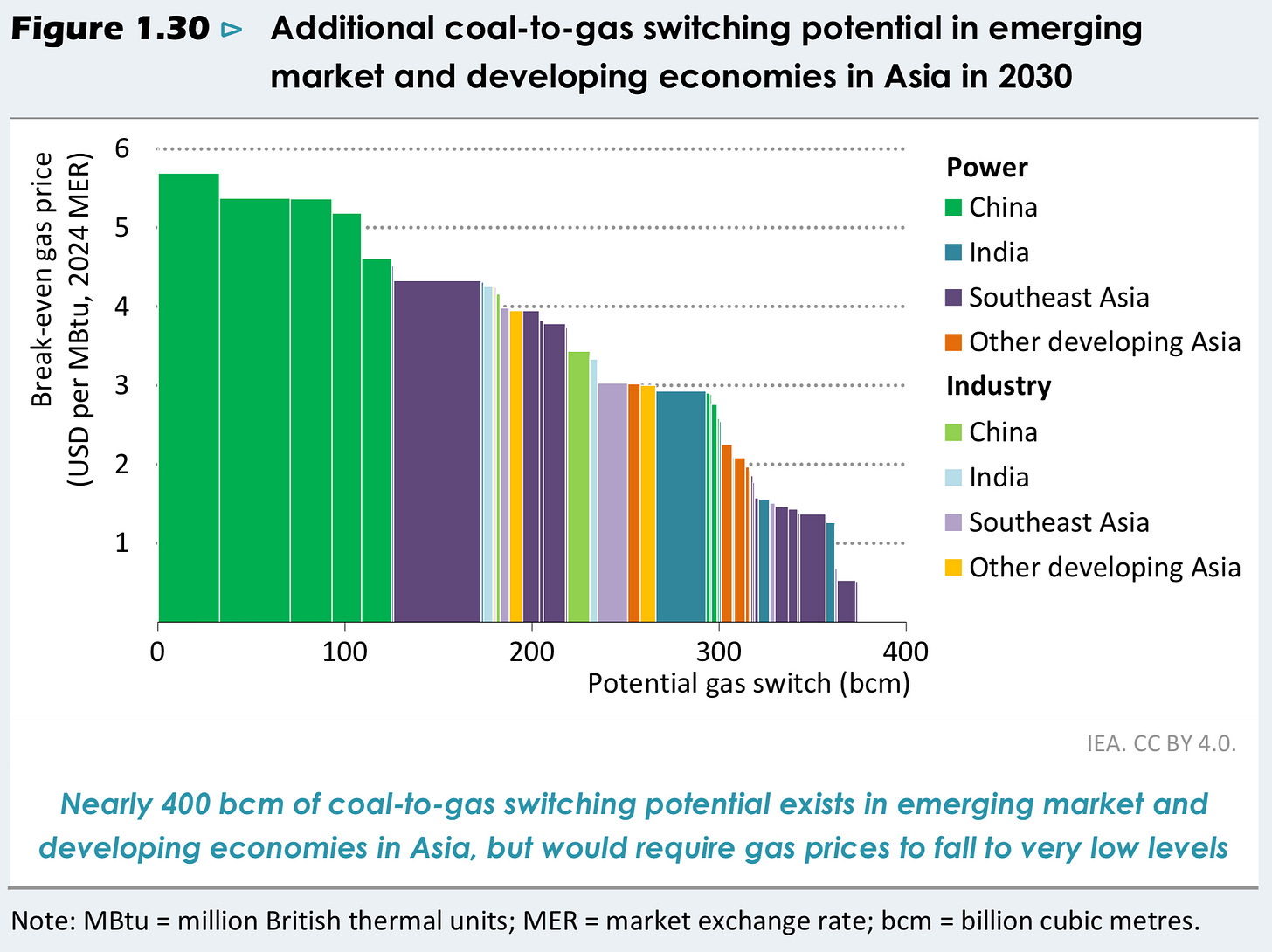

WEO-2025 identifies roughly 400 bcm of theoretical coal-to-gas switching potential in emerging Asian economies by 2030 (about 80 % of today’s entire global LNG trade). Figure 1.30 shows the price sensitivity of this potential. Almost none of it becomes economic until delivered gas prices fall below $5–6/MMBtu, with the most coal-reliant markets (India and parts of Southeast Asia) requiring prices closer to $4–$5/MMBtu to move the needle.

If Gulf Coast liquefaction and delivery costs to Asia are around $4.60/MMBtu, that leaves producers less than $0.40–$1.40/MMBtu at Henry Hub. That doesn’t work for gas focused producers in North America.

Absent the economic argument, policy can force switching. Consider China’s 2017–2021 campaign, which routinely LNG at delivered prices above $10–$15/MMBtu. That switch was not economic; it was mandated by top-down air-quality policy and enforced with winter heating conversion quotas and coal plant operating restrictions.

Policy such as binding air-pollution directives, explicit coal-phaseout schedules, or carbon pricing strong enough to flip dispatch economics could enable further coal-to-gas switching in India, Indonesia, Vietnam, or Pakistan, but economics alone will not do the job.

So will coal decline? That depends on the race between electricity demand growth, deployment pace of wind and solar, policy shifts, and efficiency.