Energy, AI, and Data Centers: Are We Asking the Right Questions?

The Week That Was: October 5-11, 2024

NOTE: “The Week That Was” is a recap of ideas shared over the last seven days.

This Week’s “On Energy”

Data centers are exploding in size and investment, with tens of billions pouring into the sector. AI boom is driving demand, and new mega-facilities like 5 GW campuses are emerging.

"How Big" will these facilities get? And what are the implications?

Spare Parts: What Caught My Eye This Week

Two Energy Majors. Two Pathways. Two Different Investor Bases.

The Election and the IRA: What comes next? What do you want to come next?

Power at scale with reliability, in the right location, often takes precedence over sustainability, in the race to build out data-center infrastructure.

Evidence? A recent The Wall Street Journal report (https://buff.ly/3NhRvhJ ) highlights Johor, Malaysia’s emergence as a major data center hub. Significant investments include ByteDance’s $350 million, Microsoft’s $95 million for a 123-acre plot, and Blackstone’s $16 billion acquisition of AirTrunk, which includes a large facility in Johor.

Why Johor?

* Resource Availability: Ample land, water, and power (primarily from coal and gas).

* Strategic Relations: Generally friendly ties with both the U.S. and China.

* Proximity to Singapore: Close to one of the world’s densest intersections of undersea internet cables, similar to Northern Virginia.

Johor’s strategic advantages make it an attractive location for data centers, despite the reliance on higher carbon intensity, but reliable and available energy sources.

If big tech's interest in nuclear is viewed through lens, what other sites come to mind? Where does gas fit in North America?

Two Energy Majors. Two Pathways. Two Different Investor Bases.

Two recent stories highlight the contrasting strategies of BP and Equinor.

BP is doubling down on hydrocarbons, boosting investments in the Middle East and Gulf of Mexico to restore investor confidence and prioritize short-term profitability.

This shift marks a step back from its earlier commitment to cut oil and gas production by 40% by 2030, though BP still aims for net-zero emissions by 2050.

In contrast, Equinor is focusing on the long term, acquiring a 9.8% stake in Ørsted for $2.5 billion, showing confidence in offshore wind despite rising costs.

With 67% state ownership, Equinor’s strategy aligns with Norway’s future-focused energy vision, standing in stark contrast to BP’s market-driven pivot.

Which strategy will pay off in the long run?

The Election and the IRA: What comes next? What do you want to come next?

That depends, and this WSJ article sheds light on what some in the oil and gas sector are hoping for. Those in power, solar, wind, biofuels may find they are aligned with some of traditional energy players.

The discussion also provides a good reminder that:

• Incentives work. Especially when they’re big. In response, many large organizations have adjusted their strategies, embracing CCUS, biofuels, hydrogen, and renewables. For smaller players, however, the shift may be less pronounced.

• Stability is valued over disruption. Many who initially opposed the IRA now favor keeping it, having adapted to the new reality it created.

• The real changes may come in enforcement and distribution. It’s easier to influence how policies are applied than to rewrite the laws themselves. So while the direction of policy may remain, enforcement, funding, and regulatory timelines could become the true battlegrounds for change.

Let me know what you think!

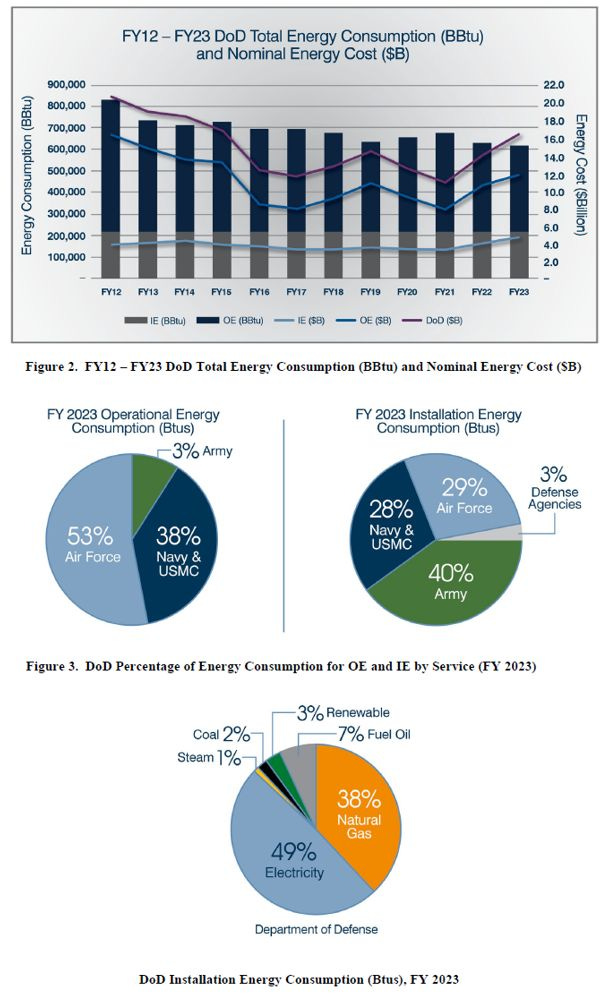

Hot Conflict Makes Energy Security a Top Priority

Especially for the military. But just how much energy, particularly power, does the military actually consume? I didn’t know, so I took a look.

While detailed figures can be hard to find, the U.S. Department of Defense (DoD) publishes an Annual Energy Performance, Resilience, and Readiness Report—and the FY2023 edition offers some insights.

The report breaks energy use into two categories: Operational Energy (fueling ships, aircraft, combat vehicles, and tactical power generators) and Installation Energy (powering military bases and non-tactical vehicles).

Some key takeaways from FY2023:

* The DoD accounts for 75% of total federal energy consumption—13x more than the next largest agency, the Postal Service.

* Over the last decade, total energy use dropped by 25%, from 825,000 billion BTUs in FY2012 to 614,000 billion BTUs in FY2023. This decline largely comes from reduced operational activities.

* About one-third of FY2023 energy use went to installations, with 49% for electricity and 38% for natural gas—amounting to 3.3 GW of power and 200 MMcf/d of gas. Sidebar: Remember to those 5GW data centers getting pitched last week?

* The DoD consumed over 70 million barrels of fuel (~192,000 bbl/d), at a total cost of $11.8 billion, which made up 72% of total energy spending. Remarkably, 47% of this fuel was purchased outside the U.S.

As global conflicts escalate, military energy demand will be critical to watch—both for its scale and the potential for advancements in energy technology.

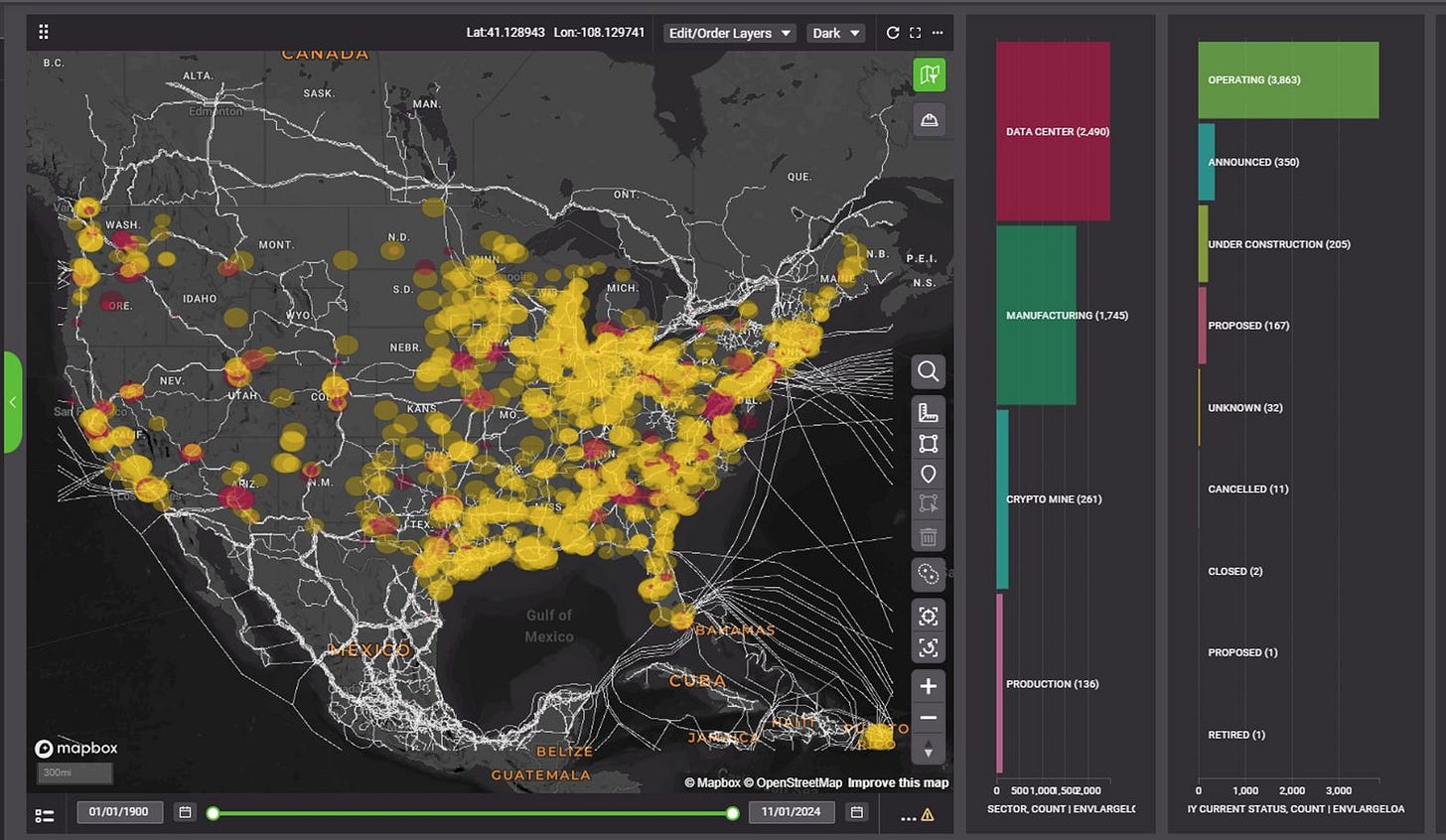

How are you siting your data center or other "large loads"?

Check out this post from Manuj Nikhanj. We've been hard at work developing workflows to simplify large load siting, including data centers. Using tools like the Enverus Large Load Tracker, which covers 5,000+ sites and hashtag#fiber infrastructure, you can assess opportunities in minutes.

Take PJM's Data Center Alley—297 substations have >500 MW capacity, but Virginia's grid needs serious investment for large expansions. Peach Bottom station is a rare standout with 2.9 GW potential and minimal upgrade needs.

Pretty cool to see how we are helping folks make smarter siting decisions faster.