From Coal's End to Data Center Dominance: The Real Energy Challenges Ahead

The Week That Was: September 28 - October 4, 2024

NOTE: “The Week That Was” is a recap of ideas shared over the last seven days.

Spare Parts: What Caught My Eye This Week

UK Marks the End of an Era: No More Coal Power – But the Real Challenge is Elsewhere

The Era of Mega Data Centers is Here!

Interconnection Queue Bottleneck

Vertex Energy, a Houston-based specialty refiner, filed for Chapter 11 bankruptcy this week, citing a series of failed investments in renewable fuels

Chasing CCUS Projects Can Feel Like a Time Sink

UK Marks the End of an Era: No More Coal Power – But the Real Challenge is Elsewhere

On September 30, 2024, the United Kingdom officially closed its last coal-fired power plant, ending 142 years of coal-powered electricity. This makes the UK the first G7 nation to completely phase out coal. Coal's share of the UK’s electricity generation has dropped from 40% in 2012 to near zero today – a monumental shift for energy.

However, globally, emissions remain a concern. Regions like the Asia-Pacific continue to rely heavily on coal, the top source of energy-related CO2 emissions. China remains the leading emitter, and projections show rising emissions from India and the broader Asia-Pacific.

Bending this curve means scaling affordable and reliable coal alternatives in these developing regions. What can fit that bill? Like with datacenters, nuclear fits the bill at scale. Solar and wind with BESS has a role. Gas with CCUS? Geothermal? Or stick with the low-cost, high-emissions coal plan?

The Era of Mega Data Centers is Here!

Last week, OpenAI reportedly pitched the White House on constructing 5 GW data centers. But what does that really mean in practical terms?

Here are some some eye-opening figures:

• 5 GW of Power is equivalent to the output of roughly five large nuclear reactors.

• One 5 GW Data Center could demand more energy than all existing data centers in Northern Virginia combined. As of March 2024, this region—responsible for over a third of the world's internet traffic—requires just 3.6 GW across 25 million square feet of infrastructure.

• A fleet of seven (reports have discussed 5-7) 5 GW Data Centers (35 GW total) running at 90% capacity would consume approximately 1% of global electricity and a massive 6.5% of U.S. power demand. This would make these facilities some of the most significant energy consumers on the planet.

Here’s what a single 5 GW data center could look like:

• IT Space: With 5 GW equaling 5 billion watts, at 250 watts per square foot, you’d need about 20 million square feet of IT space.

• Total Building Space: Adding infrastructure and support systems brings the total to roughly 28.6 million square feet, assuming 70% of the space is allocated for IT equipment.

• Building Footprint: A three-story facility would require a ground footprint of around 9.5 million square feet.

• Total Land Area: With the building covering 40% of the total site (allowing for parking, landscaping, and support services), the facility would span 547 acres—nearly a square mile.

The sheer size and energy demand of these proposed mega data centers have far-reaching implications. Assuming they can be sited and powered, they could reshape energy consumption patterns and land use, offering substantial growth opportunities for investors in data infrastructure, renewable energy, power grid modernization, and AI-driven technologies. This expansion could drive unprecedented investments, surging energy demand, and rapid cloud computing growth, positioning these facilities as critical hubs for the future digital economy.

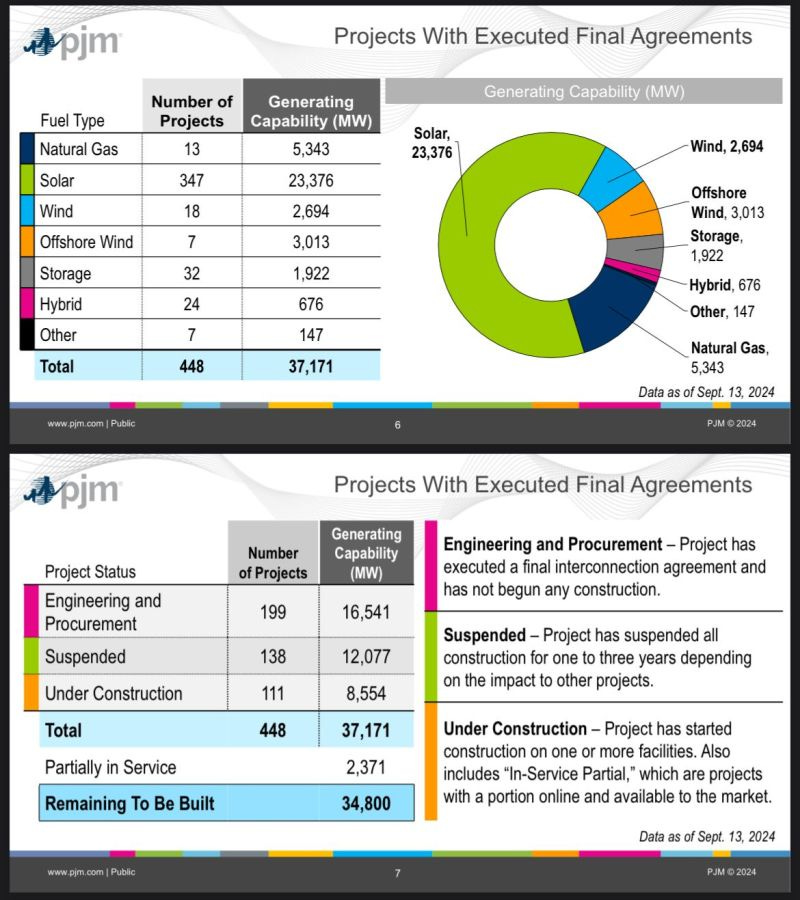

Interconnection Queue Bottleneck

Which Projects Will Survive and When Will They Be Built? With nearly 90% of projects failing to make it to completion, these questions drive our interconnection queue analytics.

PJM, the ISO potentially facing the largest datacenter load growth, has implemented queue reforms to streamline the path to interconnection agreements. However, as a recent PJM presentation highlighted, securing an agreement is only part of the battle—other roadblocks can still slow or derail development. A few PJM specific data points:

• About 450 projects in PJM, totaling 37.2 GW of capacity, have signed interconnection agreements but remain unbuilt; 8.6 GW is currently under construction, with 2.4 GW partially online.

• Of the remaining projects, 16.5 GW is in the engineering and procurement phase, while 12.1 GW is “suspended” due to a lack of transmission owner activity, though development may still continue.

• The projects cover 23.4 GW of solar, 5.3 GW of natural gas, 3 GW of offshore wind, 2.7 GW of onshore wind, and 1.9 GW of storage capacity.

What do you see as the biggest obstacles post-interconnection agreement that hinder or prevent projects from reaching completion?

The company’s project to convert its Mobile, Alabama refinery for renewable diesel production was derailed by construction delays and cost overruns at a critical hydrogen facility. Broader market conditions also weighed on Vertex:

• Low Crack Spreads: Conventional refining operations struggled with profitability due to narrow crack spreads.

• Renewable Fuel Credits: An oversupply in the renewable fuels market drove down credit prices, further eroding margins. Notably, renewable diesel and other biofuels capacity has grown sharply: as of Jan 1, the EIA estimated capacity at 4,328 MMgal/year, up from about 3,000 in 2023.

This adds to a string of setbacks in the renewable diesel industry:

• In May 2024, Fulcrum BioEnergy, a waste-to-fuel pioneer that raised over $1 billion, laid off most of its staff after technical and production issues at its Nevada plant.

• In March, Chevron shut down biodiesel plants in Iowa and Wisconsin, citing "poor market conditions" as the primary reason for indefinitely closing these facilities.

The question we keep getting is, "How long until the market shifts to a tailwind for this industry?"

Chasing CCUS Projects Can Feel Like a Time Sink

While we’ve seen a surge of proposals in recent years, many are now hitting the harsh realities of development challenges. Some exceptional projects will succeed—but many won’t.

That’s why our team created the Project Viability Index (PVI), an analytical tool designed to help the industry assess which projects and portfolios are most likely to succeed. Great work, team!