I love when a deal comes at the perfect time to make a point…

Yesterday I wrote about how “energy” products are becoming a 𝗺𝗶𝘅 𝗼𝗳 𝗽𝘂𝗿𝗲 𝗲𝗻𝗲𝗿𝗴𝘆, 𝗿𝗲𝗹𝗶𝗮𝗯𝗶𝗹𝗶𝘁𝘆 𝗮𝗻𝗱 𝗲𝗻𝘃𝗶𝗿𝗼𝗻𝗺𝗲𝗻𝘁𝗮𝗹 𝗮𝘁𝘁𝗿𝗶𝗯𝘂𝘁𝗲𝘀.

And today Diversified Energy, FuelCell Energy and TESIAC announced a strategic partnership to supply up to 360 MW of “net-zero power from natural gas and captured coal mine methane” for data centers.

What is fascinating about this deal is how the partners have combined unique assets to create an interesting (and potentially valuable) value chain:

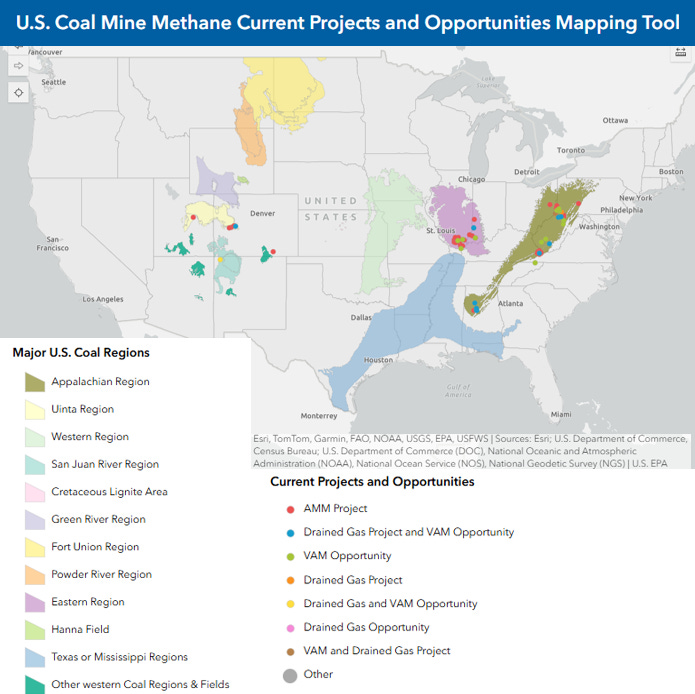

Diversified supplies natural gas and captured waste methane “that otherwise would have been vented”. That means a methane avoidance credits and potentially “negative emissions” power.

FuelCell Energy provides its fuel cell technology allowing for waste methane to be converted to power, and waste heat to enable absorption heating (I didn’t look into how that works…)

TESIAC enables a “innovative capital structuring” and “highly competitive financing options to accelerate deployment while maintaining long-term profitability and scalability”.

What I like about this example is how it illustrates how emissions can be an asset (“waste methane”), how new technology can offer attributes valuable to new consumers (energy conversion and heat absorption potential” and financial innovation can can enable deployment.

This is exactly what the “Energy Transition” is all about.

What do you think? How competitive can this partnership be with other low carbon power solutions?