Natural as is often described as a “bridge fuel”. A link between high-emission coal and low- or zero-emission energy sources. However, that transition is also leading to some unexpected results.

Consider Malaysia.

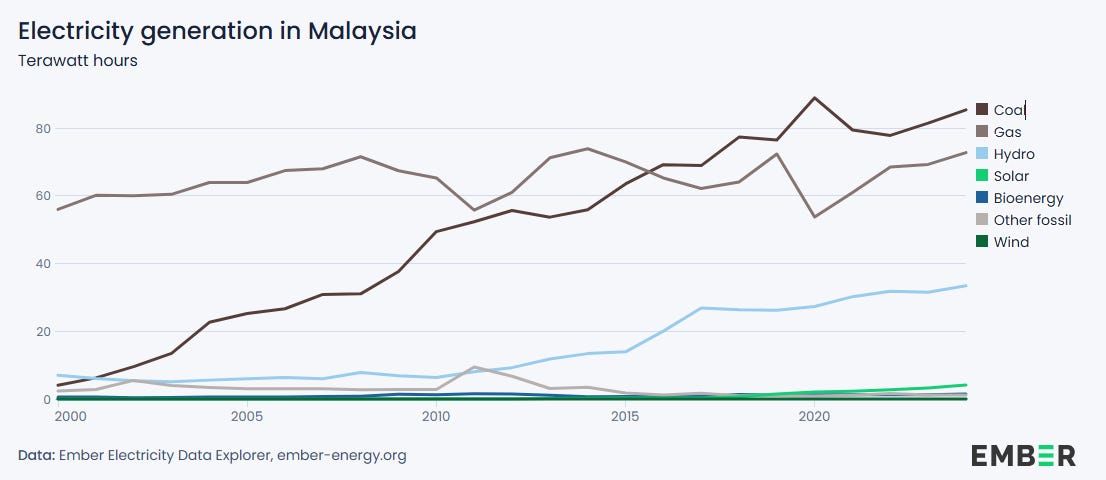

According to a recent Reuters article, Malaysia’s power mix has evolved in a surprising way: coal use has continued to climb while gas generation has been flat for more than a decade.

Figure 1 | Electricity Generation in Malaysia

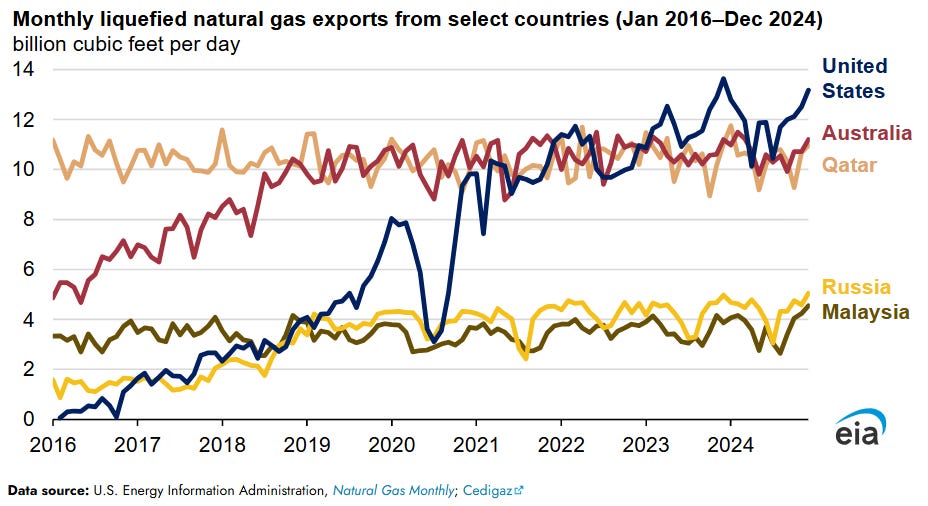

That’s not because Malaysia lacks access to gas. It remains one of the world’s top LNG exporters.

Figure 2 | Largest LNG Exporting Countries

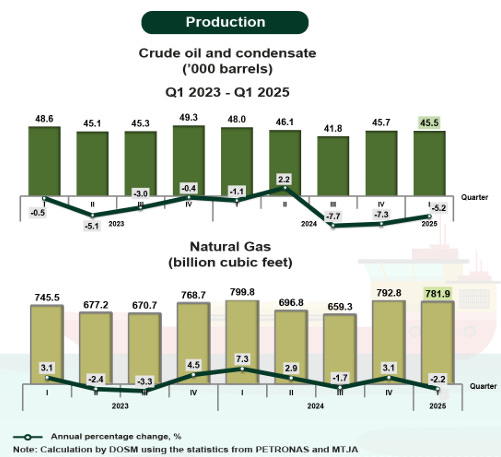

The issue lies, at least in part, in stagnant domestic gas output. With production flat, Malaysia faces a trade-off: use its gas to meet rising domestic electricity demand or preserve LNG exports that generate valuable foreign revenue.

Figure 3 | Malaysian Oil and Gas Production

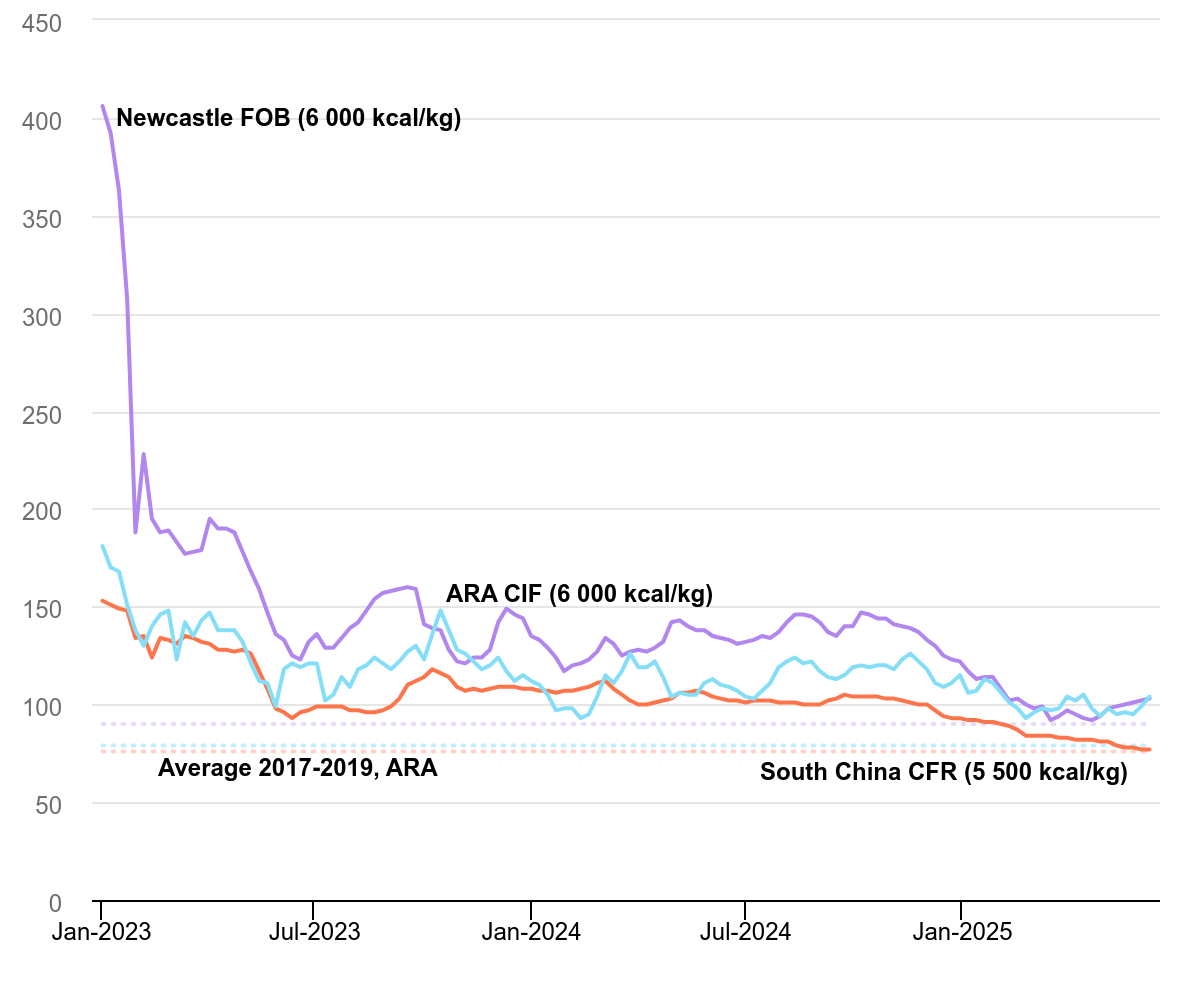

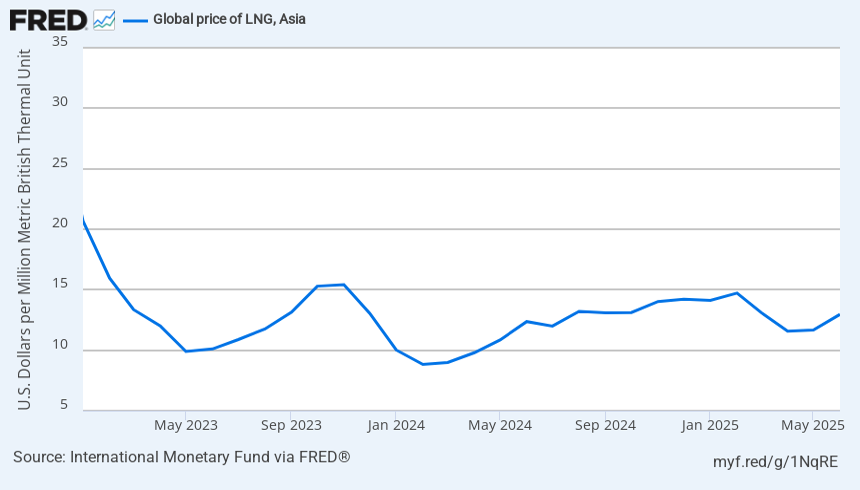

Price dynamics make the choice easier. Coal prices have fallen, LNG prices have risen, and export margins remain strong. The economic signal is clear: keep exporting LNG and burn more coal at home.

Figure 4 | Thermal Coal Price Markers

Figure 5 | Global Price of LNG, Asia

This matters beyond Malaysia’s borders. Roughly a year ago, the Wall Street Journal profiled Johor as one of the “AI boomtowns” benefiting from data-center expansion.

Johor’s advantages are strategic: proximity to Singapore (a key global data-transit hub), political balance between the U.S. and China, and abundant land, water, and power. As AI infrastructure continues to scale, Malaysia’s electricity demand will keep rising. And for now, that growth is being powered by coal.