𝗜𝘀 𝗵𝘆𝗱𝗿𝗼𝗴𝗲𝗻 𝘁𝗵𝗲 𝘀𝘁𝗲𝗮𝗹𝘁𝗵 𝘄𝗶𝗻𝗻𝗲𝗿 𝗶𝗻 𝘁𝗵𝗲 𝗴𝗮𝘀 𝘁𝘂𝗿𝗯𝗶𝗻𝗲 𝗯𝗼𝗼𝗺?

Yesterday, I highlighted some key shifts in the gas turbine market: tightening supply, rising prices, growing U.S. demand, and expansion plans from GE Vernova and Siemens Energy. That led me to ask—𝘸𝘩𝘢𝘵 𝘵𝘦𝘤𝘩𝘯𝘰𝘭𝘰𝘨𝘪𝘦𝘴 𝘤𝘰𝘶𝘭𝘥 𝘳𝘦𝘢𝘭𝘭𝘺 𝘤𝘰𝘮𝘱𝘦𝘵𝘦 𝘪𝘯 𝘵𝘩𝘦 𝘱𝘰𝘴𝘵-2030 𝘭𝘢𝘯𝘥𝘴𝘤𝘢𝘱𝘦?

While SMRs and geothermal remain strong contenders, hydrogen might be the real dark horse.

Why?

𝗖𝗿𝗶𝘁𝗶𝗰𝘀 𝗼𝗳𝘁𝗲𝗻 𝗽𝗼𝗶𝗻𝘁 𝘁𝗼 “𝘁𝗲𝗰𝗵𝗻𝗼𝗹𝗼𝗴𝘆 𝗹𝗼𝗰𝗸-𝗶𝗻” 𝘄𝗶𝘁𝗵 𝗴𝗮𝘀-𝗳𝗶𝗿𝗲𝗱 𝗴𝗲𝗻𝗲𝗿𝗮𝘁𝗶𝗼𝗻—where big investments today make switching tech later difficult and expensive.

𝗕𝘂𝘁 𝘄𝗵𝗮𝘁 𝗶𝗳 𝘁𝗵𝗮𝘁 𝗹𝗼𝗰𝗸-𝗶𝗻 𝗮𝗰𝘁𝘂𝗮𝗹𝗹𝘆 𝗲𝗻𝗮𝗯𝗹𝗲𝘀 𝗮 𝘀𝗵𝗶𝗳𝘁 𝘁𝗼 𝗵𝘆𝗱𝗿𝗼𝗴𝗲𝗻?

The major turbine OEMs—Siemens Energy, GE Vernova, and Mitsubishi—are already field-testing turbines that can burn 30–50% hydrogen blends. 𝗔𝗹𝗹 𝗮𝗿𝗲 𝗮𝗶𝗺𝗶𝗻𝗴 𝗳𝗼𝗿 𝟭𝟬𝟬% 𝗵𝘆𝗱𝗿𝗼𝗴𝗲𝗻 𝗰𝗮𝗽𝗮𝗯𝗶𝗹𝗶𝘁𝘆 𝗶𝗻 𝘁𝗵𝗲 𝗻𝗲𝗮𝗿 𝗳𝘂𝘁𝘂𝗿𝗲.

If they succeed, 𝘁𝗼𝗱𝗮𝘆’𝘀 𝗴𝗮𝘀 𝗯𝘂𝗶𝗹𝗱-𝗼𝘂𝘁 𝗰𝗼𝘂𝗹𝗱 𝗯𝗲𝗰𝗼𝗺𝗲 𝘁𝗼𝗺𝗼𝗿𝗿𝗼𝘄’𝘀 𝗵𝘆𝗱𝗿𝗼𝗴𝗲𝗻 𝗯𝗮𝗰𝗸𝗯𝗼𝗻𝗲. If low-carbon mandates are tighten, gas turbines might not be stranded—they might be springboards.

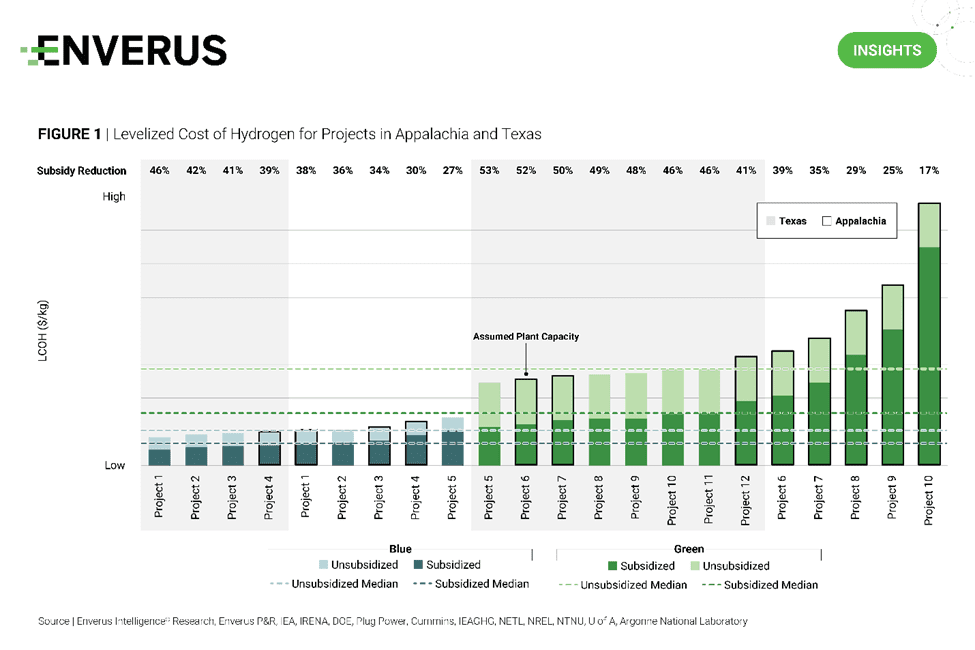

Of course, that hinges on many “ifs,” especially around hydrogen cost (see chart below) and availability .

𝗜𝘀 𝘁𝗵𝗲 𝗴𝗮𝘀 𝗯𝗼𝗼𝗺 𝗾𝘂𝗶𝗲𝘁𝗹𝘆 𝘀𝗲𝘁𝘁𝗶𝗻𝗴 𝘁𝗵𝗲 𝘀𝘁𝗮𝗴𝗲 𝗳𝗼𝗿 𝗵𝘆𝗱𝗿𝗼𝗴𝗲𝗻 𝘁𝗼 𝗼𝘂𝘁𝗳𝗹𝗮𝗻𝗸 𝗼𝘁𝗵𝗲𝗿 𝗰𝗹𝗲𝗮𝗻 𝗽𝗼𝘄𝗲𝗿 𝗼𝗽𝘁𝗶𝗼𝗻𝘀? 𝗖𝘂𝗿𝗶𝗼𝘂𝘀 𝘁𝗼 𝗵𝗲𝗮𝗿 𝘆𝗼𝘂𝗿 𝘁𝗵𝗼𝘂𝗴𝗵𝘁𝘀.