I didn't know Williams was going to make a $1.6B announcement when I drafted my note yesterday, but they did...

Energy Transfer LP's deal last month to enter into a long-term agreement with Cloudburst Data Centers to supply 450 BBtu/d of firm natural gas supply (~1.2GW) was the most recent example I had in mind of midstreamers making deals to deliver gas (and its reliability).

But today Williams announced it has "agreed to invest approximately $1.6 billion to provide committed power generation and associated gas pipeline infrastructure". Described as their "first power innovation project to deliver speed-to-market solutions for growing demand in grid-constrained markets".

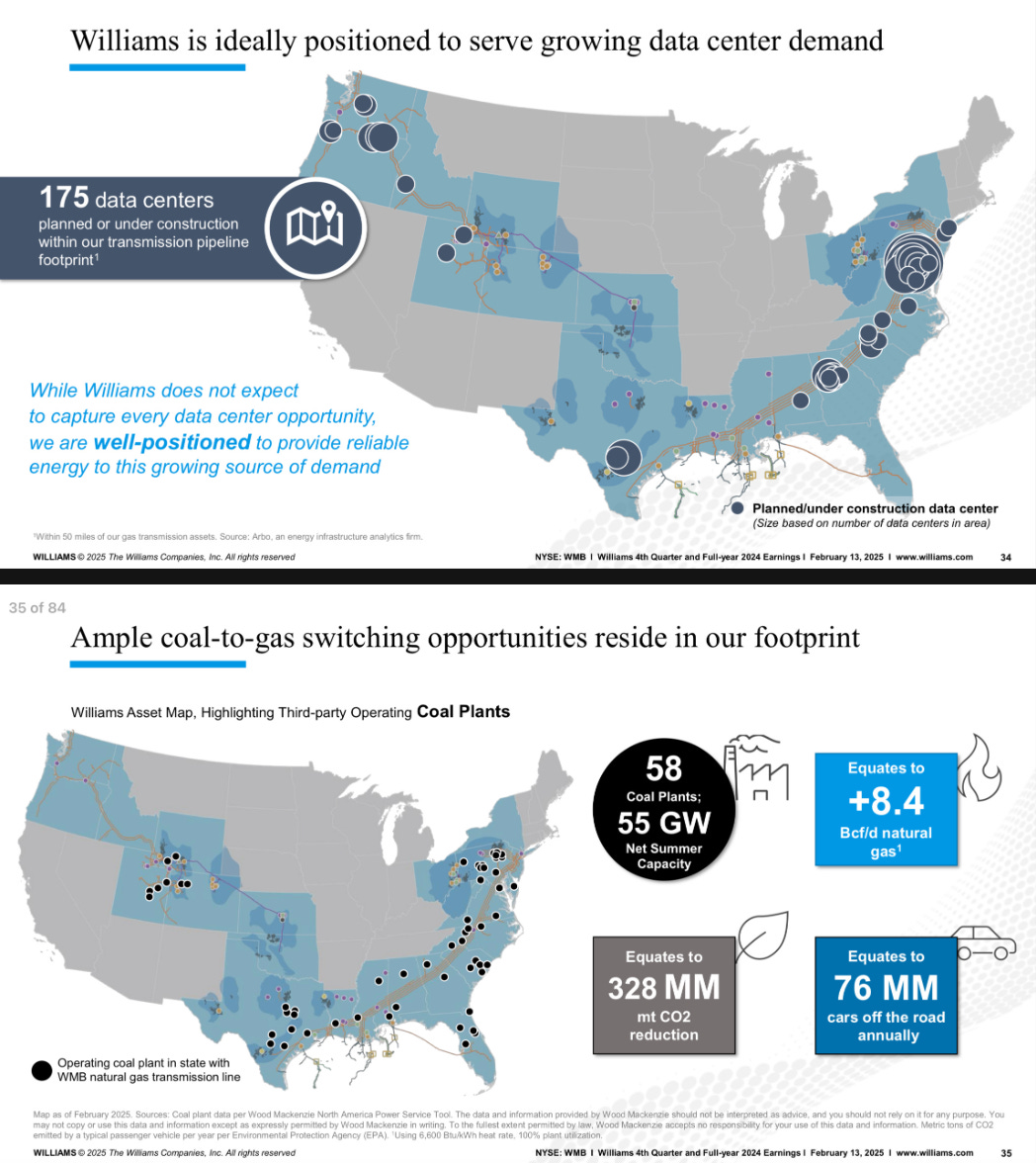

"FIRST" might be the key word in the entire release. Using their investor deck as an example (most midstreamers have similar slides), you can quickly see the set of "reliability" focused opportunities they are targeting.

One slide highlights data center demand, but you could say "large loads" (of which data centers are the flag bearers). Another points to "coal to gas switching", i.e. substitution targets for gas-fired generation.

The other significant line is "The project is backed by a 10-year, primarily fixed-price power purchase agreement".

The concept of "gas to power" has been floated by many of late, especially by those producing relatively low value gas molecules questing for better value for their product by producing and selling electrons. Like Energy Transfer, Williams appears to be realizing that dream with this deal.

For gas producers supply gas into these pipeline systems, the question remains: "How can they get a share of the economics from supplying gas to power data centers?"