“Sometimes a player's greatest challenge is coming to grips with his role on the team.” ― Scottie Pippen

Gas has fallen behind in the power generation technology race. Once dominant, its future looks increasingly niche, left to fill the gaps rather than lead the way.

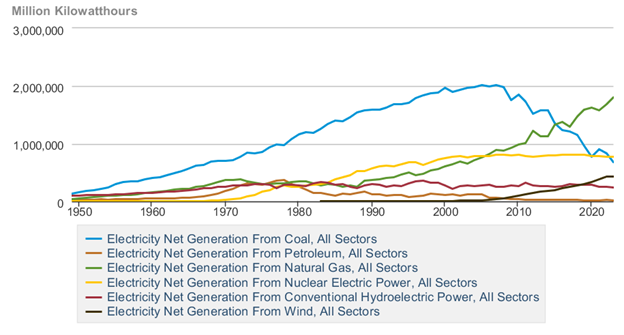

It is a remarkable turn of events, especially looking backwards. For 35 years gas fired generation was the dominant technology and consistently grew its share of US power generation (Figure 1). Dispatchable, scalable, clean (relative to coal), and relatively cheap (thanks to the abundance of gas unlocked by the shale revolution), it has been hard to beat.

Headwinds for other technologies have also helped. In the 1990s and 2000s gas delivered as load grew and nuclear capacity expansion ran into opposition. And for the last 15 years, while load was flat, gas filled the gap as coal capacity was outcompeted on cost and pressured out of the market for its emission profile. All the while renewables remained too small and insufficiently economic to pose a threat.

Figure 1 | Electricity Net Generation

Over the last year several factors flipped the script. First, emerging regulation and policy are set to change the cost structure of new gas generation. Consider the EPA rule regulating emissions from existing and new fossil fuel-fired power plants. Under the rule, new gas-fired power plants that generate at least 40% of their maximum annual capacity (base load combustion turbines) must capture 90% of their carbon dioxide emissions by 2032.

The impact is severe: new gas assets must either consider additional capex for CCS or limit run times to avoid the rule. Either choice is punitive to economics and, based on our team’s work, narrows the use case for gas fired capacity📝1:

“Given the challenging economics of operating gas-fired power plants with CCS, even in the most attractive regions where the 45Q tax credit more than offsets the cost, we expect most new gas plants in deregulated markets to operate under a 40% capacity factor.”

Net load profiles have also shifted dramatically. First, renewables penetration, solar in particular, is translating into low priced (or negative) pricing in predicable hours of the day. A few comments from our team’s recent US Capacity Expansion forecasts📝2:

“Behind and front of meter solar generation play a key role in this growing net load volatility. As solar output declines in the evening, it creates a pronounced demand for flexible, fast-ramping generation to balance the system. This metric underscores the role of storage in managing system balance and responding to the variability of renewable generation. Daily net load volatility is increasing across most regions, particularly in areas with rapid renewable growth like ERCOT.”

Enter BESS which looks better able to take advantage of short-term solar driven price dynamics. Returns that can be extraordinary. Take this quote from our analysis of Texas storage assets📝3:

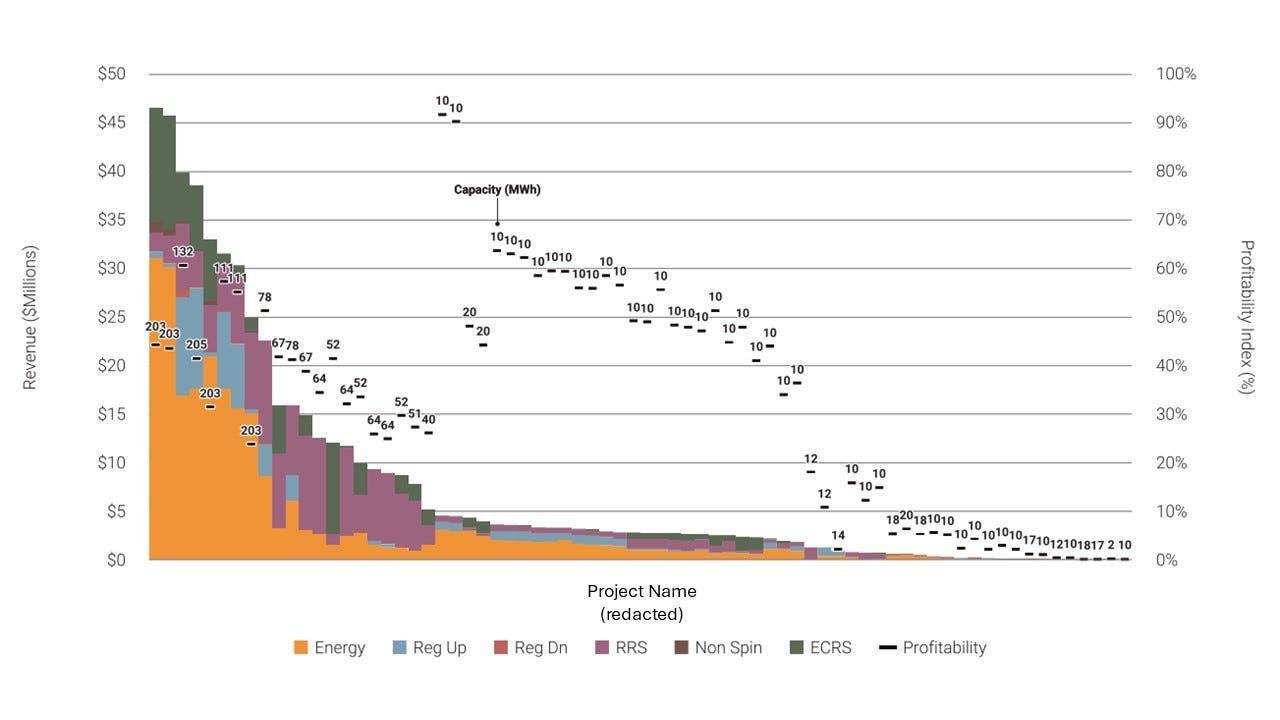

“EIR also defined a profitability index as the total annual revenue divided by our estimate of the total capital cost of each asset. The best-performing assets in this metric sit in the lower end of the capacity range, yet they were able to recover more than 90% of their capex in 2023 (Figure 2).”

Figure 2 | Total 2023 Revenue and Profitability Index of Storage Assets

Load📝4 is also changing the requirements for new generation. Load growth, new after 15 years of stagnation, is being led by massive AI data centers📝📊5 that demand gigawatt scale, highly reliable, low-carbon power. Against this rubric, the merits of nuclear shine. The recent wave of big tech announcements featuring nuclear illustrate just how attractive the technology is for this emergent consumer class.

Last, environmental concerns, headwinds for nuclear and coal in the past, are now a growing risk for gas. The EPA rules are being challenged and may get overturned, but what comes next? Gas is methane and the pressure to reduce this type of emission, from leaks or otherwise, is growing. The eyes in the sky will be watching. And if low carbon power grows as a requirement (and it is for some), creating that product with a combination of gas, CCS and CDR credits can be complicated, if not costly.

Combined, the advantages gas has enjoyed in power look to be eroding. Solar penetration is providing a tailwind to BESS to serve short-duration peaking hours. Nuclear appears more attractive to the consumers (big tech) driving load growth. All while the regulatory and environmental headwinds get tougher for gas. Still, even if it is the end of its dominance, it is not the end of gas generation📝6. Our work sees capacity continuing to grow, albeit with declining capacity factors, and a growing emphasis on providing reliability as the generation mix evolves. That is a very different world than the one we have come from.

Upcoming Events Hosted by Enverus

Wednesday, November 6 & 7, 2024 Power Markets this Winter: 2024 Outlook for PJM, MISO, SPP, NYISO, ISO-NE and Mid-C | Join our Power Market Analysts for a 2-day deep dive into winter outlooks for PJM, MISO, SPP, NYISO, ISO-NE, and Mid-C, covering weather forecasts, load and renewable generation, infrastructure updates, transmission outages, market policies, and price projections to help you navigate the season ahead.

Wednesday, November 20, 2024 Navigating Water Management in Upstream Oil & Gas: Insights and Innovations for U.S. Operators | Join Dr. Chad Daloia, Jeb Burleson, Stephen Sagriff, Dave Savelle, and Graham Bain for an in-depth analysis of water hauling and management in U.S. oil and gas operations, covering trends, challenges, opportunities, and innovative solutions to enhance efficiency and cost management. Register here.

Notes:

📝 indicates Intelligence content that requires an Enverus subscription to access.

📊 indicates dashboard content that requires an Enverus subscription to access.

Please contact intelligence@enverus.com if you would like to learn more about Enverus Products and Services.

📝Power Plant CCUS a Pipe Dream | EPA Thermal Generation Ruling | This report analyzes the potential impact of the EPA's greenhouse gas standards and guidelines for fossil-fueled power plants in the U.S. The new regulations will impact new natural gas plants, operating coal plants and the generation mix for specific markets and states.

📝Long-Term Capacity Expansion | Market Makeover | This report encompasses Enverus Intelligence Research's capacity expansion model for the Lower 48, based on forecast load, risked interconnection queues and technology cost curves.

📝Texas Grid Storage Gold Rush | Keys to Unlocking Profitability | We explore what battery size, operating strategy and location for storage assets in ERCOT are the most profitable.

📝Long-Term Load Forecast | Returning to Growth | Our long-term power demand forecast model considers historical drivers of power demand across the Lower 48 U.S. and models variables that we believe will impact future load, including data centers, electric vehicles (EVs), residential solar and storage, cryptocurrency mines, green hydrogen, carbon capture and storage (CCUS) and electrification trends. This report analyzes the effects that these new exponential load drivers will have on our power demand forecasts from 2024-2050.

📝📊 Data Center Alley | Capacity Running Out | This Fusion Insights analyzes load interconnect opportunities remaining in PJM and identifies prime locations to locate new data centers. Subscribers can download the nodal withdrawal capacity data file attachment and use Fusion to join it with our ATC or substation tables in Prism to recreate this dashboard.

📝Natural Gas-Fired Screening | Benchmarking Prime Development Regions | This report builds on Enverus Intelligence Research's solar, battery storage and onshore wind market analyses to identify top locations for natural gas-fired projects in the U.S. Our screening considers factors like power prices, gas feedstock costs, spark spreads, capacity market prices, changes in the generation mix, load growth, cost of entry via acquisition and carbon prices.

Nice work. Thoughtful pro-nuclear commentators have often advocated for an “N2N” (natural gas to nuclear) policy. I think what you may be pointing out is that if such an outcome unfolds, being the first of the two “Ns” will have a long, awkward time in that transition.