We Are All In Power Now

Why the Electricity Bill is Now a Strategic Line Item

Large power consumers are discovering that their electricity bill is now a strategic line item. As one oil and gas executive recently shared with our team: “You used to be able to count on the utility whenever you needed more power. Now, you must manage how you source and integrate your power into your base business.” They are not alone in their view.

This is an AI-generated conversation based on the written content of the article below. The conversation may deviate from the intended meaning of the original content. Please see the disclosures.

“You used to be able to count on the utility whenever you needed more power. Now, you must manage how you source and integrate your power into your base business.”

Why has this become a boardroom topic? Organizations, as consumers, have increasing exposure to the price of power and face rising risks related to the reliability of their power supply. For many industrial and energy producers, power is a critical input, making it essential to actively manage reliability (sourcing) and costs.

So what do we need to watch out for? Several overlapping themes are changing the market and forcing these conversations. Here are a few of my favorites:

Growing Individual Power Consumption: Large power consumers are becoming even larger as they electrify operations📝1 to decarbonize. For example, in the oil and gas sector, combustion emissions (Figure 1) from gas compression are significant, and many operators are turning to electric drives to reduce their footprint. In high-production regions like Far East Texas (home of the Permian), this is expected to more than double power demand by 2040.

Figure 1 | Emissions Intensities of Top 50 US Producers by Simplified Source📝2

The Race for Premium Generation: Some large consumers are locking in access to premium generation (reliable and low-carbon) to support their operations and growth. Big tech companies like Microsoft, for instance, are willing to pay a premium for reliable, low-carbon electricity to power their data centers. This trend is prompting other consumers to consider similar strategies.

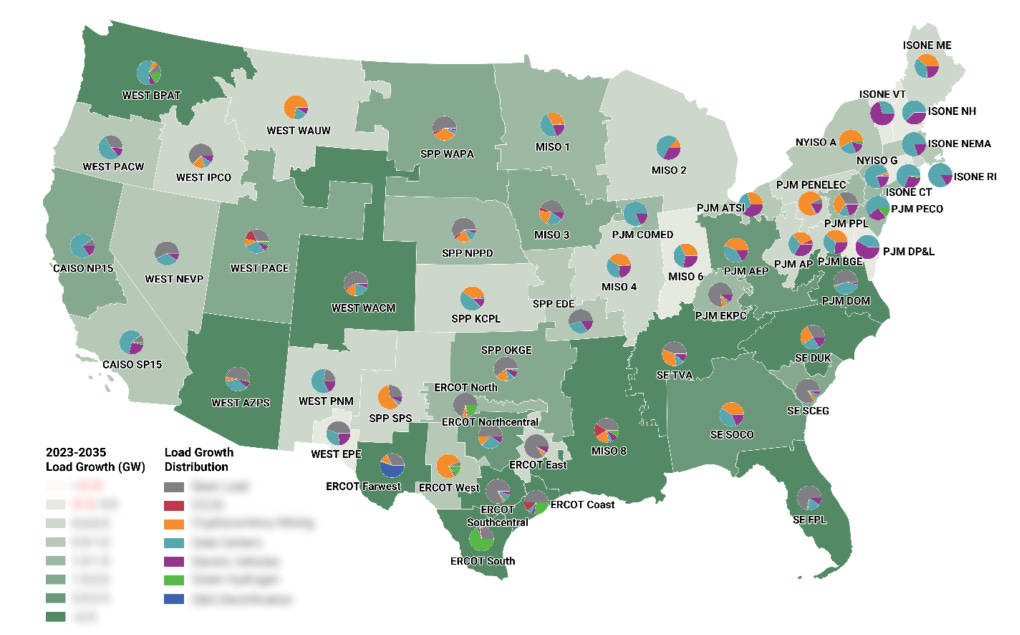

National Load Growth: Load growth is back at a national level📝3, but the pace, scale, and profile vary widely, changing the grid’s topology (Figure 2). Existing consumers will be impacted by where new data centers will develop, which CCUS or hydrogen projects will proceed, and the availability of existing generation to support this growth.

Figure 2 | Load Growth to 2035 by Zone and Load Driver

Interconnection Queue Uncertainty: Interconnection queues are full, but only about 10% of projects get built📝4. That makes it hard to pick partners and risk portfolios (side note: there are a lot of really cool ways to look at portfolios, including this example by Evan Powell) . Moreover, most queued projects are solar, BESS, and wind, which behave and contribute differently to the grid than traditional sources.

Changing Grid Topology: As new load and generation come online, congestion patterns are shifting, leading to increased volatility, price escalation, and sometimes decreased reliability📝5. This makes power management increasingly crucial for operations dependent on electricity.

Integrated Value Chains Drive Value: Integrated value chains drive value in the energy transition, and power often plays a key role. M&A transactions📝6 often focus on combining assets to unlock credits and monetize environmental attributes. Examples include turning emissions into assets (45Q credits), capturing additional value through LCFS and RIN markets, and using low-cost gas feedstock to produce high premium power.

Power is rapidly taking center stage, and even if you’re not focused on it yet, its influence on every business is only growing. The challenges and opportunities for large consumers are real, but regardless of your core focus, building expertise in this space and integrating a strong power strategy could be a game-changer—one that sets you apart in the future. Now’s the time to make that bet.

Upcoming Events Hosted by Enverus

Wednesday, October 16, 2024 Gas-Fired Generation | Power’s Burning Question | Join Carson Kearl in an upcoming webinar as he explores how the U.S. plans to manage a 42% power load increase by 2050, highlighting the pivotal role of natural gas as a transition fuel amid the surge of data centers and renewable energy. Register here.

Wednesday, November 6 & 7, 2024 Power Markets this Winter: 2024 Outlook for PJM, MISO, SPP, NYISO, ISO-NE and Mid-C | Join our Power Market Analysts for a 2-day deep dive into winter outlooks for PJM, MISO, SPP, NYISO, ISO-NE, and Mid-C, covering weather forecasts, load and renewable generation, infrastructure updates, transmission outages, market policies, and price projections to help you navigate the season ahead.

Wednesday, November 20, 2024 Navigating Water Management in Upstream Oil & Gas: Insights and Innovations for U.S. Operators | Join Dr. Chad Daloia, Jeb Burleson, Stephen Sagriff, Dave Savelle, and Graham Bain for an in-depth analysis of water hauling and management in U.S. oil and gas operations, covering trends, challenges, opportunities, and innovative solutions to enhance efficiency and cost management. Register here.

Notes:

📝 indicates Intelligence content that requires an Enverus subscription to access.

📊 indicates dashboard content that requires an Enverus subscription to access.

Please contact intelligence@enverus.com if you would like to learn more about Enverus Products and Services.

📝Electrifying the Permian | Decarbonize or Destabilize? | This report quantifies the potential electrification of oil and gas assets in the Permian Basin based on operators' emissions reduction targets and its impact on grid demand, transmission flows and the generation required to serve this growing load.

📝U.S. Emissions Stocktake | Methane Mitigation Drives Decline | This report serves as a U.S. emissions stocktake for the oil and gas sector, evaluating industry progress based on the latest EPA-reported data. We analyze trends in the upstream and gathering sectors from 2020 to 2022, highlighting where operator efforts are paying off and which sources are harder to mitigate. Our analysis also compares the top-producing operators and identifies the main reasons behind the most notable step changes in emission intensity.

📝Long-Term Load Forecast | Returning to Growth | Our long-term power demand forecast model considers historical drivers of power demand across the Lower 48 U.S. and models variables that we believe will impact future load, including data centers, electric vehicles (EVs), residential solar and storage, cryptocurrency mines, green hydrogen, carbon capture and storage (CCUS) and electrification trends. This report analyzes the effects that these new exponential load drivers will have on our power demand forecasts from 2024-2050.

📝Predicting the Interconnection Queue: Derisking Developer Portfolios | At Evolve 2024, this presentation highlights the latest insights from our interconnected machine learning probability model. By correlating the probability of success to queued projects, we can assess developer M&A multiples according to the likelihood of success for their undeveloped portfolios.

📝ERCOT Fundamentals | Lighting the Lone Star | Gain valuable insights into the future of the ERCOT power market with Enverus Intelligence Research's comprehensive report, covering generation mix projections, load forecasts, power price impacts, market restructuring, interconnection queues, asset benchmarking and project siting analysis.

📝Gevo Acquires Red Trail Energy | Come Fly With Me | This Deal Insight examines Gevo, Inc's. recent $210 million acquisition of Red Trail Energy's 65 million gallon per year ethanol facility in North Dakota equipped with carbon capture and an approved Class VI well that is actively sequestering 160,000 tpa of CO2 with the capacity to scale to 1 mtpa. The analysis covers CCS asset valuation, including subsurface analysis, and the potential of environmental attribute stacking pathways that have been unlocked through this transaction.