We Are Missing the Big Question About Data Centers

Why “How Big?” Is The Biggest Question of All

Over the past year, data centers have captured significant attention from both the energy and investment communities. This focus is justified by the tens of billions of dollars in investments and the extraordinary growth projections in this sector. At Enverus, we frequently encounter questions such as, “Where can we site new facilities? How much load growth will the AI boom bring? Where will the energy come from to power these facilities?”

This is an AI-generated conversation based on the written content of the article below. The conversation may deviate from the intended meaning of the original content. Please see the disclosures.

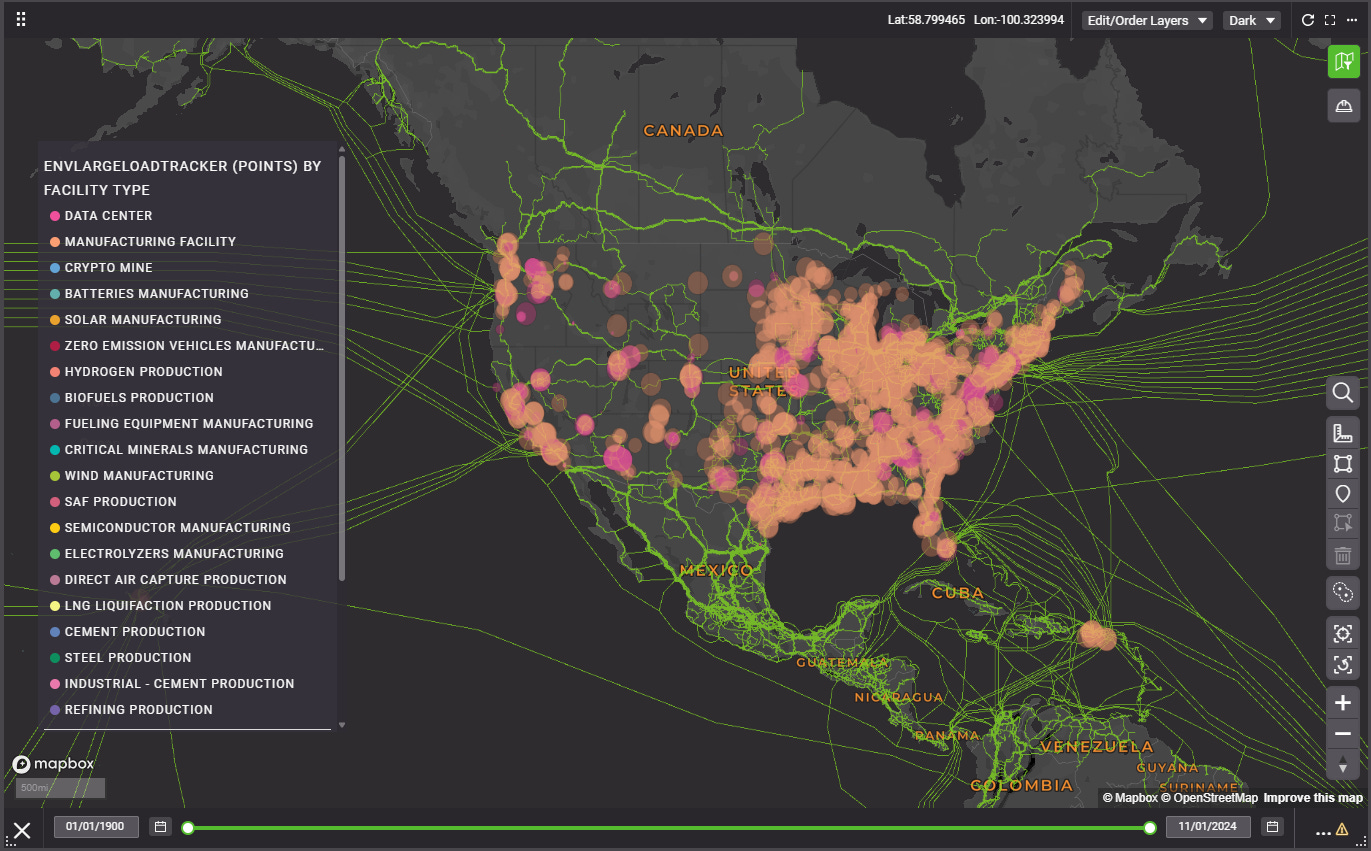

Figure 1 | Data Centers, Fiberoptic Lines, and Other Large Loads📊1

Source | Enverus Intelligence® Research, Enverus Foundations – Power & Renewables

While these are important questions, much of my team’s internal discussion revolves around, “How big will data centers get?” Recent headlines highlight the trend of “bigger”: Sam Altman and OpenAI recently floated the idea of a series of 5 GW data center campuses. To put this in perspective, a 1 GW facility seemed enormous just last year. These increasingly larger facilities signal a transformative wave for the energy system.

The numbers are staggering. A single 5 GW campus might cover close to a square mile of land. Such a facility would exceed the power load of all the data centers in Northern Virginia, which connect to a third of the world’s internet traffic. This concentrated load would place enormous pressures on existing grid infrastructure and generation capacity. Remarkably, it would also exceed the total energy consumption of the entire US Department of Defense consumes across it’s installations (military bases and non-tactical vehicles) around the world.

5 GW is more than the total energy consumption of the entire US Department of Defense consumes across it’s installations (military bases and non-tactical vehicles) around the world.

How you answer "How Big" leads to a wide range of answers to the typical questions. For example:

What technologies can serve concentrated loads of this scale? 5 GW is roughly equivalent to five large new nuclear reactors, each similar in scale to Georgia’s recently completed Vogtle Unit 4. When we think about highly reliable, low-carbon power at this scale, nuclear stands out as a viable option – perhaps the only option. That’s certainly what heard at the Advanced Reactor Summit📝2 this spring.

At the more “modest” 1 GW scale (or smaller), nuclear looks attractive, as evidenced by the recent deals made by AWS and Microsoft to access GW-scale nuclear power. And at this scale the range of advanced reactors📝3 that are viable options gets much more diverse.

What about gas? A 5 GW facility could burn ~850 MMcf/d of gas (running at 100% capacity factor and assuming a 7,500 BTU/kWh heat rate). That’s a decent-sized pipeline, backstopped by a large and long-duration resource. This may be manageable in a few places, but you would probably need to add CCS, as per EPA regulations📝4, and you’d probably still have concerns about supply security over the next 20+ years (perhaps due to policy, or reliance on production economics carried by oil revenues).

Where can we site these facilities? At smaller scale there are a number of existing industrial sites and options to pursue. But as you scale up, the choices shrink rapidly and the obvious sites are disappearing quickly📝5. There is a growing premium on those who can find, access, fund, permit, connect and build at this scale.

What flexible loads pair at this scale? We also know that while data centers demand large-scale, highly reliable power, their demand can be highly variable. At this scale, there would be real advantages to pairing flexible loads that can take advantage of GW scale lulls in data center demand. The answer needs to be better than “more crypto mining📝6”.

Then there’s the absolute scale of the investments and resources. At 5 GW, that is $35-50 billion (assuming $7-10 million/MW), plus the cost of power generation capacity. In short, we are talking about an investment and resource boom too.

It seems clear we have only begun to consider the implications of the AI boom in the world of infrastructure and energy. How big will these facilities get? And what does that mean? The answers are more profound than we can imagine.

Upcoming Events Hosted by Enverus

Tuesday, October 15, 2024 ERCOT Power Market Summer 2024 Lookback | Join Rob Allerman and Adam Jordan for a deep dive into ERCOT’s cooler, wetter summer of 2024 and its impact on the Texas grid, including load growth, solar and battery contributions, and future energy challenges. Register here.

Wednesday, October 16, 2024 Gas-Fired Generation | Power’s Burning Question | Join Carson Kearl in an upcoming webinar as he explores how the U.S. plans to manage a 42% power load increase by 2050, highlighting the pivotal role of natural gas as a transition fuel amid the surge of data centers and renewable energy. Register here.

Notes:

📝 indicates Intelligence content that requires an Enverus subscription to access.

📊 indicates dashboard content that requires an Enverus subscription to access.

Please contact intelligence@enverus.com if you would like to learn more about Enverus Products and Services.

📊AI-Driven IPP Expectations: EIR analyzed gas plants operating at less than a 90% capacity factor and located near existing and planned data center infrastructure to differentiate power plant operators that are uniquely exposed to data center load growth.

📝Advanced Reactor Summit XI: Members of our Energy Transition Research team attended the Advanced Reactor Summit XI in Houston, Texas, in April. The conference brought together a surprising mix of technologists, vying consumers, policymakers and leaders from molecule-focused energy sectors.

📝Unshackling Prometheus: Enverus Intelligence Research presents the state of the advanced reactor industry and its participants.

📝Power Plant CCUS a Pipe Dream: This report analyzes the potential impact of the EPA's greenhouse gas standards and guidelines for fossil-fueled power plants in the U.S. The new regulations will impact new natural gas plants, operating coal plants and the generation mix for specific markets and states.

📝Data Center Alley: This Fusion Insights analyzes load interconnect opportunities remaining in PJM and identifies prime locations to locate new data centers. Subscribers can download the nodal withdrawal capacity data file attachment and use Fusion to join it with our ATC or substation tables in Prism to recreate this dashboard.

📝Long-Term Load Forecast: Our long-term power demand forecast model considers historical drivers of power demand across the Lower 48 U.S. and models variables that we believe will impact future load, including data centers, electric vehicles (EVs), residential solar and storage, cryptocurrency mines, green hydrogen, carbon capture and storage (CCUS) and electrification trends. This report analyzes the effects that these new exponential load drivers will have on our power demand forecasts from 2024-2050.