Episode Length: ~20 minutes

Episode Summary

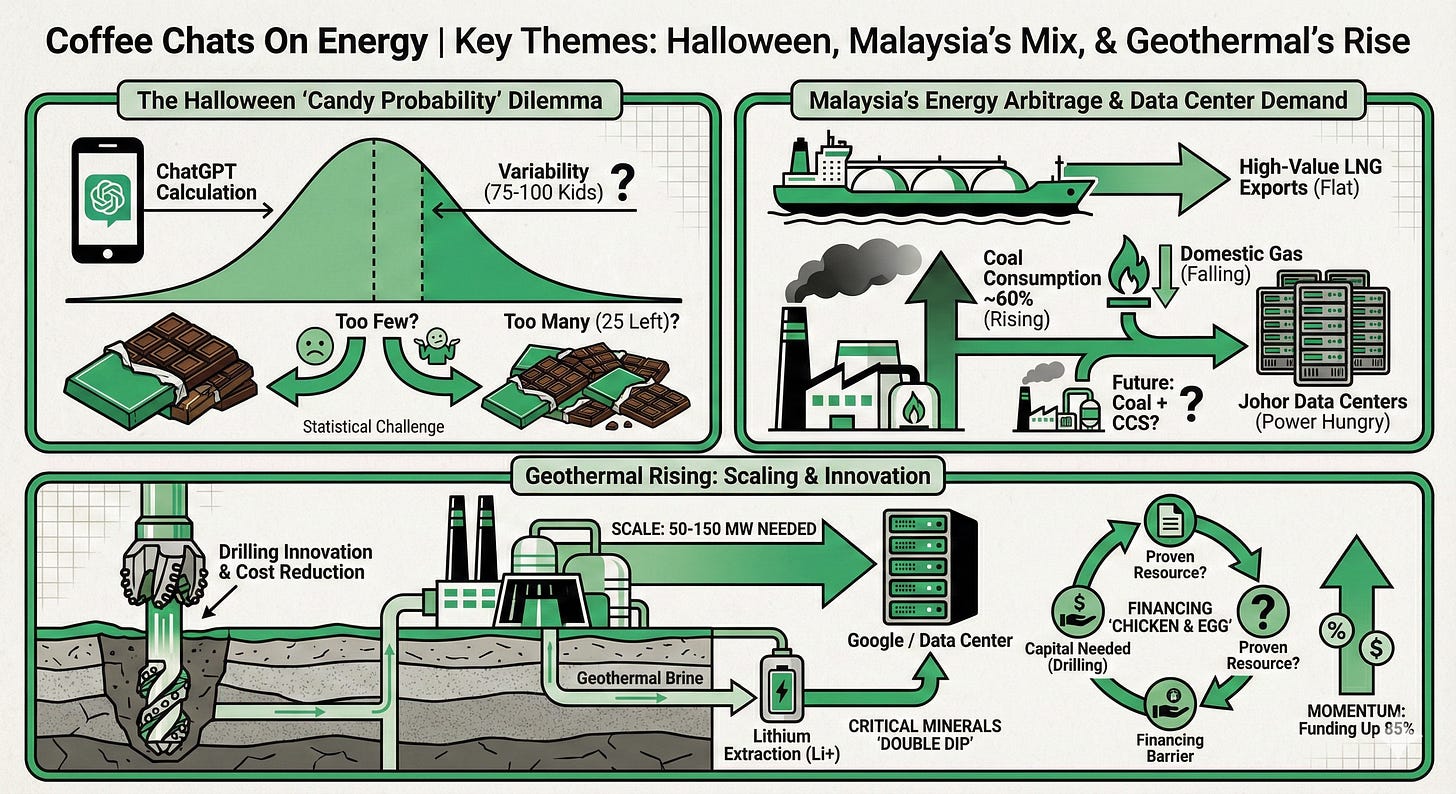

In this episode, the hosts catch up just before Halloween, discussing costume plans and the statistical dilemma of how much candy to buy for a new neighborhood. The conversation then pivots to global energy markets, analyzing a recent report on Malaysia’s strategy to increase domestic coal consumption while maintaining high-value LNG exports. Finally, one host reports back from the Geothermal Rising Conference in Reno, sharing critical insights on the industry’s push for larger-scale projects, cost reductions in drilling, and the potential for mineral extraction.

Topics Covered

Halloween Logistics: Balancing the “candy probability” in a new neighborhood and costume ideas.

Malaysia’s Energy Mix: The economic arbitrage of exporting natural gas (LNG) while utilizing thermal coal for domestic power generation.

Data Center Power Demand: The rise of data centers in Johor, Malaysia, and their impact on regional power and fuel choices.

Geothermal Industry Trends: A recap of the Geothermal Rising Conference, focusing on attendance, funding, and technological advancements.

Key Takeaways

Economics vs. Decarbonization: Malaysia illustrates a complex energy reality where high-value LNG is exported for revenue, while the domestic grid shifts back toward coal—rising from 10% to roughly 60% of the mix—to meet demand.

The Need for Scale: For geothermal energy to serve major customers like Google and support data centers, projects must move beyond small pilots to scalable 50–150 MW facilities.

Drilling and Mineral Innovation: The geothermal sector is focused on lowering costs through optimized drill bit designs for hard rock and “double-dipping” on revenue by extracting lithium and other critical minerals from geothermal fluids.

The Financing Dilemma: Developers face a “chicken and the egg” scenario where they need capital to drill wells to prove resources, but financial institutions often require proven flow rates before committing that capital.